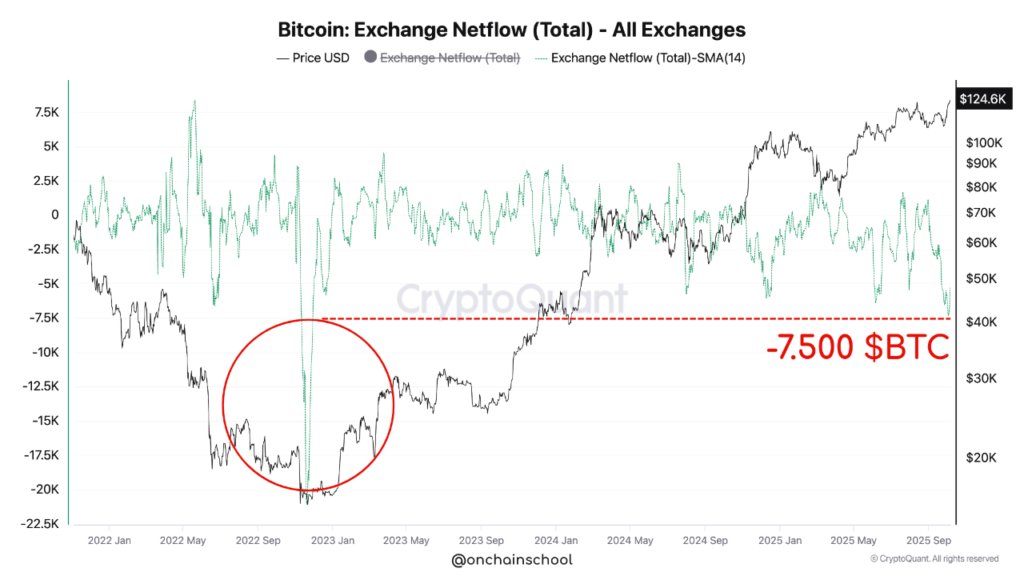

Overnight (October 7, 2025), Bitcoin once again set a new all-time high — and the crypto market showed a rare combination: the price is rising, while coins are leaving exchanges en masse. In the past 24 hours, investors withdrew about 7,500 BTC — nearly $942 million. That’s the largest net outflow in the last three years!

Source: cryptoquant.com

Interestingly, this is happening against the backdrop of record prices. Typically, when Bitcoin hits new highs, traders rush to take profits. This time, however, it’s the opposite — holders are pulling coins off exchanges, signaling growing confidence in long-term value and reduced short-term selling pressure.

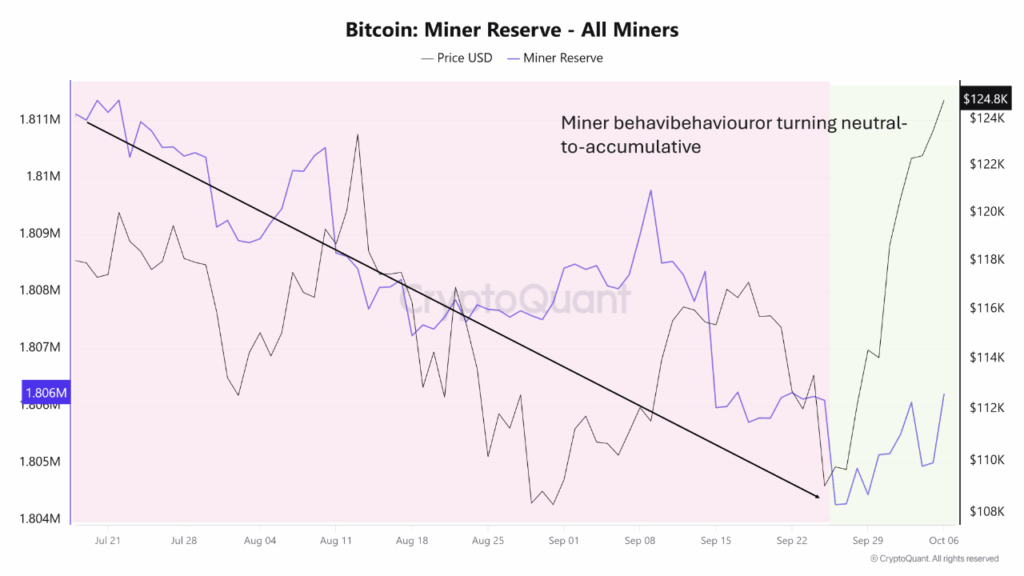

Miners Shift Strategy

After months of heavy selling, miners have started accumulating Bitcoin again. Their reserves have stabilized, reducing the pressure from the supply side. Historically, such periods have coincided with the start of more sustainable bullish phases — when liquidity gradually shifts toward buyers.

Market Balance Is Changing

Another key indicator — the taker buy-sell ratio — has confidently risen above 1. This means there are now more aggressive buyers than sellers in the market. While in late September the market wavered in uncertainty, participants are now once again willing to buy at market prices instead of waiting for dips. The price action fully confirms this behavioral shift.

Institutions Return

CME options data show that major investors are actively increasing their exposure, especially in short- and medium-term contracts (with maturities of two to four months). This rise in open interest is happening alongside a price increase, indicating new capital inflows rather than mere hedging.

If the trend continues, the market could establish a solid medium-term support level. In that case, a new upward impulse could follow, potentially liquidating around $16 billion in short positions before the next consolidation phase.

Source: cryptoquant.com

Bottom Line

This time, Bitcoin’s rally doesn’t look speculative. Unlike previous surges, the current move is built on structural shifts — declining miner supply, growing institutional positions, and the confidence of long-term holders. All of this points to the formation of a more mature and sustainable rally, where fundamentals are finally catching up with the hype.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.