? The service market in the US includes plumbers, electricians, HVAC specialists, and other household system professionals. For a long time, it remained “old-school”: built on personal contacts, word-of-mouth recommendations, paper notes, and the experience of craftsmen. However, digitization is now entering this sector. One of the main drivers of this change is ServiceTitan (ticker TTAN), which has created a comprehensive software solution for managing service businesses.

The ServiceTitan platform covers all key processes: from the first client call and job request to technician dispatch, work execution, invoicing, and payment. For many companies, this is a leap to a completely new level — from chaotic management to systematic and transparent business processes.

What Has Changed and How the Company Is Growing

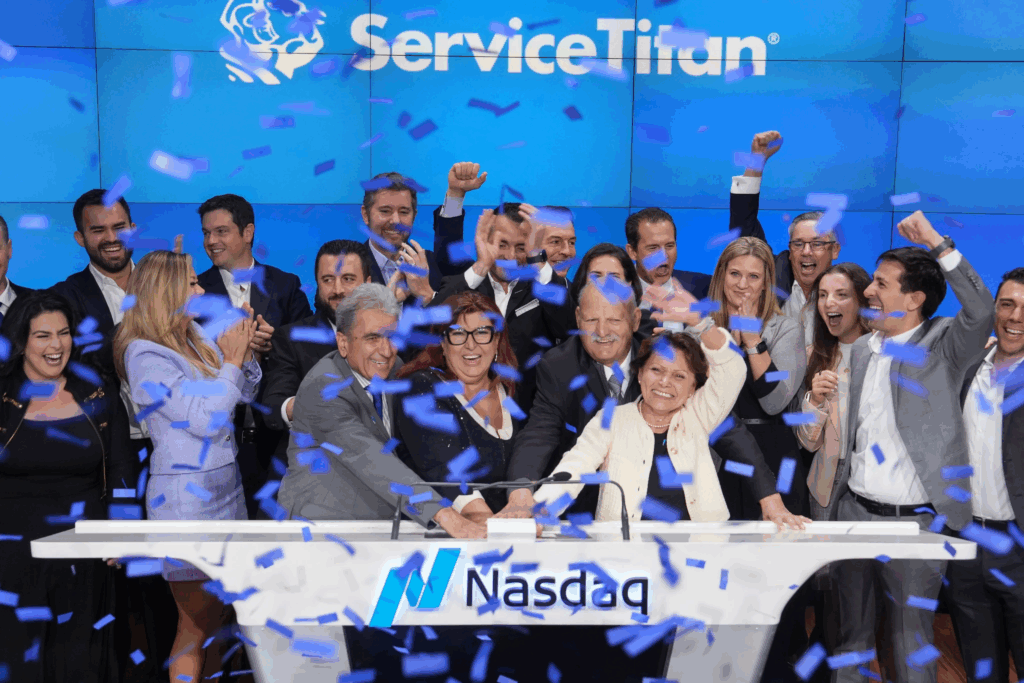

Today, more than 9,500 clients — companies from the service sector — already use the ServiceTitan platform.- At the end of 2024, the IPO took place, and in 2025 the company’s stock showed growth of about 12%.

- Second-quarter financial results demonstrated impressive dynamics: profit increased by 200%, while revenue rose by 25%.

- A key growth driver has been Titan Intelligence, the company’s AI technology. It allows processes to be almost fully automated. There are already real cases where an order — from a client’s call to invoicing — is processed entirely without human involvement.

Who ServiceTitan Works With

The company is actively expanding its partner network. Among the notable partners:

- Roto-Rooter — the largest player in plumbing services;

- Affirm — a popular “buy now, pay later” installment service.

In addition, more than 1,000 ServiceTitan clients bring the company over $100,000 per year. This shows that the product is in demand not only among small contractors but also among large market players.

Why This Is Interesting for Investors

- Huge and fragmented market. Service services represent a trillion-dollar segment of the US economy, with many small and medium-sized companies. A system that unites their work on a single digital platform has massive scaling potential.

- Unified solution. ServiceTitan offers a full suite of tools: CRM, accounting, analytics, workforce management, and payments. For clients, this is more convenient than integrating a dozen different services.

- Revenue model. Around 75% of revenue comes from “Pro” subscriptions. This creates a stable and predictable cash flow.

Risks for the Company and Investors

- Competition. Giants like Salesforce and other tech companies with resources and existing customer bases may enter the market.

- Slowdown in transaction growth (GTV). If clients carry out fewer operations or order growth slows, it may hurt revenue dynamics.

- Dependence on the US market. ServiceTitan is still focused on the American market, and expansion into other regions will require significant investment and product adaptation.

? Conclusion

ServiceTitan is an example of how digitization and artificial intelligence are entering even the most traditional industries, where nothing has changed for decades. The company has already proven that its solutions can transform the market, and its second-quarter results only confirm the growth potential.

For investors, this is an interesting case: the service market is huge, and there are not many competitors offering such a comprehensive solution. The potential of ServiceTitan will become even more evident if the company actively expands into the commercial segment and moves beyond the US.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.