According to the annual report of the analytical company CryptoQuant, 2025 became a period of unquestionable dominance for Binance in the centralized cryptocurrency exchange market. The platform not only maintained its leadership but also significantly widened the gap with its closest competitors across all key metrics at once: trading volumes, liquidity, reserves, and user on-chain activity. These data were presented in an official press release shared by the service’s representatives with readers.

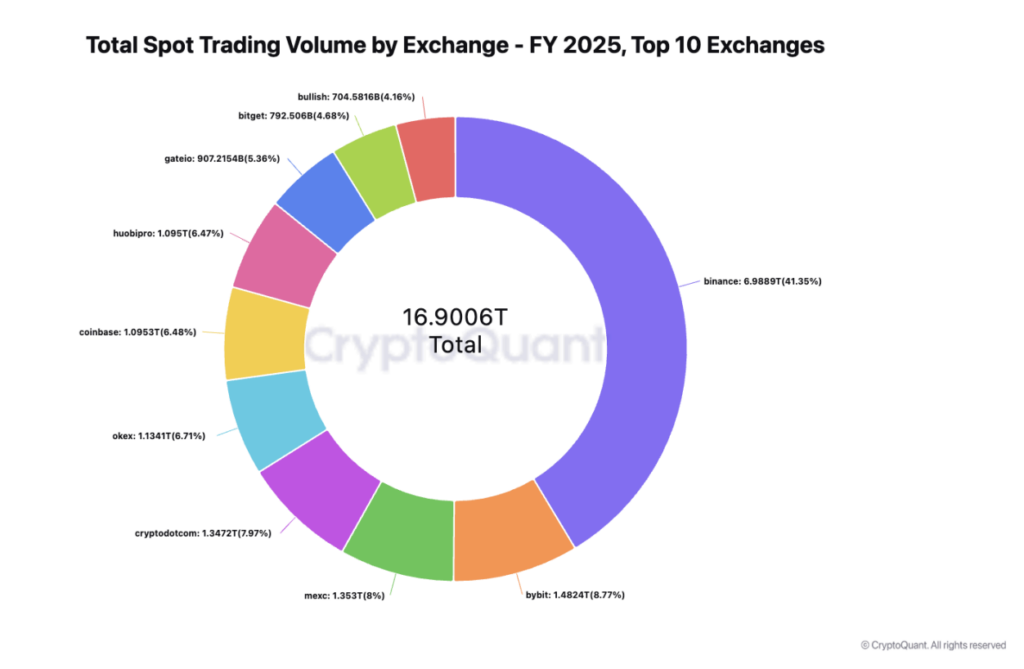

According to CryptoQuant’s research, in 2025 Binance processed nearly $7 trillion in spot trading volume. This provided the exchange with approximately a 41% market share among the top 10 centralized exchanges. For comparison, the closest competitor, Bybit, recorded volumes of $1.5 trillion, while MEXC posted around $1.4 trillion. Thus, Binance’s advantage over its competitors exceeded 4.6 times, which analysts describe as a rare case of such a pronounced concentration of liquidity in a single center.

Total spot trading volume among the top 10 exchanges. Source: CryptoQuant

The report separately highlights the structure of these volumes. Binance leads not only in Bitcoin trading but also in the altcoin segment, with altcoins accounting for a particularly significant share of total turnover. According to CryptoQuant, this points to Binance’s “unmatched market breadth,” where hundreds of trading pairs with high liquidity are available, and trader activity remains resilient even during periods of heightened volatility.

