? Bitcoin last week continued its downward trend that began in August. At the start of the week, BTC reached a new local low at $107,270, followed by a short-term rebound to $110,000. Such volatility is typical for weekends and holidays when trading volumes decline, and speculators actively react to any news.

1-day BTC/USD chart (source: BITSTAMP)

Trader Sentiment: Testing the Psychological Level of $100,000

Market sentiment remains tense. Many traders are waiting for a more convincing bottom to form, while others consider the possibility of retesting support at $100,000 — a psychologically significant level for market participants.

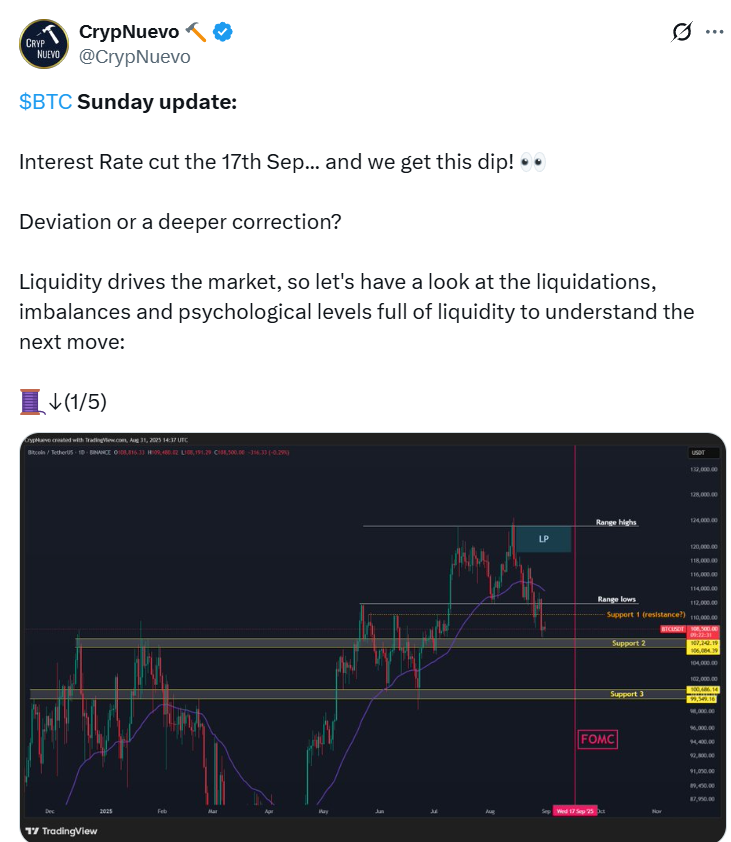

«Short position liquidations are concentrated between $112,000 and $115,000,» said X trader CrypNuevo, who correctly predicted the drop to the $107,200 zone. According to him, if the correction deepens, the $100,000 level will be tested, as large long positions are concentrated here. A break below $94,000 could trigger a cascade of stop-losses and new liquidations.

Impact of Macroeconomics and Tariff Disputes

U.S. markets were closed on Monday for Labor Day, so investors and traders will have to wait until September 2 to assess the impact of recent disputes over international tariffs. At the end of last week, a federal appeals court ruled that former President Donald Trump’s actions in imposing tariffs exceeded his authority, leaving agreements in limbo.

This uncertainty quickly affected the cryptocurrency market. Trump emphasized that he would fight to maintain the tariffs, warning that otherwise the U.S. could become a «third-world country». Against the backdrop of existing volatility, traders of risky assets will also monitor the week’s macroeconomic data and expectations regarding the Federal Reserve’s interest rate decisions.

Gold Challenges Bitcoin

While Bitcoin and altcoins stagnate, gold continues to strengthen as a «safe haven» for investors. Gold reached $3,489 per ounce on September 1, just a few steps from the historical high of $3,530 recorded on April 22.

1-week XAU/USD chart (source: TradingView)

«The breakout of gold and silver is a bearish signal for Bitcoin,» wrote Peter Schiff, a well-known crypto critic and chairman of the consulting firm Europac, warning that BTC is «ready to drop significantly lower».

