Bitcoin’s price dropped sharply and on the Bitstamp exchange fell to the level of $75,555, recording a decline of about 40% from the all-time high reached on October 6, 2025. In just two days, starting from January 29, the first cryptocurrency lost around 15% of its value, marking one of the sharpest short-term downward moves in recent times. The market has once again entered a phase of increased volatility, and participant sentiment has quickly shifted from cautious optimism to openly defensive.

Loss of key support levels

Crypto Candy analyst points to a critically important technical moment: Bitcoin confidently broke through and closed below the $80-81k range, which previously acted as a reliable support zone. According to him, the current dynamics look as if the market is “biting through” support levels without the slightest resistance. Active manipulation and aggressive selling amplify the effect, turning even strong levels into a mere formality.

Crypto Candy warns that if the current momentum persists, Bitcoin may rather quickly test the $73.7k level and then move into a broader $70-67k zone in the coming days. The key condition for this scenario remains unchanged: as long as the price trades below $90k, the market is effectively under the control of sellers.

Scenarios from traders: from prolonged decline to capitulation

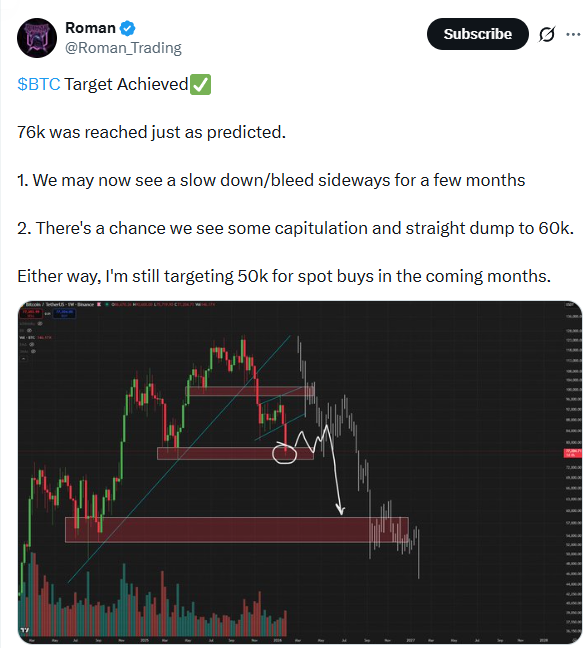

Trader Roman notes that his target around $76k was reached with high precision. In his assessment, two fundamentally different scenarios are possible from here. The first is a slow, time-stretched decline that could last several months, exhausting the market and gradually squeezing speculative capital out of it. The second scenario is a classic capitulation, in which the price could collapse sharply and impulsively down to $60k.

In both cases, Roman does not view current levels as long-term attractive for building a position. His strategy is focused on spot purchases in the range around $50k in the coming months, when, in his opinion, the market will be closer to forming a sustainable bottom.

Lack of fresh capital as the key problem

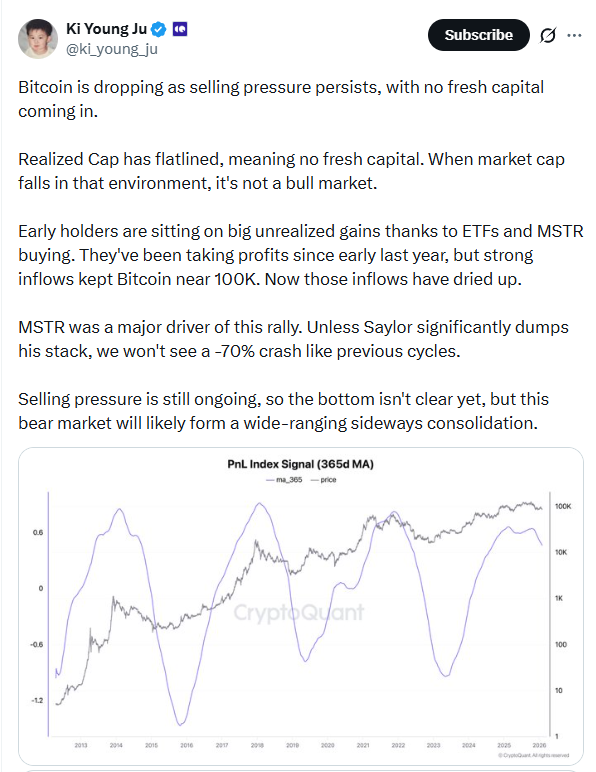

The head of analytics platform CryptoQuant, Ki Young Ju, points to the fundamental reason for the current market weakness – the absence of new capital inflows. According to his data, the Realized Cap metric has effectively stalled, indicating that fresh investment has stopped coming in. Under such conditions, the decline in market capitalization can no longer be considered a correction within a bull market – it is a sign of a shift in the market regime.

