The situation around Ethereum currently looks like a classic crossroads of “bull” and “bear” interests, where the market is at a turning point and neither direction has yet taken clear control. Expert opinions are divided: some believe ETH is still in a capitulation phase, and the price could fall below current levels before a final structural bottom forms, while others see the current prices as a unique opportunity for long-term accumulation.

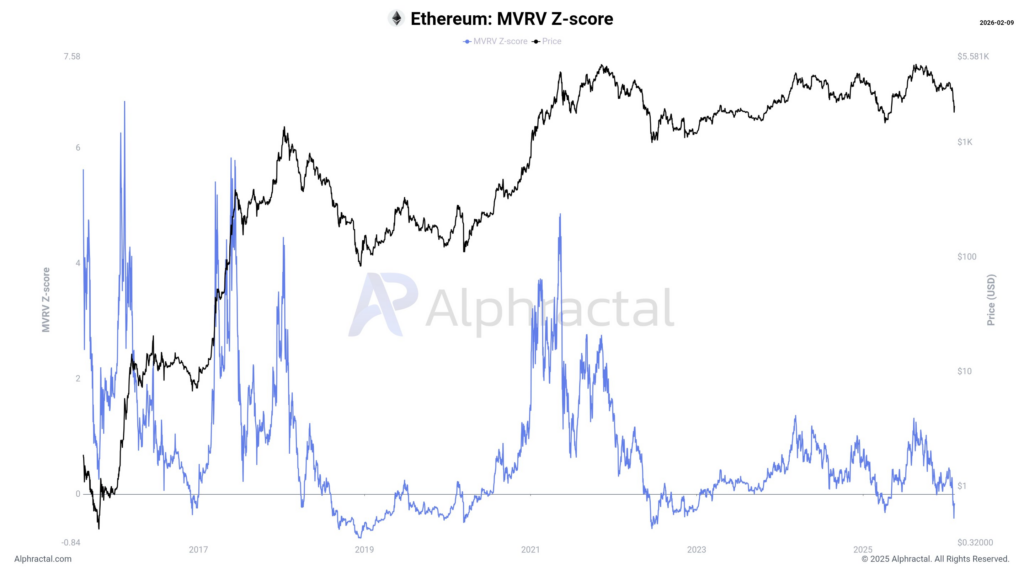

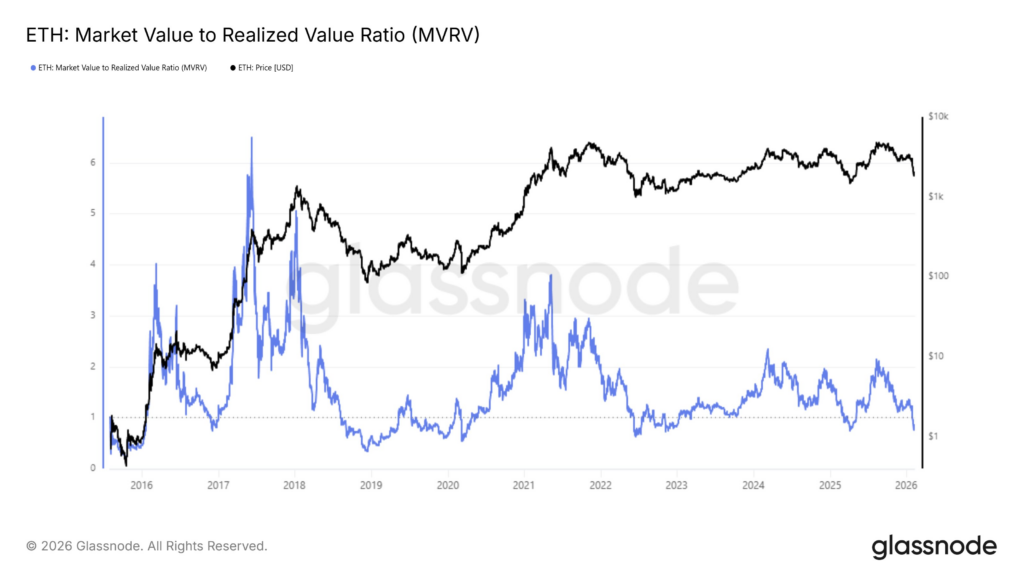

Alphractal founder João Vedson points to the Ethereum MVRV Z-Score, which is in the capitulation zone at -0.42, above the historical low of -0.76 from December 2018, warning of possible further declines before the final price bottom forms.

HashKey Group senior researcher Tim Sun emphasizes that it is premature to claim the correction is over: despite improvements in the network’s fundamentals, external macroeconomic factors continue to exert pressure, and the upcoming April tax season may create a liquidity shortage and increase volatility. Meanwhile, MN Trading founder Michael van de Poppe calls the current level a “fantastic opportunity,” noting the significant gap between Ethereum’s market price and its potential “fair value,” creating unique chances for long-term investors.

The technical picture also signals tension: ETH is trading around $2,020, down 3% over the past 24 hours, breaking key support levels. The price is below both the 90-day and 360-day moving averages, while the RSI below 30 indicates oversold conditions. Key levels to watch: $2,200 — a multi-year support and resistance level since December 2023; a break below this range could open the way to $1,800–$1,850, a historically significant liquidity zone. Above, important resistance levels are at $2,420 and $2,800, placing the current price squarely in the middle of the range, awaiting either a confident rebound or an accelerated drop.