Institutional Investors Retreat

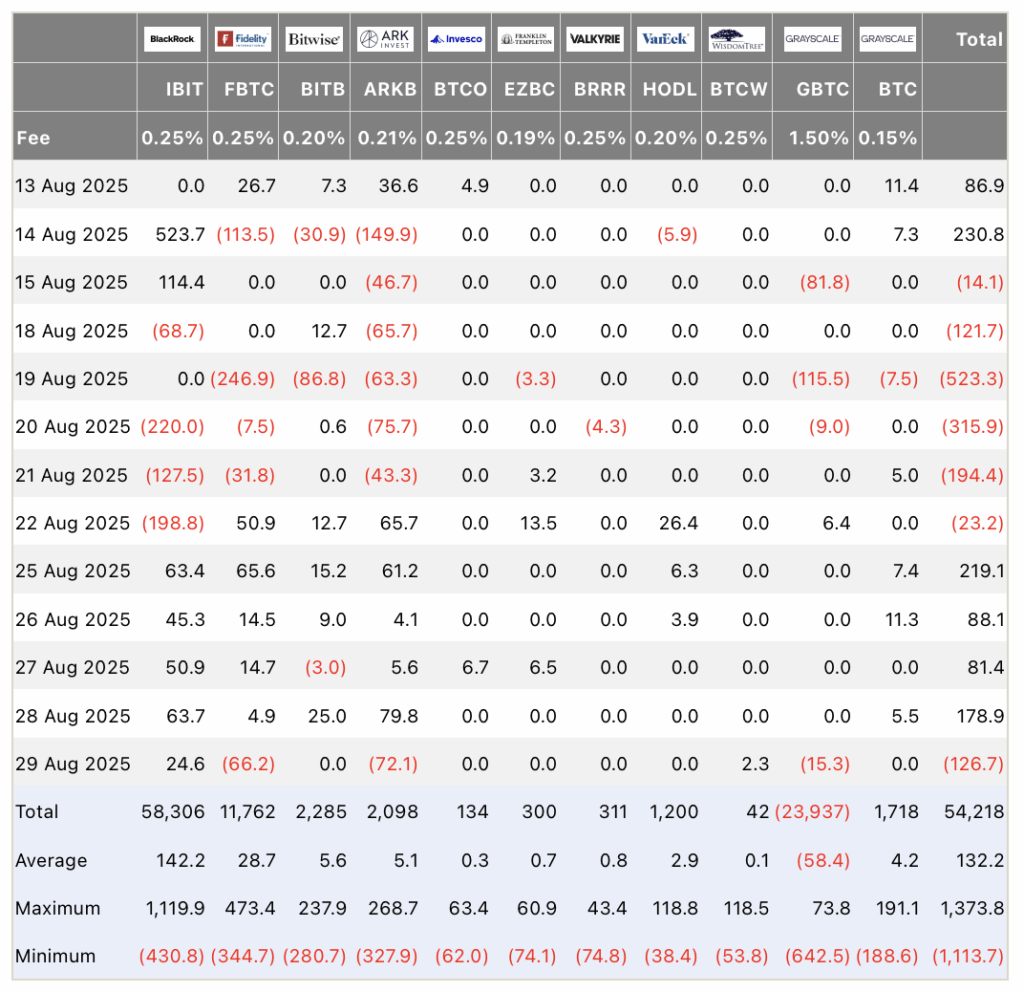

Bitcoin’s decline is beginning to impact the behavior of major players. Data from the British investment firm Farside Investors shows that on the last trading day of August, U.S. spot Bitcoin ETFs recorded a capital outflow of $126.7 million.

U.S. Bitcoin ETF fund flows (source: Farside Investors)

