? A whole Bitcoin in 2025: luxury or achievement?

Owning a whole Bitcoin in 2025 is a status only a tiny fraction of people on the planet can afford. While a regular investor sees BTC as a digital asset, a true owner of a whole coin belongs to the exclusive “blue bird” club of the financial world.

BTC owners: who they really are

Blockchain data shows that 827,000–900,000 addresses hold at least 1 BTC. However, many of these wallets belong to exchanges, large funds, or are split across multiple addresses of the same owner. The actual number of unique owners is estimated at 800,000–850,000.

Out of 8 billion people on Earth, owning a single coin is available to only 0.01%–0.02%. Among crypto investors in 2025, only 0.18% own a full BTC — meaning fewer than two out of a thousand market participants can claim this rarity.

Bitcoin distribution by addresses

90% всех BTC — 1,86% адресов

14% всех BTC — 4 крупнейших адреса

58% всех BTC — топ-100 адресов

Остальные 42% BTC — все остальные адреса

Comment: most Bitcoins are concentrated in the hands of a very small number of owners.

Bitcoin vs. millionaires: myth or reality?

The world has about 16 million USD millionaires, while fewer than 900,000 people own at least one Bitcoin. Owning a whole Bitcoin is therefore rarer than having millionaire status.

Example: NFL star Odell Beckham Jr. converted his 2021 salary into Bitcoin for $750,000. Today that amount is worth around $1.35 million — a clear demonstration of the digital asset’s power.

Number of Whole Bitcoin Owners

Мир: ~8 млрд человек

Владельцы хотя бы 1 BTC: ~800 000–850 000

Доля населения: 0,01–0,02%

Среди криптоинвесторов: 0,18%

Comment: fewer than two out of a thousand crypto investors own a whole Bitcoin.

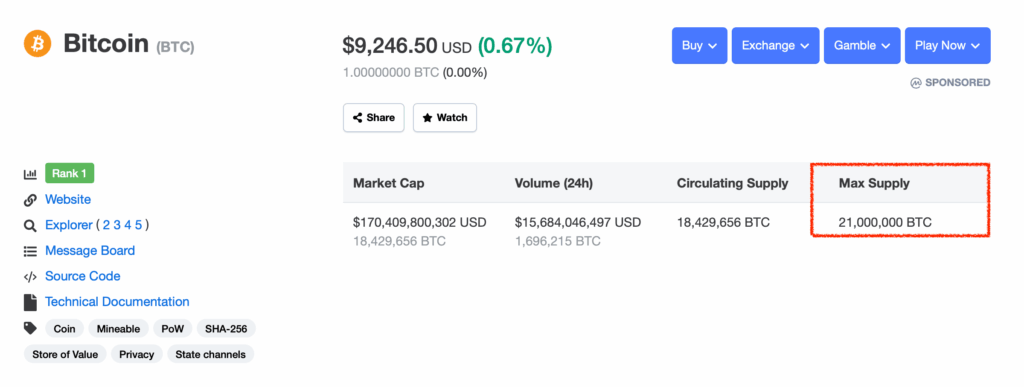

BTC as gold: why Bitcoin is scarce

Satoshi Nakamoto set a limit of 21 million coins, expecting Bitcoin to become scarce over time, increasing its value.

By mid-2025, over 19.8 million have been mined. Less than 1.2 million remain for future mining. Accounting for lost coins, the available pool shrinks even further.

Extremely uneven distribution:

1.86% of addresses control 90% of supply

Four addresses with 100,000–1 million BTC collectively own 14% of all coins

Top 100 addresses hold over 58% of supply

Satoshi’s estimated holdings: 750,000–1.1 million BTC, valued at $92–135 billion

Comparison with Millionaires

Долларовые миллионеры: ~16 млн

Владельцы целого BTC: <900 000

Вывод: быть владельцем целого BTC сложнее, чем миллионером

Comment: the rarity of BTC is more illustrative than any banking statistics.

Why a whole Bitcoin is hard to get

According to Triple-A, about 6.8% of adults globally own cryptocurrencies — around 560 million people. Most hold less than 0.01 BTC.

There are financial, infrastructure, and psychological barriers:

- Financial: 1 BTC costs over $110,000, high volatility

- Infrastructure: 1.4 billion adults without banking access, internet limitations, KYC, fees, tax uncertainty

- Psychological: price swings from $109,000 to $70,000 in weeks can paralyze a typical investor

Mining and remaining BTC supply

Общее ограничение: 21 млн

Добыто на середину 2025: >19,8 млн

Осталось для майнинга: <1,2 млн

Учет потерянных монет: фактически меньше

Comment: scarcity increases the value of each new BTC.

Ways to acquire your first BTC or reach a full coin

- DCA (Dollar-Cost Averaging): regular purchases to smooth volatility

- Spot BTC ETFs: launched in 2024 (BlackRock IBIT, Fidelity FBTC) raised $120 billion, creating a safe, regulated channel

- Salary in crypto: Web3 employees can receive part of their income in Bitcoin

Bitcoin vs. gold: who is the king of security?

Unlike gold, mined over millennia, Bitcoin is technologically limited. Each BTC has a strict cap, and rising institutional demand makes it a rare asset with growth potential.

If owning a gold bar is accessible to a wide range of investors, a whole Bitcoin is both a status symbol and a rarity. One could say that BTC in the digital world acts as the “digital gold of the 21st century.”

Exclusive club

? Owning a whole Bitcoin is not just an investment; it’s membership in an exclusive club. With rising institutional demand and continued scarcity, joining this club becomes increasingly difficult. Each new BTC is a symbol of rarity, status, and strategic thinking.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.