Against the backdrop of gold rising more than 230% since 2020, central banks around the world have triggered one of the largest waves of precious metal purchases in modern history. What was once seen as a classic “panic hedge” has now become a full-fledged strategic reserve — almost a political tool on par with oil or currency reserves.

The reasons are clear: the world has been living in a state of constant turbulence for the past few years. Geopolitical tensions, sanction wars, inflation spikes, rising government debt, and the gradual weakening of trust in traditional reserve currencies are pushing countries to seek an asset that doesn’t depend on any single country, central bank, or payment system. Gold has once again become the universal language of financial security.

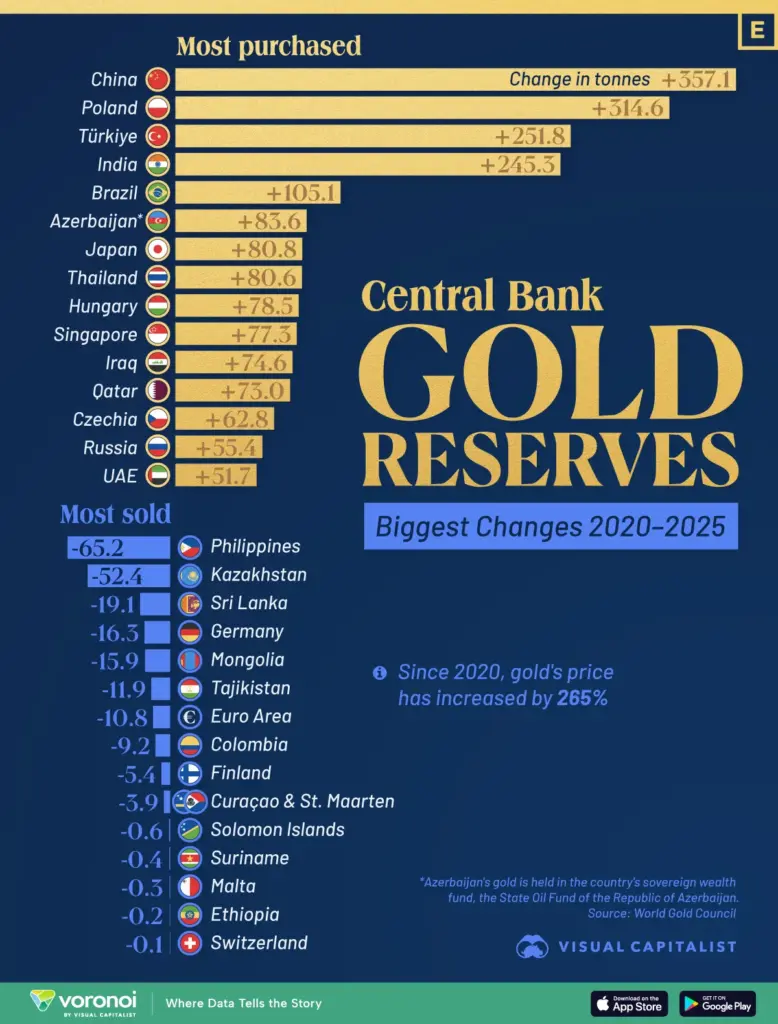

Visual Capitalist’s infographic, based on data from the World Gold Council, shows the scale of this process: the 15 largest buyers increased official holdings by nearly 2,000 tons of gold over five years. This is not a cosmetic reshuffle but a real revision of the global reserve architecture.

The absolute leader is China, which added over 350 tons. This move aligns with Beijing’s long-term strategy to reduce dependence on the U.S. dollar and decrease vulnerability to the Western financial system. Here, gold serves not just as an investment asset but as a politically neutral reserve that cannot be “frozen” by a single foreign regulator’s decision.

Poland ranks second, increasing its reserves by more than 300 tons. Warsaw is steadily strengthening financial resilience, viewing gold as insurance against instability in Europe and potential currency shocks. In a sense, Poland is following the old-school approach: better to have metal in storage than illusions on paper.

Other major buyers include Turkey and India. Both countries face chronic inflationary pressures and volatile national currencies, making gold a natural hedging tool. It is a way to protect reserves from devaluation and strengthen confidence in the financial system.

Top countries by net gold purchases since 2020: China +357 tons, Poland +314 tons, Turkey +251 tons, Italy +245 tons, Brazil +105 tons.

The difference in motivations is particularly interesting. Beijing continues its strategic move away from dollar dependence, Warsaw hedges against European instability, Turkey and India protect against inflation, while other nations simply aim to diversify reserves in a world where the old rules no longer work as reliably.

And this is where the second part of the story begins — when retail enters the game.

Central banks bought gold calmly, methodically, without emotion. But once prices shot into “space,” retail jumped in, and the market experienced the classic FOMO effect. Gold looked too expensive for the average buyer, so many shifted to a “more accessible alternative” — silver.

This triggered a side silver pump: when gold seems out of reach, the crowd always looks for the next asset that “hasn’t flown yet.” Critics may argue that silver is simply a strong asset and demand naturally rose, but industrial consumption statistics do not support such an explosive jump.

It was mostly pure market psychology: fear of missing out pushed silver to around $120. Now, the market is seeking a new “fair” price, which many see closer to $80.

The takeaway is simple: gold wasn’t pumped by bloggers or traders, it was pumped by states. When central banks act as the largest buyers, it’s no longer hype, it’s a structural shift. And as always, retail joins last — amplifying the movement to its maximum noise.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.