We certainly love mentioning Kiyosaki in our articles. There is something unmistakably familiar about him: like an old friend who shows up at the most anxious moment and loudly declares, “everything will collapse,” yet smiles as if it’s the best day of his life. Robert Kiyosaki, the American entrepreneur, investor, and author of the iconic bestseller Rich Dad, Poor Dad, has once again issued a warning that sounds both like a threat and an invitation.

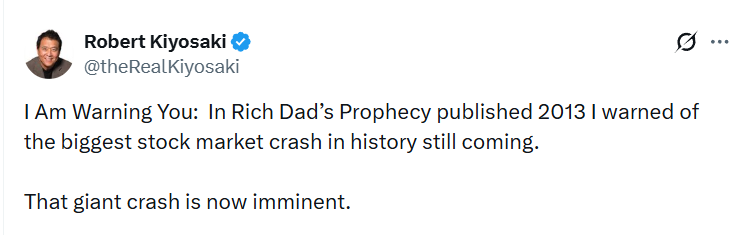

This time, he stated that a massive stock market crash is inevitable and is literally at the doorstep. According to him, this is not an ordinary correction or another nervous episode on Wall Street, but the largest market decline in history. And, characteristic of Kiyosaki, he does not merely frighten — he speaks of it with enthusiasm, like someone who has been waiting for exactly this scenario.

In his address, he reminded that back in 2013, in the book Rich Dad’s Prophecy, he warned that the biggest stock market crash was still ahead. At that time, it sounded like a hypothesis, a dramatic forecast for a distant future. Today, however, he claims the moment is arriving right now. The crash he spoke about more than ten years ago is becoming “inevitable.”

Kiyosaki builds his rhetoric around a simple but powerful idea: crises are not only destruction but also opportunity. For those who have prepared in advance, the coming crash could be a chance to get richer than they ever dreamed. For those who live without a strategy, protective assets, or understanding of financial cycles, the crash will be a real nightmare.

This duality is Kiyosaki’s trademark style. He always divides the audience into those who are awake and ready, and those who continue to sleep in the illusion of stability. In his eyes, the crash will be the moment of truth, revealing who truly owns assets and who merely keeps numbers on a screen.

The entrepreneur paid special attention to the assets he considers a true support in times of instability. Kiyosaki stated outright that he already holds physical gold and silver, as well as Ethereum and Bitcoin. He emphasizes real, physical gold and silver, not paper derivatives. His words reflect a distrust of all “synthetic” assets — those that exist only as promises or entries in financial systems.

The same goes for cryptocurrencies: no “fake” Bitcoin, no surrogates. Only real assets you truly own. The main focus of his statement again became Bitcoin. Kiyosaki admitted he is extremely bullish on the first cryptocurrency and plans to buy more and more as its price falls. For him, the drop is not a signal to flee, but a signal to buy.

He explains his stance simply: Bitcoin is limited. There will never be more than 21 million coins, and nearly all are already in circulation. Unlike fiat currencies, which can be printed endlessly, Bitcoin is built into a scarcity logic. That is why, according to Kiyosaki, the crowd’s panic becomes a gift for those who think strategically. He directly states he will buy even more aggressively when people start selling in fear of the crash. According to him, such moments create the best conditions for wealth accumulation.

Kiyosaki phrases it almost as an investment aphorism: market crashes are a sale of priceless assets. This is when what seemed expensive yesterday suddenly becomes affordable. If you understand the nature of cycles and are prepared in advance, a crisis becomes not a catastrophe, but a window of opportunity. This approach reflects the entire philosophy of Rich Dad: the rich get richer not when everything is calm, but when others lose self-control. Where the crowd sees the end of the world, the investor sees discounts.

Although some users on X remain skeptical of his optimism. Imagine being wrong 14 years in a row but still clinging to the grift.

Imagine this: being wrong for 14 years straight but still clinging to the grift.

It is worth noting that such statements are not new for Kiyosaki. Previously, he said he was ready to buy Bitcoin even if it dropped to $6,000. In early February 2026, he again called the market crash a “sale” and declared his intention to buy Bitcoin, gold, and silver while others panic-sell assets. His position is crystal clear: the crisis is inevitable, the question is only whether you will be among those prepared, or among those caught off guard.

Of course, Kiyosaki’s words can be interpreted in different ways. Some see him as a prophet of financial cycles, others as a master of bold headlines. But one thing remains constant: he repeatedly reminds the market that stability is an illusion, and big money is most often made not in moments of euphoria, but in moments of fear. And if the crash is truly approaching, the key question following his statement is very simple: are you ready, or do you hope “this time it will pass”?

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.