? Ethereum Could Reach $80,000 — Expert

Ethereum continues to remain at the center of attention for analysts and investors. Former Wall Street trader and CEO of Etherealize, Vivek Raman, stated that in the long term, the price of Ethereum (ETH) could reach $80,000 per coin, with its market capitalization growing to $10 trillion. According to him, such products prove that Ethereum is building an alternative financial system that works without intermediaries and traditional banks.

Х

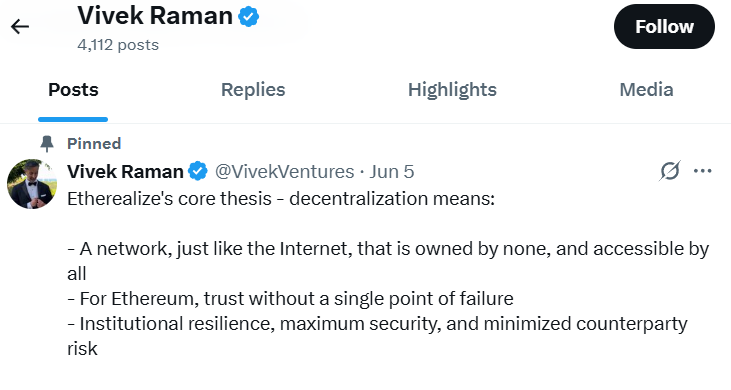

Etherealize’s core thesis – decentralization means:

- – A network, just like the Internet, that is owned by none, and accessible by all

- – For Ethereum, trust without a single point of failure

- – Institutional resilience, maximum security, and minimized counterparty risk

According to the expert, Ethereum has long ceased to be “just a cryptocurrency.” Today, it is the largest decentralized ecosystem that brings together DeFi, NFTs, smart contracts, and Web3 applications.

After Trump’s inauguration, the Ethereum ecosystem experienced a revival, but this has not yet been reflected in the price of ETH. The Trump family is actively investing in Ethereum-based DeFi, and banks can now custody crypto assets. Staked Ether ETFs are expected, which could become a growth catalyst.

Raman called ETH “the strongest infrastructure in the world” and emphasized that its potential is far from fully realized.

Why Ethereum?

Vivek Raman recalls his first experience using Uniswap — a decentralized exchange built on Ethereum: “When I tried Uniswap, I thought: isn’t this the future of Wall Street?”

According to him, it is products like these that prove Ethereum is building an alternative financial system that operates without intermediaries and traditional banks.

Institutional players are joining in

The expert emphasizes that institutional investors — funds, banks, and large corporations — are increasingly turning their attention to Ethereum. Evidence of this includes:

the growing number of Ethereum-based ETF applications;

- interest from hedge funds and venture capital firms in DeFi projects;

- the development of corporate solutions built on smart contracts.

In Raman’s view, the inflow of institutional capital could be the main driver pushing Ethereum toward exponential growth.

ETH/USDT – 22.08.2025

Competition and challenges

However, Ethereum also faces serious challenges. Among the key ones are competition with other blockchains (Solana, Avalanche, BNB Chain), scalability issues, and high transaction fees. Although the transition to Proof-of-Stake and the implementation of Layer 2 solutions (such as Arbitrum and Optimism) have already significantly improved the situation.

What does the $80,000 forecast mean?

At a price of $80,000, ETH’s market capitalization would amount to around $10 trillion. For comparison:

- the entire gold market is estimated at about $13 trillion,

- U.S. GDP is around $28 trillion.

Thus, Ethereum could stand alongside the world’s largest assets.

⚡Conclusion

Raman’s forecast sounds ambitious, but it reflects confidence that Ethereum is gradually becoming the foundation of a new digital world. If institutional interest continues to grow and the network manages to overcome its technical challenges, Ethereum could indeed claim the role of a “new Wall Street” — only on the blockchain.

A fragment of Vivek’s video speech can be found on our Telegram channel.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.