? U.S. exchanges are closed today in observance of Labor Day, but the week ahead may bring plenty of reasons for market moves.

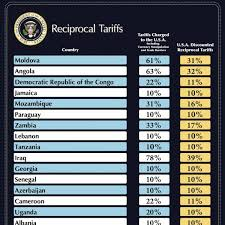

Tariff Policy and Legal Battles

The U.S. Court of Appeals has ruled part of the tariffs introduced by Donald Trump’s administration unlawful.

This step opens the way for a possible Supreme Court case. For businesses, it means growing uncertainty: companies are forced to plan operations without knowing what trade conditions will look like tomorrow. For markets, this is so far a neutral factor: participants are waiting and assessing scenarios.

Employment Report (Nonfarm Payrolls)

The key event of the week is Friday’s labor market data release.

The forecast calls for a +74,000 increase in jobs — the same figure as in July. If the numbers come in weaker than expected, the likelihood of a Fed rate cut by 0.25% at the September 17 meeting rises sharply (according to CME FedWatch — over 87%). In other words, markets would take the report as a direct signal for action.

China Surprises Again

The manufacturing PMI rose to 50.5 in August — above analysts’ forecasts and, for the first time in five months, back in expansion territory.

This added optimism to investors, while Alibaba shares in Hong Kong jumped 18% in a single day on expectations of strong growth in the company’s cloud business.

Oil Market

Oil prices edged higher at the start of September: Brent rose 0.5% to $67.8 per barrel, WTI climbed 0.6% to $64.3.

However, in August as a whole, prices fell around 7% amid fears of oversupply. Geopolitical risks remain a supportive factor, but the fundamental picture points to continued pressure on the market.

What does it mean for investors?

What It Means for Investors

This week, all eyes are on Friday’s jobs report. It will determine the Fed’s rhetoric and the next moves in markets throughout September.

In such conditions, diversification remains a prudent strategy: allocate part of the portfolio to defensive sectors that can withstand a slowdown in activity, and another part to growth stories linked to artificial intelligence and China.

? Possible Scenarios

- Weak numbers (below 50K): markets receive a strong signal for a rate cut. The dollar weakens, gold and growth stocks surge. The Nasdaq could see a double-digit rally within a month.

- In line with forecast (around 70-80K): markets take the data as confirmation of the current scenario. The Fed is almost certain to cut rates in September, but no sharp market moves are likely. Stocks remain sideways, the dollar relatively stable.

- Strong numbers (above 100K): this could trigger a Fed pause in easing policy. The dollar strengthens, bond yields rise, and tech stocks come under pressure. Gold may correct lower.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.