![]() Wall Street faces a tense week ahead, although formally it begins with a pause: Monday in the U.S. is a holiday. However, starting Tuesday (02.09.2025), investors’ attention will be drawn to a series of economic releases and corporate events.

Wall Street faces a tense week ahead, although formally it begins with a pause: Monday in the U.S. is a holiday. However, starting Tuesday (02.09.2025), investors’ attention will be drawn to a series of economic releases and corporate events.

Main focus of the week — U.S. labor market

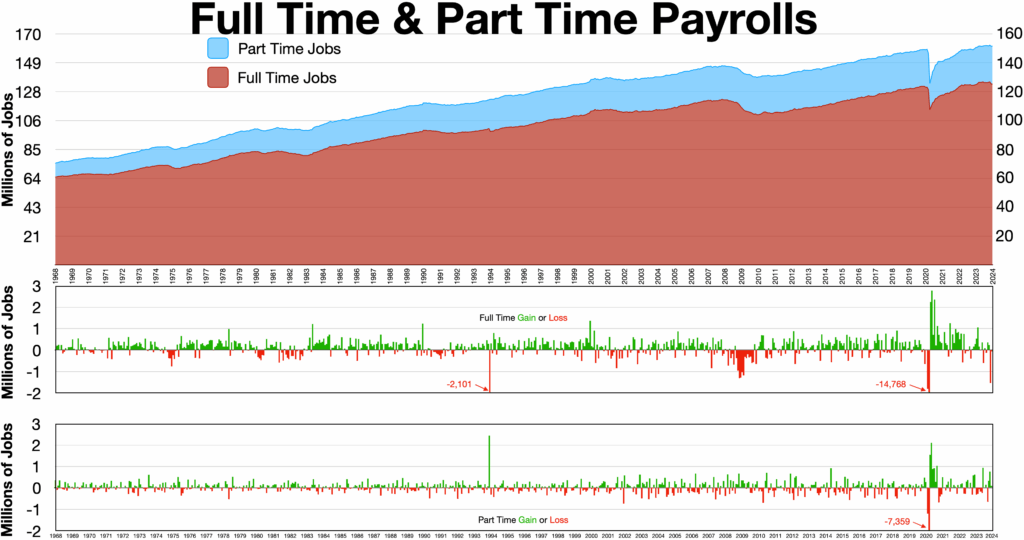

The highlight will be Friday’s employment report (Nonfarm Payrolls). The forecast is modest: only +75,000 new jobs alongside a rise in the unemployment rate to 4.3%.

- Weak data could strengthen the case for the Fed to cut rates as early as September, while strong numbers may signal a pause in policy easing.

- Strong numbers, on the contrary, may signal a pause in policy easing.

In addition to the NFP, the week will deliver a full set of economic “thermometers”: JOLTS job openings, ADP private-sector employment report, and manufacturing and services PMI indexes. Together, these releases will provide a more complete picture of the U.S. economy as fall begins.

Corporate and sector developments

- Nvidia and the chip sector are under pressure after news that Alibaba is preparing its own AI chip for the Chinese market. On this backdrop, Nvidia shares fell, while Alibaba gained upward momentum.

- Broadcom will release its report on September 4, viewed as a test of the AI sector’s resilience.

- Tesla displayed typical volatility: a rapid rise was followed by a pullback, but prices remain near key technical levels.

- Marvell Technology lost 18% following a weak AI report, highlighting the sector’s sensitivity to expectations.

- In aviation, Spirit Airlines again declared bankruptcy, while competitors, including Frontier, continue to grow.

Overall market backdrop

August marked the fourth consecutive month of gains for U.S. indices.

- S&P 500 remains near historic highs, although it lost around 0.2% at month-end due to AI sector sell-offs.

- Among ETFs, movements diverged: semiconductors (SMH) declined, while energy (XLE) and mining (XME) posted solid gains.

What does it mean for investors?

- All eyes are on Friday. The employment report will largely determine expectations for Fed rates. This could become a turning point for markets.

The AI sector remains highly volatile. Risks and opportunities intertwine: some companies see setbacks, while others experience short-term surges.

- Alibaba emerged as the stock of the week. Its performance may inspire investors, yet the long-term outlook for the chip sector remains uncertain.

Conclusion: The start of fall greets investors with mixed signals. On one hand, markets show confidence and approach record highs. On the other, uncertainty in the tech sector and anticipation of key macro data keep everyone on edge.

The main intrigue of the coming days: will labor market numbers confirm the need for an immediate Fed rate cut, or will the regulator find a reason to pause?

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.