? If you’ve ever opened a crypto chart and watched the price drop 30% in just a few minutes — congratulations, you’ve witnessed a dump live.

But what is it really, and why does it keep causing chaos even on the most “civilized” exchanges?

1. What is a dump

A dump is a sharp and large-scale drop in an asset’s price caused by mass selling.

In simple terms, someone — or a whole group — starts unloading huge amounts of coins, and the price collapses.

Usually, a dump is part of the classic “pump & dump” scheme — “inflate and dump”:

- first, the asset is “pumped”, creating hype and an illusion of growth,

- then it’s dumped at a high price, leaving late buyers with useless tokens.

2. How it looks in reality

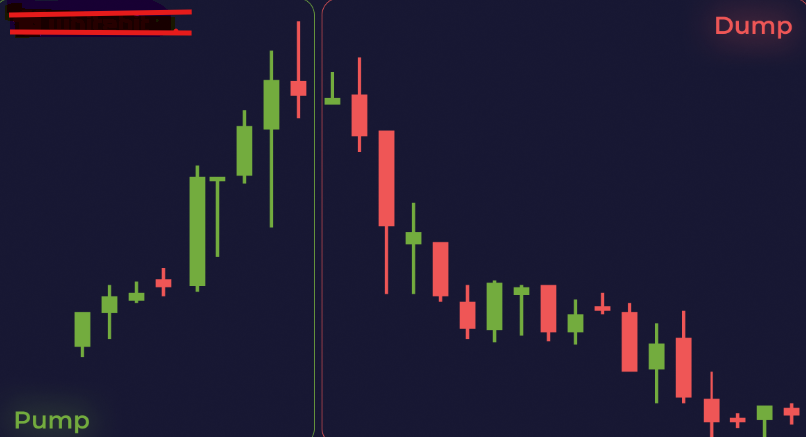

The pattern is almost always the same:

- Anonymous insiders or big players start buying a low-liquidity token.

- Chats, posts, and “analysts” appear — “X100 soon! Project connected to Binance! Don’t miss it!”

- The price rises — the crowd sees green candles and starts buying.

- Once the target price is reached, the main holders (whales) start selling in bulk.

- The market crashes, liquidity vanishes, and the crowd is left “at the bottom of the chart” with tokens now worth less than a cup of coffee.

3. Who causes dumps

- Whales — big players controlling millions of tokens, profiting from price swings.

- Project insiders — sometimes even developers “dump” their own tokens after listing.

- Telegram manipulators — the “Pump Groups” promising “secret X10 signals”.

4. Are there “natural” dumps?

Yes, quite often. Not every crash is a conspiracy.

Sometimes dumps happen because:

- investors take profits after a long rally,

- bad news (exchange hacks, CEO arrests, stricter regulations),

- sudden liquidity exits (like Bitcoin dropping sharply).

In these cases, the crash is just a part of the market cycle, not a planned attack.

5. Why dumps are especially dangerous in crypto

The crypto market is young, volatile, and barely regulated.

That’s why “pump and dump” schemes are easy to pull off:

- the coin costs pennies,

- liquidity is tiny,

- the team is anonymous,

- most tokens are in a few wallets.

That’s how “legends” like $PEPE, $BONK, or yesterday’s “innovative” coins are born — only to vanish after the first sell wave.

6. How not to get caught in a dump

- Check token distribution. If 80% is in five wallets — run.

- Avoid Telegram “signal” and “pump” groups. 99% are scams.

- Watch liquidity. If 24h volume is $10,000, a “300% rise” means nothing.

- Don’t buy the top. If the token’s up 500% today — you’re already late.

- Research the project. No website, empty GitHub, CEO named “CryptoDoge1988”? Enough said.

7. Why dumps still exist

Because they’re part of human psychology.

Everyone wants “fast and easy” profit — and manipulators exploit that.

Every new market cycle brings fresh meme coins, pump groups, and “insiders” promising effortless riches.

In the end, it always ends the same:

someone sells a Lamborghini, and someone sells their phone to pay gas fees.

? Conclusion

Dumps are not just chart drops — they show how emotional and alive the crypto ecosystem is.

Yes, manipulation is everywhere, but the moral is simple: the market always punishes those chasing easy money.

? You can watch how dumps really happen in our Telegram channel.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.