? Ethereum has been hovering on the edge of a major price surge for months, with $5,000 increasingly mentioned as a key psychological target. Yet, despite favorable conditions for the broader crypto market, ETH has so far failed to break through this threshold. Let’s analyze what is holding the second-largest cryptocurrency back.

Pressure from long-term holders (LTH) One of the main factors is the behavior of so-called LTH (long-term holders) — investors who keep coins for months or years.

One of the main factors is the behavior of so-called LTH (long-term holders) — investors who keep coins for months or years.

ETH and Liveliness metric. Source: Glassnode

According to Glassnode, the Liveliness metric shows rising activity: old, “dormant” coins are coming back into circulation. This means some investors decided to lock in profits after the recent rally.

- The more old coins hit the market, the greater the downward pressure on price.

- Historically, such periods coincided with consolidation or correction phases.

- For ETH, this signals the market isn’t ready for a sustainable breakout without new buyers.

Futures traders fueling bearish sentiment

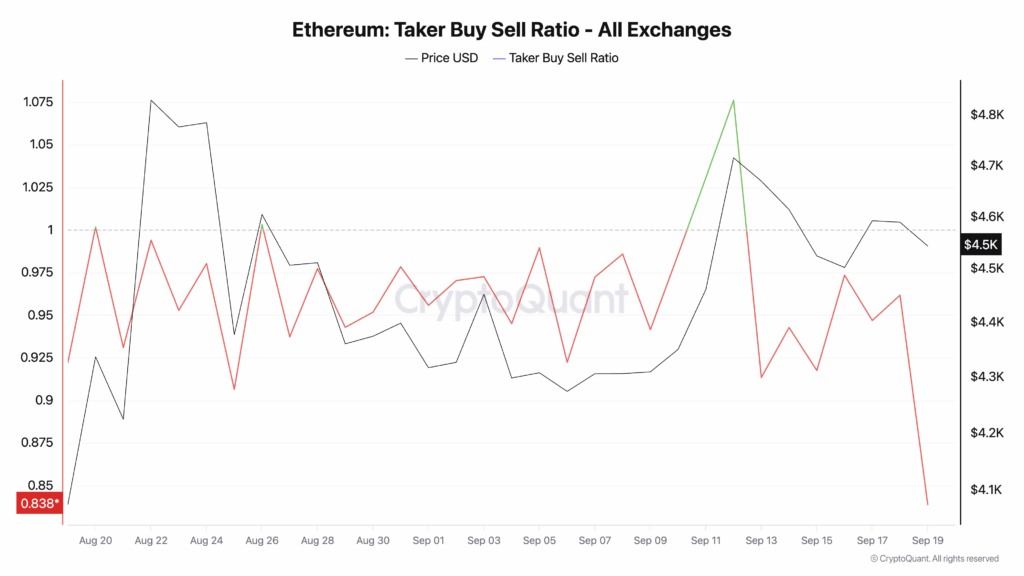

Another factor is the derivatives market. The taker buy-sell ratio from CryptoQuant has remained below 1 for a month.

Ethereum and Taker Buy Sell Ratio metric. Source: CryptoQuant

- This indicates that futures and perpetual contracts are dominated by selling.

- When open interest grows while the buy-sell ratio is negative, markets often see higher volatility and additional price pressure.

- In other words: derivatives traders keep “betting against ETH.

” This dynamic often prevents the asset from climbing, even if the spot market remains supportive.

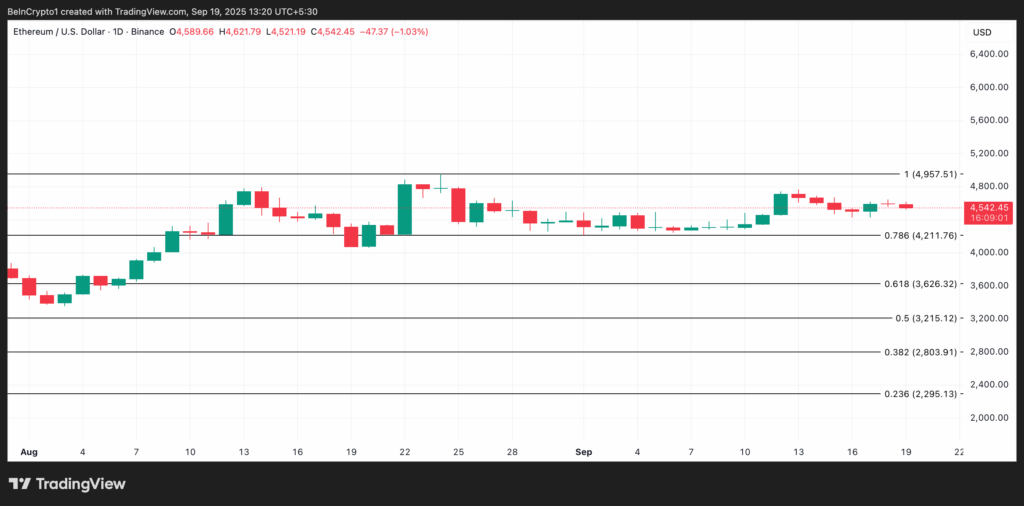

Support levels and the psychological barrier

Currently, the key support is at around $4,211. This level is preventing a deeper correction.

However, to reach $5,000, ETH needs stronger demand — from both institutional players and retail investors. Without a solid capital inflow, the market risks getting stuck in range.

Ethereum price analysis. Source: TradingView

- $5,000 is not just a technical milestone but also a psychological one.

- Breaking above could spark fresh FOMO and accelerate growth.

- But with demand still muted, the move is postponed.

What could trigger the breakout?

- Institutional interest:

- approval of new Ethereum ETFs or rising inflows into existing funds could push the price up.

- Growth in DeFi and L2:

- Network upgrades:

- announcements on scaling improvements or lower fees typically act as catalysts.

- Network upgrades:

- announcements on scaling improvements or lower fees typically act as catalysts.

Market recovery: if Bitcoin holds above key levels, ETH usually follows. - What’s next? Scenarios for Ethereum

- Support: $4,211. A drop below may send price down to $3,626.

- Resistance: $4,957. A breakout above paves the way toward the psychological $5,000+.

- Growth currently lacks one key factor — a massive return of demand. As long as big players are locking in profits and traders don’t believe in growth, the move to new highs is postponed.

- The main question: who will prove stronger — profit-taking “old” investors or new buyers ready to believe in Ethereum at $5,000 and beyond?

- announcements on scaling improvements or lower fees typically act as catalysts.

What’s next? Scenarios for Ethereum

- Support: $4,211. A drop below may send price down to $3,626.

- Resistance: $4,957. A breakout above paves the way toward the psychological $5,000+.

Right now, growth lacks one thing — a strong return of demand. As long as big players are taking profits and traders remain skeptical, the path to new highs is delayed.

The main question: who will prevail — profit-taking long-term holders or new buyers ready to believe in Ethereum above $5,000?

⚖️ Conclusion

Ethereum is stuck in a “pressure corridor”:

- on one side — long-term holders locking in profits,

- on the other — futures traders betting on decline.

Without fresh capital and renewed interest from institutions and retail, the road to $5,000 is postponed.

Still, as long as support holds above $4,211 and demand gradually returns, Ethereum retains every chance for a new historical growth phase.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.