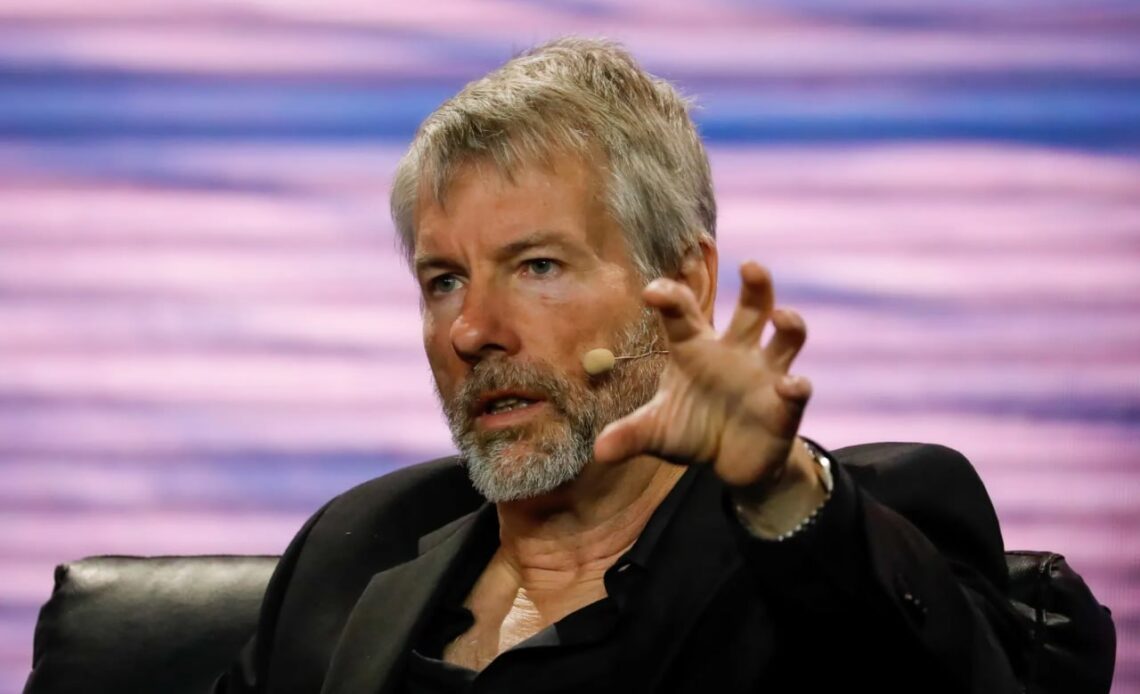

⚡ Michael Saylor, founder of Strategy and a man who looks at Bitcoin the way an accountant looks at a perfect report, is confident: 2026 will be a pivotal year for BTC. And no, it’s not about the halving, which once was the main star of the show. Now on stage are those who usually appear last but get the most applause — the banks.

Banks are beginning to treat Bitcoin like a gold bar in a safe. They want to store BTC, issue loans secured by the coins, and turn crypto assets into a full-fledged financial instrument. In other words, businesses will be able to borrow money using BTC as collateral without selling it. For the market, it’s like opening a window in a stuffy room — liquidity immediately flows in.

The halving has lost its role as the orchestra conductor. It once set the rhythm for the entire market, but now its influence is drowned out by massive trading volumes. Saylor says plainly: the main growth engine now is not reduced issuance, but banks, funds, and corporations beginning to treat Bitcoin not as a tech toy, but as a real asset on the level of real estate.

Corporations are adding BTC to their balance sheets en masse. Strategy was the first pioneer, and now they are a whole flock. And the more companies hold Bitcoin, the faster a new market forms: loans against BTC, bonds against BTC, financial products against BTC — all like what was once done with land, houses, and gold. Traditional financial instruments, version 2.0.

Bitcoin is finally becoming digital gold. It is now compared not to payment systems but to assets for wealth preservation. People buy it not to spend, but to hold as a strategic reserve. A next-generation safe.

2025–2026 will be the point when institutions say: “Alright, we’re in.” Regulation is leveling out, laws are clearer, big business stops being afraid, and banks finally connect. Full approval from grandma in the kitchen is still far off, but the movement in that direction is clear.

? Saylor paints the following picture for 2026:

companies start buying Bitcoin → banks issue loans against BTC → liquidity increases → demand pushes up the price.

It’s a neat economic engine: works quietly, but pulls noticeably.

In short: Saylor believes 2026 will be the moment when Bitcoin stops being an “alternative” and becomes a full-fledged part of the global financial system.

And what do we do? We just buckle up and watch. Could come in handy.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.