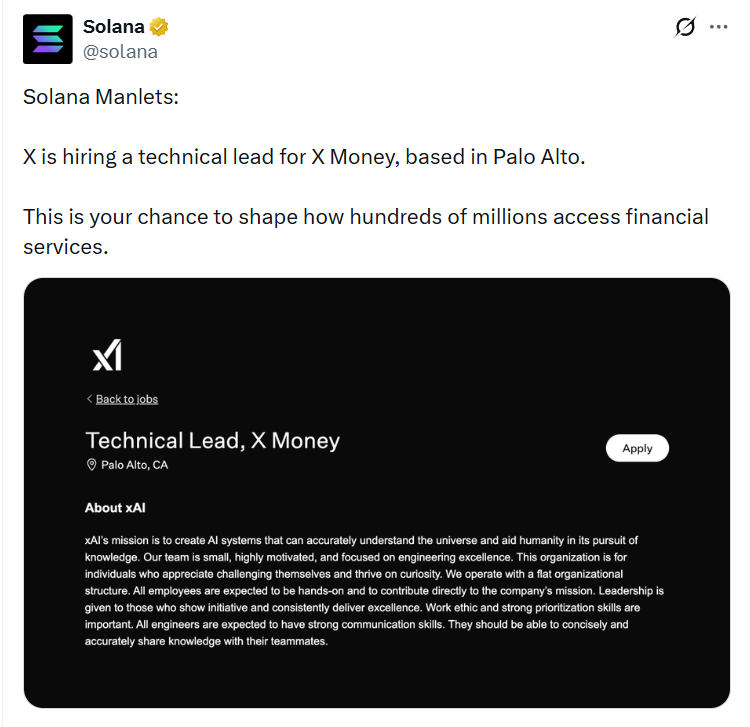

The social network X is preparing to take a step that until recently seemed futuristic: trading stocks and cryptocurrencies may appear directly inside the user feed. Not through third-party links, not through external exchanges and brokerage apps, but literally with a single tap – right where people read the news, argue about markets, and discuss Elon Musk’s latest tweet.

The head of product at the platform, Nikita Bier, announced the upcoming launch of the Smart Cashtags feature. According to him, within a couple of weeks users will be able to buy and sell assets without leaving the app.

“We’re launching a number of features in a couple of weeks, including Smart Cashtags, which will allow you to trade stocks and cryptocurrencies directly from the feed,” Bier wrote on February 14.

This statement looks like a logical continuation of what X is gradually becoming: not just a social network, but a financial and information hub where market discussions can instantly turn into action.

A return to the roots, but on a different scale. Interestingly, the very idea of Cashtags is not new for X. Back in 2022, the platform introduced a basic system for tracking the prices of major stocks and cryptocurrencies. A user could enter a ticker or cashtag and see visual data for an asset – Bitcoin, Ethereum, and a number of popular companies.

It was more of an informational add-on: check the price, the dynamics, brief statistics. However, the feature was soon disabled, and the experiment remained an unfinished episode.

Now Musk’s team is returning to this concept, but no longer in the format of “a chart for the sake of a chart,” but as a full-fledged trading tool. The difference is fundamental: monitoring is passive observation, while trading is infrastructure, responsibility, and a completely different level of regulation.

If Smart Cashtags truly allow users to place trades directly from the feed, it will mean that X stops being just a platform for talking about money and becomes a place where money actually moves.

The “everything app” becomes reality. Smart Cashtags are only part of Elon Musk’s broader strategy, as he has long talked about turning X into an “everything app.” Essentially, it is an attempt to build a Western analogue of China’s WeChat, where social media, payments, services, business, and finance coexist within one interface.

X has already become a center of crypto activity: this is where narratives are formed, meme trends are born, ETFs, halvings, rallies, and crashes are discussed. Adding built-in trading makes the next step inevitable: if the audience is already discussing the market, why not give it the ability to act instantly?

In parallel, X Money is being developed – a payment system designed to let users send money to each other as easily as they send messages today. This is a direct challenge to services like Venmo and Cash App. On February 11, Musk updated the timeline for X Money during a presentation of his AI company xAI. “X Money is still in limited beta testing for the next two months, after which global rollout will follow,” he explained.

He added a phrase that sounds like a manifesto: “This is the place where all the money will be. The central source of all financial transactions.”

With an audience of around 600 million monthly active users, these ambitions no longer look like fantasy. Musk openly says he wants people, if they wish, to be able to live their entire lives inside X: communication, content, payments, investments, services.

If successful, X will become not just a social network, but a next-generation financial platform. Competition moves to a new level. Integrating trading functions into social networks is not a revolution in itself. Financial apps have long tried to become “social,” and social networks have long wanted to monetize audiences through finance.

But the scale of X could be unprecedented. This is a platform where a huge layer of traders, investors, crypto enthusiasts, and analysts already exists. Market movements are discussed daily, news breaks, expectations are formed.

Now imagine: you read a post claiming that some coin is “about to explode,” and right under that post a Buy button appears. No switching apps, no broker, no pause for rational thinking.

This changes the very nature of market interaction. Trading becomes not a separate action, but an extension of content. The user experience may become completely seamless: discussion – signal – trade. But this is exactly where the main question arises: where is the line between convenience and danger?

Regulatory risks and technical reality. One thing is to announce a launch. Another is to ensure the stable operation of a trading system for millions of users.

The success of Smart Cashtags will depend on many factors:

- regulatory approval in the US and other jurisdictions

- quality of order execution and liquidity

- protection against fraud and manipulation

- infrastructure resilience during activity spikes

- transparency of fees and the partnership model

If X truly wants to become a financial hub, it will have to play by the rules of the financial world, not the rules of social media. And that is much harder than simply adding a “buy” button.

From the perspective of behavioral economics, built-in trading in a social environment amplifies herd behavior. Markets are already driven by emotion, but when trades become part of social dynamics, the risk multiplies. A viral post can become not just a news event, but a trigger for thousands of simultaneous orders. Every tweet mentioning an asset potentially turns into a market event.

This creates conditions for sharp waves of buying and selling driven not by fundamentals, but by attention algorithms.

The key question is: will X’s infrastructure be able to withstand such pressure without delays that could cost traders millions? And will the platform itself be able to maintain a balance between being a financial service and a social environment where emotions always overpower logic?

If Smart Cashtags truly go live, X will do what until recently seemed impossible: merge social media and markets into a single interface. And then financial reality will become closer, faster, and more dangerous. Because when trading becomes as easy as a like, markets stop being a place for the patient and turn into a place for the impulsive. And that is already a completely different era.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.