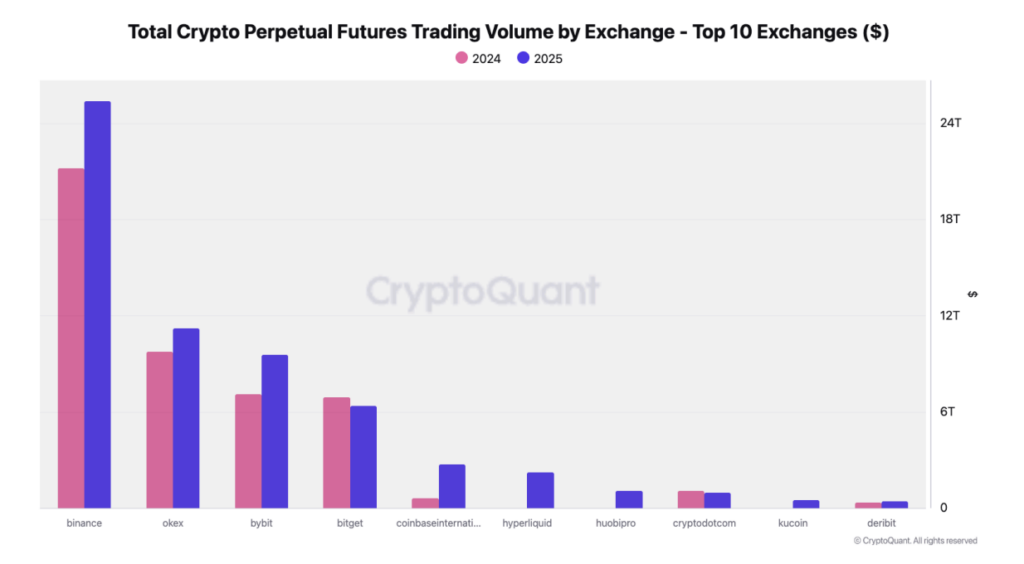

Equally impressive figures were recorded in the derivatives market. In 2025, Binance processed $25.4 trillion in Bitcoin perpetual futures volume. This result is more than double the figures of OKX ($11.3 trillion) and Bybit ($9.6 trillion). As a result, Binance accounted for around 42% of the total Bitcoin futures trading volume among the top 10 CEXs. Analysts emphasize that such a high concentration of liquidity provides users with a deep market, tight spreads, and stable order execution, which is critically important for large traders, market makers, and institutional participants.

Total cryptocurrency trading volume in the perpetual futures market among the top 10 exchanges. Source: CryptoQuant

Significant attention in the report is paid to the platform’s reserves. As of the end of 2025, Binance held $47.6 billion in USDT and USDC stablecoins. This is 51% more than a year earlier, when stablecoin reserves amounted to $31.7 billion. For comparison, the next-largest exchange, OKX, holds about $9.3 billion, making the gap fivefold. According to CryptoQuant, such a volume of liquid reserves allows Binance to efficiently handle large capital flows and reduces risks during periods of market stress.

The total volume of Binance’s reserves, including Bitcoin, Ethereum, USDT, and USDC, reached $117 billion. This is approximately 45% more than Coinbase, whose reserves are estimated at $81 billion. CryptoQuant notes that these figures “definitively establish Binance as the central global hub of crypto liquidity,” through which key capital flows in the industry pass.

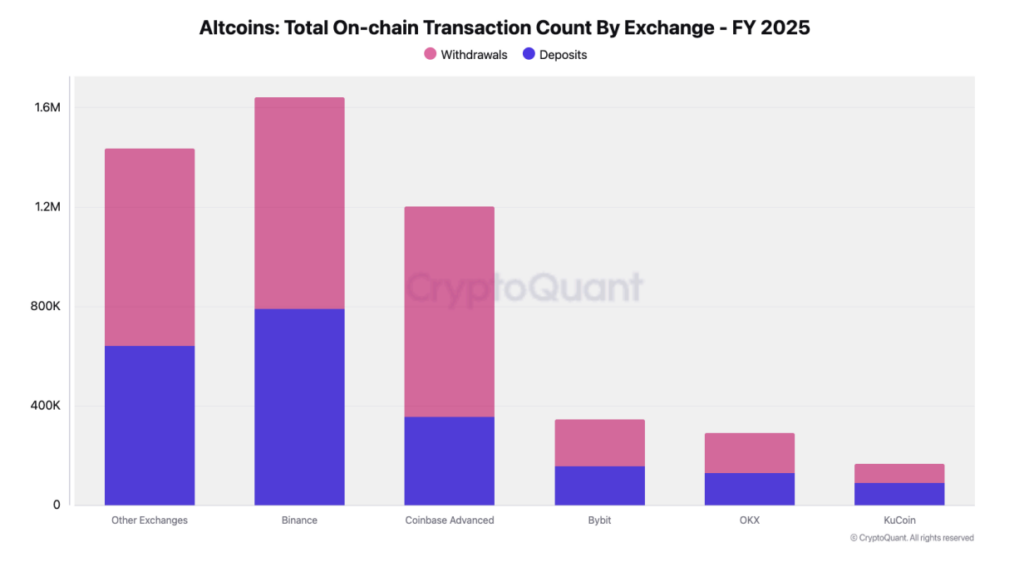

Another important aspect was user on-chain activity. Throughout 2025, Binance supported more than 1.6 million altcoin deposit and withdrawal operations, which is 33% higher than Coinbase’s comparable figure. According to analysts, this dynamic reflects not only the scale of the user base but also the platform’s high operational efficiency. Traders are able to quickly move capital between the exchange and blockchains, flexibly managing positions and risks.

Total number of altcoin on-chain transactions on exchanges. Source: CryptoQuant

CryptoQuant emphasizes that high on-chain activity reflects the largest active user network in the industry, as well as the most powerful custodial and settlement flows among all centralized exchanges. This is especially important at a time when trust in infrastructure and reserve transparency have become key factors in platform selection.

In conclusion, analysts determined that the results of 2025 confirmed Binance’s dominance across all key segments of the centralized crypto market – from spot trading and derivatives to reserves and on-chain metrics. This position strengthens trust among both retail and institutional users and cements Binance’s status as the platform of first choice for global crypto trading.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.