?In the mid-1990s, the US stock market was buzzing: the tech sector was just beginning to rise, investors eagerly discussed Microsoft and Intel, but few paid attention to industrial companies working “in the shadows.” It was there, among these unnoticed businesses, that the future golden ticket was hiding.

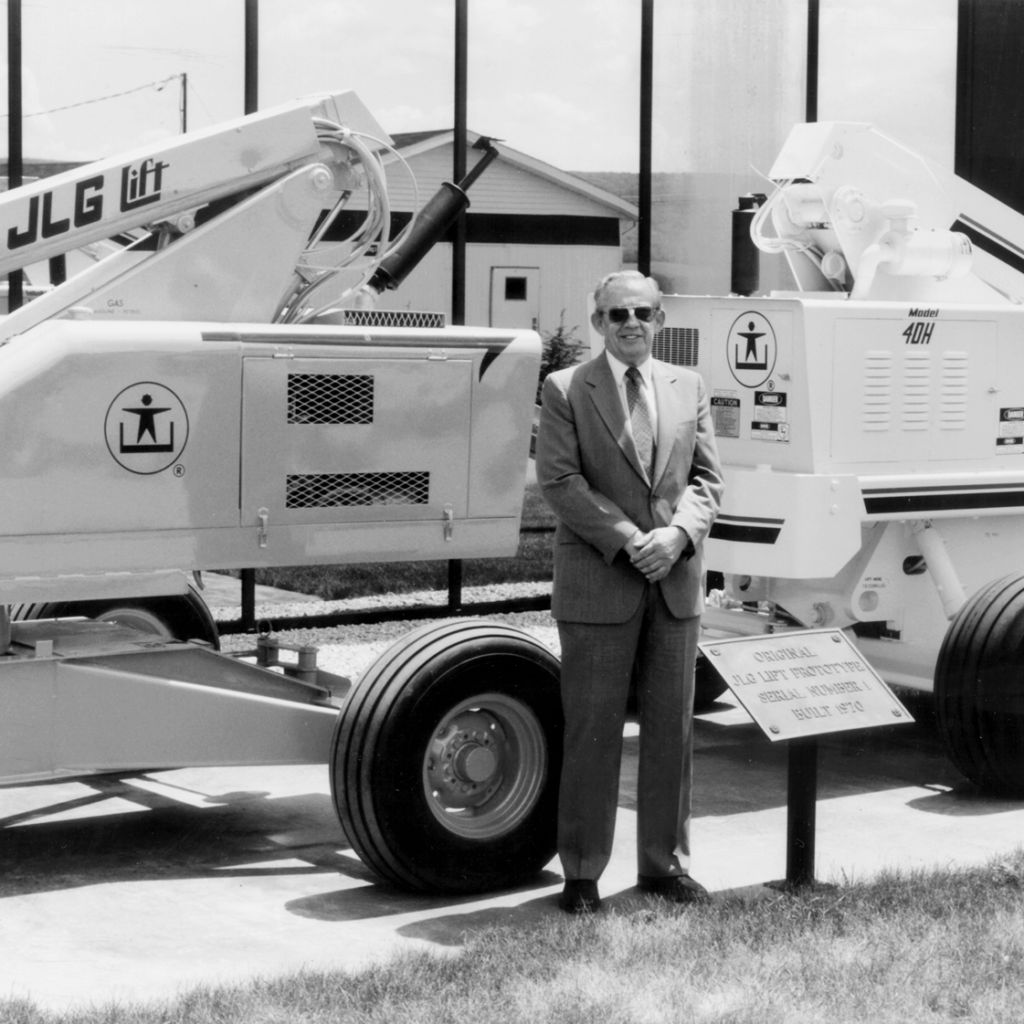

This company was called JLG Industries. A manufacturer of hydraulic lifts, construction equipment, and warehouse machinery. At first glance, a boring business with no trendy words like “internet,” “Silicon Valley,” or “nanotechnology.” But the numbers told a different story: return on equity (ROE) was around 22%, and sales were growing year after year. For an industrial firm, this was a figure that caught experienced investors’ attention.

