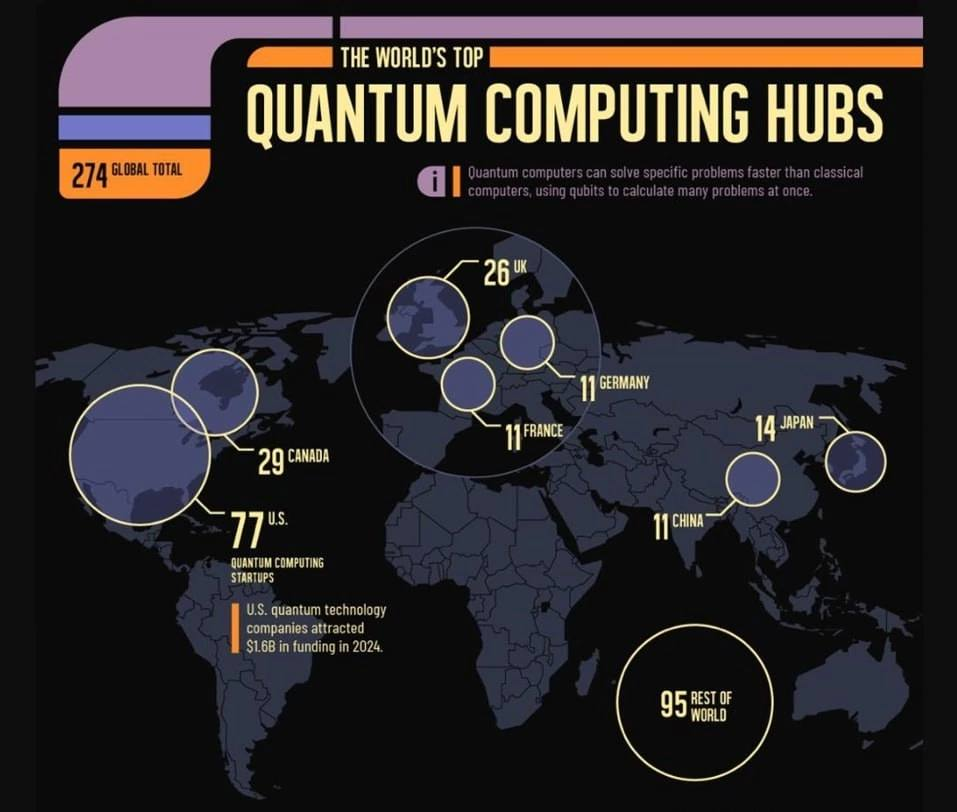

⌨️ Quantum startups: where the leaders are concentrated and why investors are actively entering the market

- USA — 77 startups: market leader thanks to a strong venture ecosystem, top universities, and government support.

- Canada — 29 startups: synergy between research and industry, quantum hubs in Toronto and Waterloo.

- United Kingdom — 26 startups: government grants and focus on quantum computing, communication, and materials.

Globally, there are 274 quantum startups, with government investments in quantum technologies reaching approximately $54 billion.

Today, the main centers of quantum technology are concentrated in the USA, where 77 startups work on quantum computing, quantum cryptography, sensors, and other innovative applications. The USA remains the leader due to a combination of a strong venture ecosystem, leading university programs, and government support.

Canada ranks second with 29 startups. The country emphasizes the synergy of academic research and commercialization. For example, Toronto and Waterloo host active quantum labs closely linked with industrial partners.

The United Kingdom rounds out the top three with 26 companies focusing on quantum computing, communications, and materials. The UK government provides significant grants to develop the sector, attracting researchers and investors from around the world.

Overall, government investments include not only research funding but also programs for training specialists, creating national quantum centers, and supporting the scaling of technologies to industrial levels.

Why are investors actively buying shares in quantum startups? Quantum technologies promise a revolution in computing, big data processing, medical diagnostics, and cybersecurity. Even small successes can lead to rapid growth in company valuations, making the sector attractive for long-term investments. Additionally, government support and strategic importance reduce some of the risks for investors.

? Conclusion: The USA, Canada, and the UK form the core of the global quantum ecosystem. For investors, this represents a strategic bet on the future of high-tech industries.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.