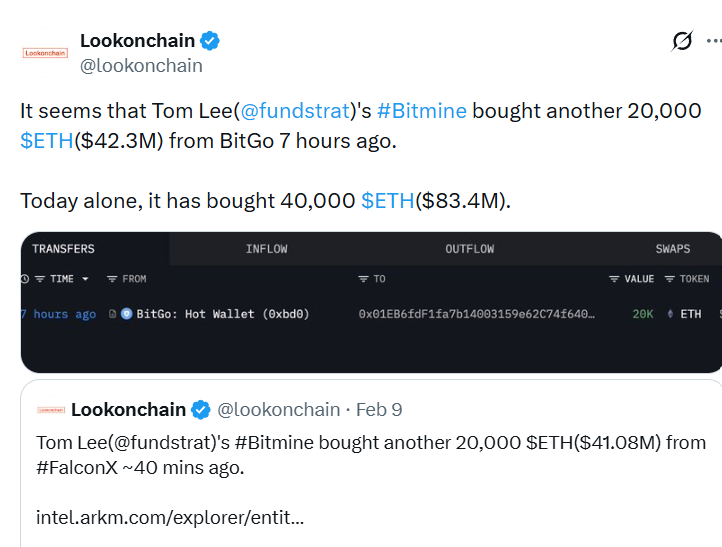

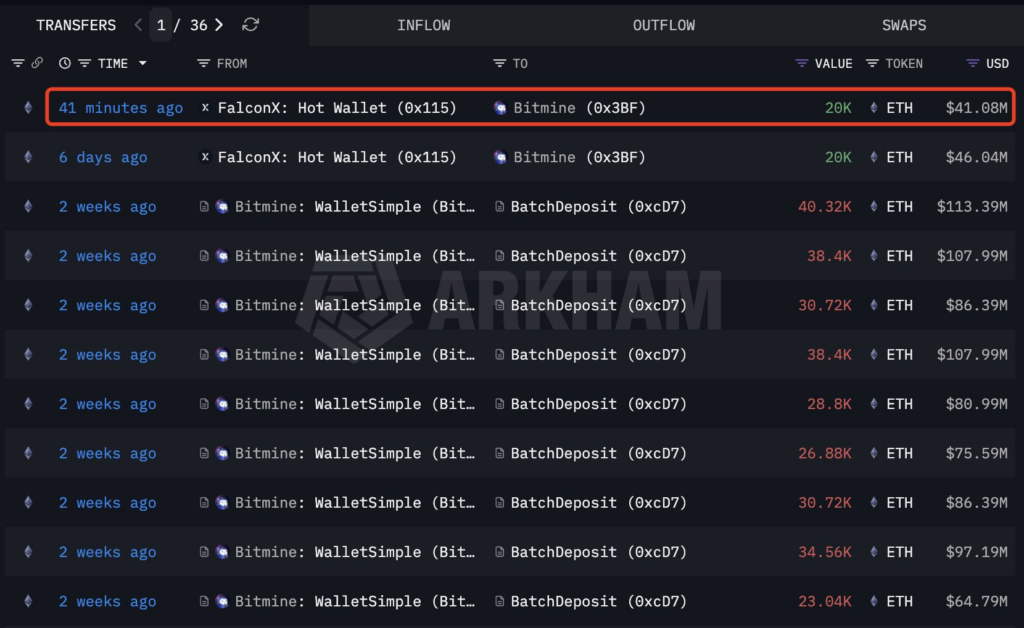

Institutional activity is also in focus. BitMine Immersion Technologies acquired an additional 40,000 ETH for roughly $83.6 million, receiving 20,000 ETH via FalconX. Lookonchain analysts recorded another purchase of the same volume through the custodian BitGo at around $2,090 per coin. With the previous purchase of 40,613 ETH last week, BitMine’s total reserves exceeded 4.36 million ETH, representing 72% of their plan to accumulate 5% of the total Ethereum market supply. BitMine’s chairman Tom Lee emphasized that current levels are attractive for entry, stating: “The best investment opportunities come after market declines.”

From a long-term strategy perspective, Ethereum’s current prices indeed appear as a chance for gradual accumulation. Bitrue lead researcher Andri Fauzan Adjiima adds that historically, negative MVRV values have preceded strong recovery impulses, making the $2,000–$2,100 zone attractive for entry, while the $1,800–$1,850 range serves as key support for more aggressive strategies. If the market can hold above $2,500, it could trigger a new rally with target levels of $3,000–$3,300. It remains essential to follow basic capital management rules: use stop-losses, diversify risks, and adhere to Money Management, as the crypto market remains volatile and unpredictable.

Ethereum is at a crossroads: some see further decline, others see a chance for accumulation, and major players like BitMine confirm interest in the asset even at current levels, demonstrating institutional confidence in the network’s long-term potential. This combination of market uncertainty and strategic accumulation creates a unique moment, with all participants’ attention focused on key support and resistance levels, shaping scenarios for a potential new growth cycle for ETH.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.