Spotting the diamond in the rough

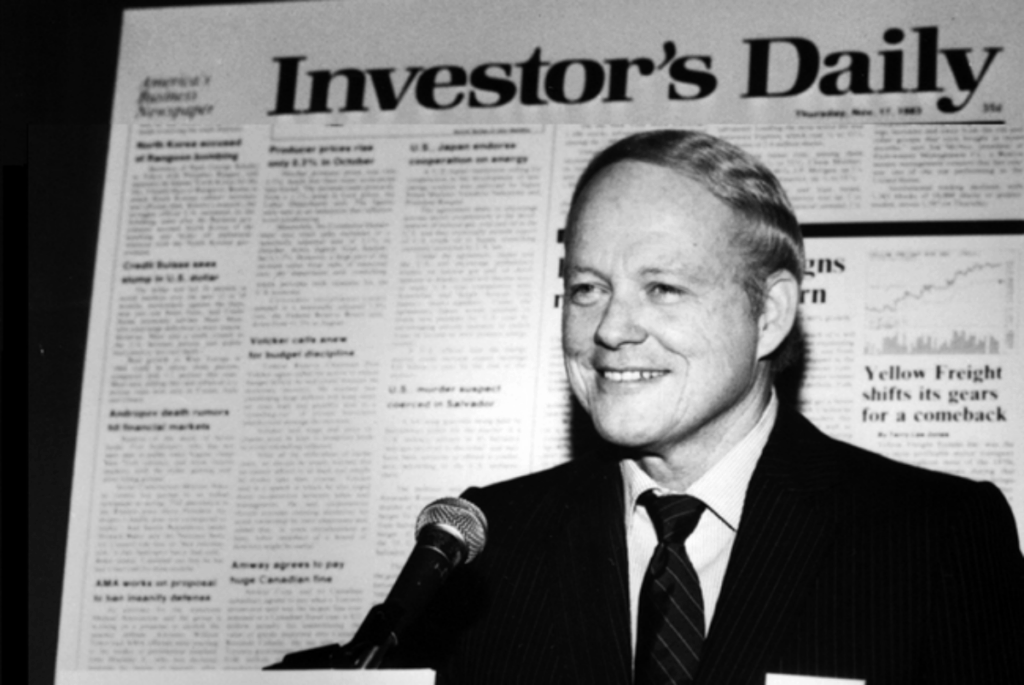

Most analysts underestimated JLG at the time. But William O’Neil, author of the famous CAN SLIM method, knew how to identify companies by key criteria:

- Strong profit and sales growth.

- High profitability.

- Institutional interest — funds and large investors starting to buy in.

- Proper chart formation — accumulation without large-volume sell-offs.

All these factors aligned, and O’Neil bought JLG shares at around $11 (split-adjusted). Within a few months, the price rose to $28.

The first surge and the first test

Many investors in O’Neil’s place would have locked in profits and celebrated. But the market always tests patience and discipline: a correction followed soon after, and the price fell nearly 20%.

Here lies the main difference between a successful trader and the crowd. Novices would panic-sell. O’Neil saw this not as a disaster but as a healthy pause.

His rule: “If the price holds above the 10-week moving average and volume decreases, it’s not a drop, but consolidation.”

The second surge — reward for discipline

The company soon released a new report: profits and sales grew again. This was the signal of strength, and instead of closing his position, O’Neil added to it.

Eight weeks later, the price jumped to $47.

Those who sold on the first rise or panicked during the correction were left with modest gains. O’Neil demonstrated how strict systems and iron discipline can turn a single idea into a trade comparable to winning the lottery.

Lessons for traders and investors

The JLG Industries story is not just about a successful trade; it’s a miniature textbook:

- Fundamentals matter. Profit growth and high ROE signal business strength.

- Charts and volumes don’t lie. A 15–20% correction is normal if volume declines and the trend holds.

- Adding to a position is an art. Enter again only on confirmed signals.

- Emotions are the enemy. Panic and greed destroy profits. Only a pre-defined system saves you.

- One stock can change everything. The right market leader can offset dozens of mistakes.

✅ Conclusion

O’Neil proved that success in the market comes from discipline and system, not luck. He saw opportunities where others saw only “gray” industry. That is why the JLG Industries story is still cited in trading textbooks.

Sometimes, one right trade is enough to transform your entire investment career. The question is whether you are ready to wait and act according to rules, not emotions.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.