They control around $60 trillion. That is more than the GDP of the United States and China combined. These are not governments and not central banks. These are the world’s largest asset management companies – the ones that determine where global capital flows.

We are talking about so-called asset managers – structures that manage the money of pension funds, insurance companies, sovereign wealth funds, corporations, and millions of private investors. Their power lies not in loud statements, but in the scale and inertia of capital.

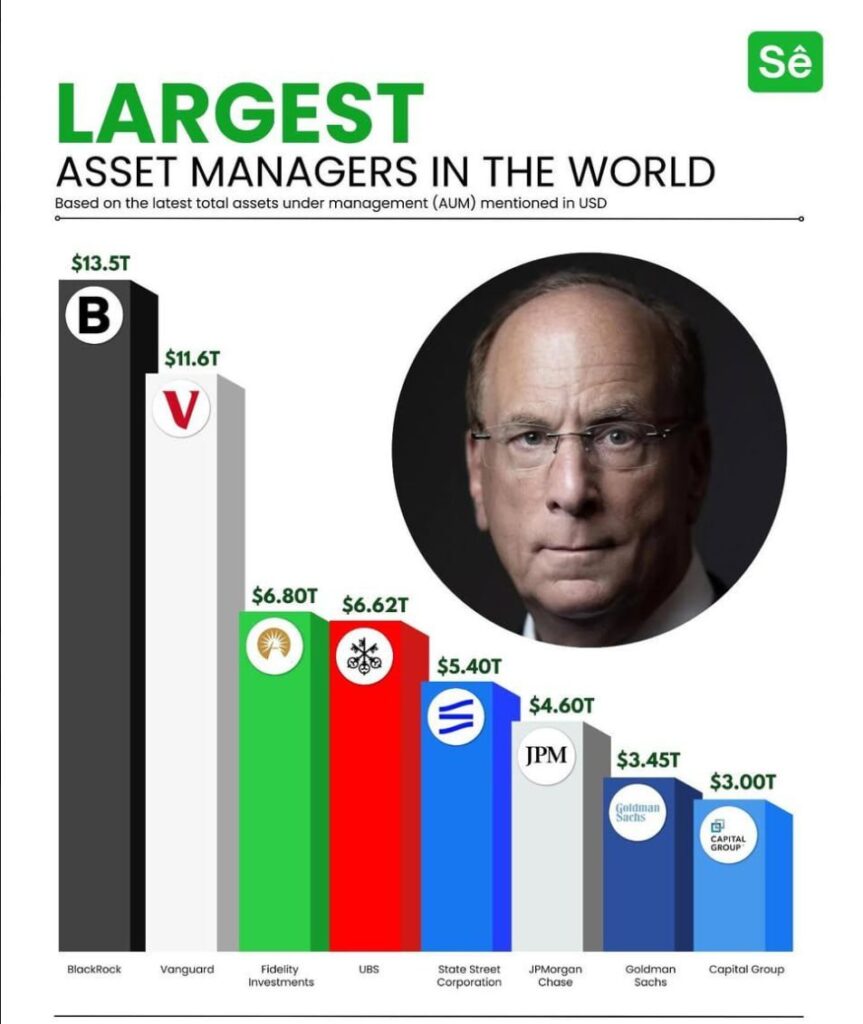

The top 10 largest asset managers look like this:

BlackRock – $13.5 trillion under management. The absolute number one. A company whose decisions are capable of moving markets. It was BlackRock that first turned Bitcoin from a marginal asset into an “acceptable” instrument for institutions through the launch of a spot ETF.

Vanguard – $11.6 trillion. A conservative giant managing money through index funds. Vanguard avoided the crypto market for a long time, but its clients are already getting exposure through companies connected to BTC, and the pressure from below is only growing.

Fidelity Investments – $6.8 trillion. One of the earliest institutional supporters of Bitcoin. Several years ago, Fidelity launched custodial solutions for BTC and is actively promoting crypto products for institutional clients.

UBS – $6.62 trillion. A European banking giant that is cautiously but consistently integrating digital assets into investment products for wealthy clients.

State Street Corporation – $5.4 trillion. One of the key players in ETF infrastructure. Without State Street, the modern fund market simply does not function – and it is precisely companies like this that make Bitcoin “part of the system.”

JPMorgan Asset Management – $4.6 trillion. A paradoxical player: publicly skeptical, yet actively working with blockchain, tokenization, and crypto products for clients.

Goldman Sachs – $3.45 trillion. A classic investment bank that always enters later than others, but does so at scale. Goldman already offers clients instruments linked to BTC and the crypto market.

Capital Group – $3 trillion. One of the largest managers of pension and long-term capital. Funds like these create “slow,” but stable demand.

Crédit Agricole – $2.68 trillion. Conservative European capital that is increasingly viewing digital assets as an element of diversification.

BNY Investments – $2.1 trillion. The oldest bank in the United States and a key custodian of the global financial system. Its involvement in crypto infrastructure is an important signal of market maturity.

Together, these structures manage capital that forms the foundation of the global financial system. This is money from pensions, insurance, reserves, and long-term strategies. And now this capital is looking more and more closely toward Bitcoin.

It is important to understand: this is not about speculation or “quick multiples.” These companies do not buy assets for hype. Their interest in BTC is recognition of it as a new asset class, comparable in importance to gold, bonds, or equities.

The launch of spot Bitcoin ETFs became a turning point. It transformed BTC from a complex technological tool into a familiar financial product that can be purchased through a brokerage account, a pension plan, or an institutional portfolio. For such giants, this is crucial: infrastructure matters more than ideology.

If even a small portion of these $60 trillion is allocated to Bitcoin, the market will face a fundamentally new level of demand. With Bitcoin’s fixed supply, this changes not only the price, but the very status of the asset.

Bitcoin is gradually ceasing to be an alternative to the system. It is becoming part of it. And when the world’s largest asset managers begin building products around it, the question is no longer “whether BTC is needed,” but what role it will occupy in global portfolios.

Historically, this is exactly how major shifts happen: first an asset is ignored, then mocked, then cautiously accepted – and eventually embedded into the core of the financial architecture. Judging by the actions of these companies, Bitcoin is already at the final stage of this path.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.