Early Bitcoin holders still sit on significant unrealized profits, formed in part through ETF purchases and the MicroStrategy (MSTR) strategy. Since the beginning of last year, they have gradually been taking profits, but strong capital inflows kept the price near $100k. Now these inflows have noticeably weakened, and the market has been left without support.

“MSTR was the main driver of this rally. Until Michael Saylor significantly reduces his positions, we are unlikely to see a 70% drop like in previous cycles,” notes Ki Young Ju. In his view, selling pressure remains, the final bottom has not yet been formed, and the current bear market is more likely to lead to a broad and prolonged sideways consolidation rather than a one-off collapse.

Correlation with gold and capital rotation

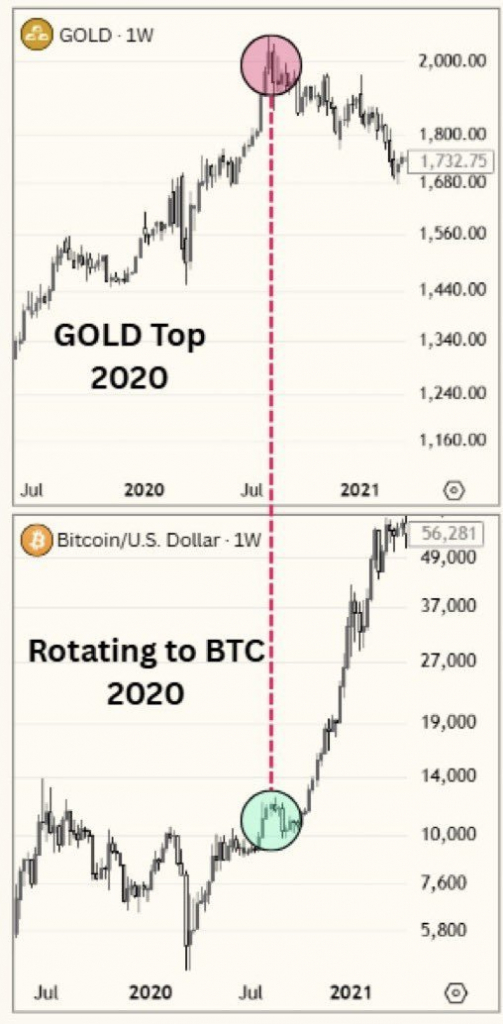

Michaël van de Poppe highlights another important factor – the synchronous correction of Bitcoin and gold. In his opinion, the reason lies in general panic in financial markets and investors’ desire to reduce risk. Once the panic phase ends and markets stabilize, capital rotation back into Bitcoin may begin, especially from investors seeking an alternative to traditional assets.

Analyst Rekt Capital confirms that Bitcoin’s price has crossed the boundary of the bull market and moved into a zone that historically corresponds to a bear cycle. From a quantitative and machine-learning data analysis perspective, the current correlation between Bitcoin and gold looks atypical. Usually these assets move independently, and their simultaneous decline may point to deeper macroeconomic processes – for example, portfolio rebalancing by large funds or a broader reassessment of attitudes toward risk assets.

Liquidations and the domino effect

Additional pressure on price comes from mass liquidations of long positions, which create a dangerous technical picture. The cascading effect of liquidations can intensify the decline in the short term, especially under conditions of low liquidity and a high share of leverage.

However, the market has repeatedly shown that excessive consensus among analysts often becomes a signal for an unexpected move in the opposite direction. Bitcoin’s history contains many examples when turning points were formed at moments of maximum pessimism. For now, the market remains in a phase of uncertainty, where caution and cold calculation are more important than any loud forecasts.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.