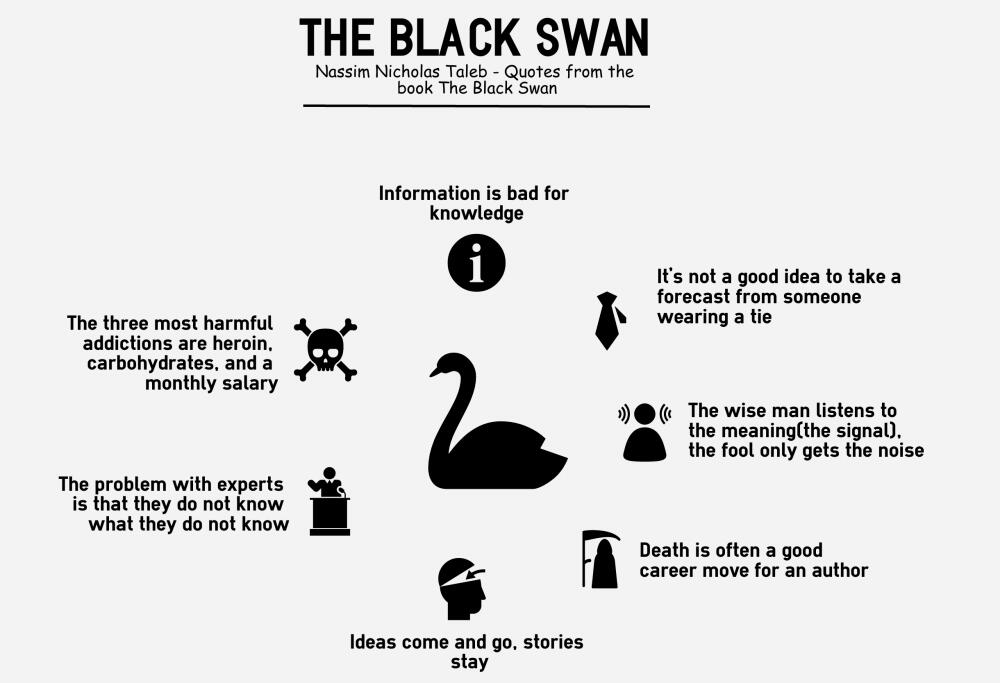

? The term “Black Swan” entered economics and finance from Nassim Nicholas Taleb’s book “The Black Swan: The Impact of the Highly Improbable.”

It refers to a rare and unexpected event that has three key characteristics:

- Rarity and unpredictability — such events occur extremely rarely and do not fit ordinary statistical models, making them almost impossible to predict based on past data.

- Extreme impact — the consequences of these events are usually massive, capable of sharply changing a market, industry, or the economy as a whole.

- Retrospective explainability — after the event occurs, people find “logical” explanations for why it should have happened, even though it was practically impossible to foresee in advance.

Examples of “Black Swans” in financial history:

- The stock market crash of 1987 (“Black Monday”), when the Dow Jones index lost over 20% in a single day.

- The 2008 financial crisis, triggered by the collapse of the U.S. mortgage-backed securities market.

- The COVID-19 pandemic in 2020, which sharply affected global markets, supply chains, and the economies of many countries. The world was caught off guard, global markets collapsed, supply chains and businesses were in crisis. But investors prepared for shocks were able to profit from the drops and quick recoveries.

- The crypto market and the FTX collapse (2022) — the unexpected bankruptcy of one of the largest crypto exchanges triggered a drop in many token prices. Those who had pre-distributed risks and maintained reserves limited losses, and some managed to profit from the market decline.

- The tech stock crash of 2022 — a combination of inflation, interest rate hikes, and geopolitical risks came as an unexpected “shock” for investors.

Why “Black Swans” matter for investors

Standard forecasting and risk assessment models based on statistics and historical data often do not account for the probability of a “Black Swan.” As a result, markets can experience shocks and strong volatility when an unexpected event actually occurs.

For investors, a “Black Swan” is both a risk and an opportunity. On one hand, unexpected events can lead to significant losses. On the other hand, those who are prepared in advance or can quickly adapt can gain significant profits from sharp market movements.

How to mitigate Black Swan risks

Although such events cannot be fully predicted, strategies exist to minimize losses:

- Asset diversification — spreading investments across different asset classes and geographies reduces the risk of large losses.

- Hedging — using options, futures, and other instruments to protect a portfolio.

- Financial cushion — having liquid reserves allows surviving unstable periods.

- Flexibility and readiness to adapt — the ability to respond quickly to events and adjust strategy in a crisis.

? Conclusion

The “Black Swan” reminds us that the financial world is full of uncertainty. Risks cannot be completely eliminated, but understanding the nature of rare and unpredictable events helps investors be cautious, prepared for shocks, and able to seize opportunities when they arise.

In crypto and stock markets, such events can be both a threat and a chance — if you are ready.

By the way, do you think tonight is a “Black Swan”? (Earlier today, we wrote about Donald Trump announcing a 100% tariff on goods from China and what that could mean).

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.