? ETH is a profitable deal, while BTC remains the cornerstone in this new type of bull market.

Analyst Eric Crown notes that the current crypto market cycle is significantly different from previous ones. In 2017 and 2021, after breaking historical highs, there was a sharp and rapid rise followed by corrections. Now, the situation is different: Bitcoin has gone through three prolonged corrections, each lasting about six months, trading within relatively narrow ranges. This behavior is unusual compared to past cycles and points to new market formation mechanisms.

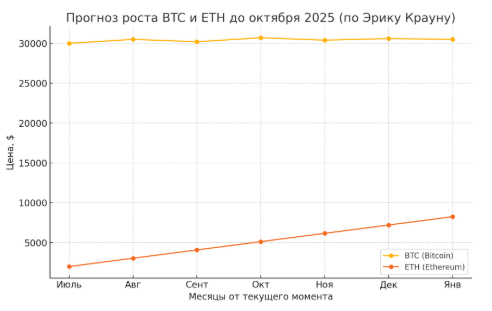

While BTC remains a key asset and the “cornerstone” of the market, its growth may slow down soon. Meanwhile, Ethereum shows potential for leading growth. According to Eric Crown’s forecast, by October, ETH’s price may reach a minimum of $6,500 and a maximum around $9,000–10,000.

The expert emphasizes that Ethereum can grow another 50% relative to Bitcoin, making it attractive for short-term investments. Therefore, he recommends investors increase their ETH share in portfolios to maximize opportunities of the new cycle and diversify risks.

Approximate forecast growth chart of BTC and ETH according to Eric Crown

- BTC shows relatively slow growth with corrections, maintaining stability.

- ETH demonstrates more active growth from current levels toward the $6,500–10,000 range by October.

? This reflects the idea that ETH can outperform BTC and become a profitable investment in the coming months.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.