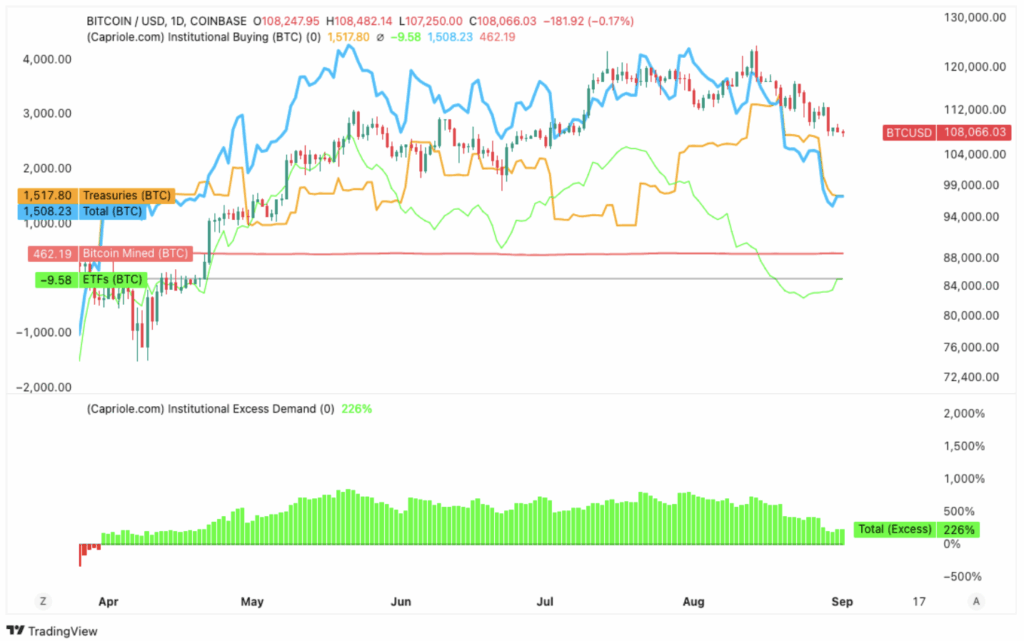

Charles Edwards, founder of the digital asset fund Capriole Investments, noted that institutional activity in Bitcoin purchases reached a multi-month low: «Institutional Bitcoin acquisition has fallen to the lowest level since early April.»

Institutional Bitcoin demand dynamics (source: Capriole Investments)

September Outlook

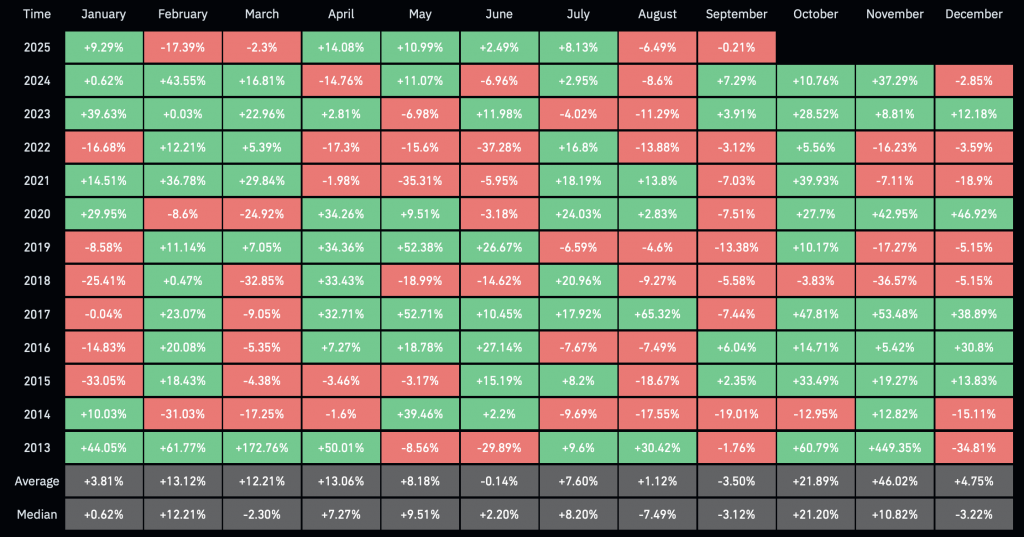

September is traditionally considered a weak month for BTC. On average, historical September shows a return of around -3.5% for BTC/USD, while the «best» September in the past twelve years delivered growth of only 7.3%.

Monthly Bitcoin performance (source: CoinGlass)

The market is currently in a state of uncertainty: institutional demand is declining, gold demonstrates strength, and the typical September weakness adds pressure on Bitcoin’s price. Nevertheless, corporate demand for BTC still exceeds miner productivity by approximately four times, providing some market support and limiting sharp declines.

✅ Weekly Takeaways:

- Bitcoin continues to stagnate and may test the psychologically important $100,000 level.

- Volatility persists amid the holiday season and low trading volumes.

- Macroeconomic uncertainty and tariff disputes add pressure to risk assets.

- Gold and silver continue to strengthen, acting as alternative «safe havens».

- Institutional demand for BTC is declining, increasing short-term uncertainty.

This week shows that the cryptocurrency market remains highly sensitive to macroeconomic events, institutional investor sentiment, and trader psychology. Even with «safe haven» gains and small BTC rebounds, market participants should consider both technical levels and fundamental factors to adequately assess risks and opportunities.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.