? American billionaire and legendary investor Warren Buffett this week wrote his, essentially farewell, letter to the shareholders of Berkshire Hathaway. The man is 95 years old, and he is finally preparing to hand over management to his successor – Greg Abel, who is 63. Amusingly, Abel is almost the same age as Berkshire Hathaway itself: the company that Buffett over decades turned from a dying textile factory into one of the most powerful financial machines in the world.

The event is, without exaggeration, epochal. Buffett, of course, is not slamming the door – he will remain in the “shadows” and promises to delight investors with annual letters for Thanksgiving. But this is no longer active steering – this is a wise elder who hands the ship over to reliable hands and steps a little aside to observe how his legacy lives its own life.

Buffett’s main creation is the holding Berkshire Hathaway. Once, before his arrival, it was an ordinary textile company doomed to slow fading. He bought it before he even turned 30, and by the age of 32 he had already become a dollar millionaire. Back then, few could imagine that this particular deal would become the starting point for creating an investment empire that influences the global economy.

What does Berkshire look like today? In early November, the company reported results for Q3 2025: profit amounted to 30.8 billion dollars compared to 26.3 billion a year earlier. The main operating profit traditionally came from insurance, manufacturing, and retail – areas that Buffett historically considered fundamental and less susceptible to the whims of fashion.

Berkshire’s portfolio is a real museum of American capitalism: from car dealership chains and its own railroad to energy giants and insurance companies. Plus a sizeable stock portfolio. Over the past eight quarters, however, Berkshire has been a net seller, carefully accumulating cash. There are now more than 300 billion dollars in cash and equivalents on the fund’s accounts – a record safety cushion.

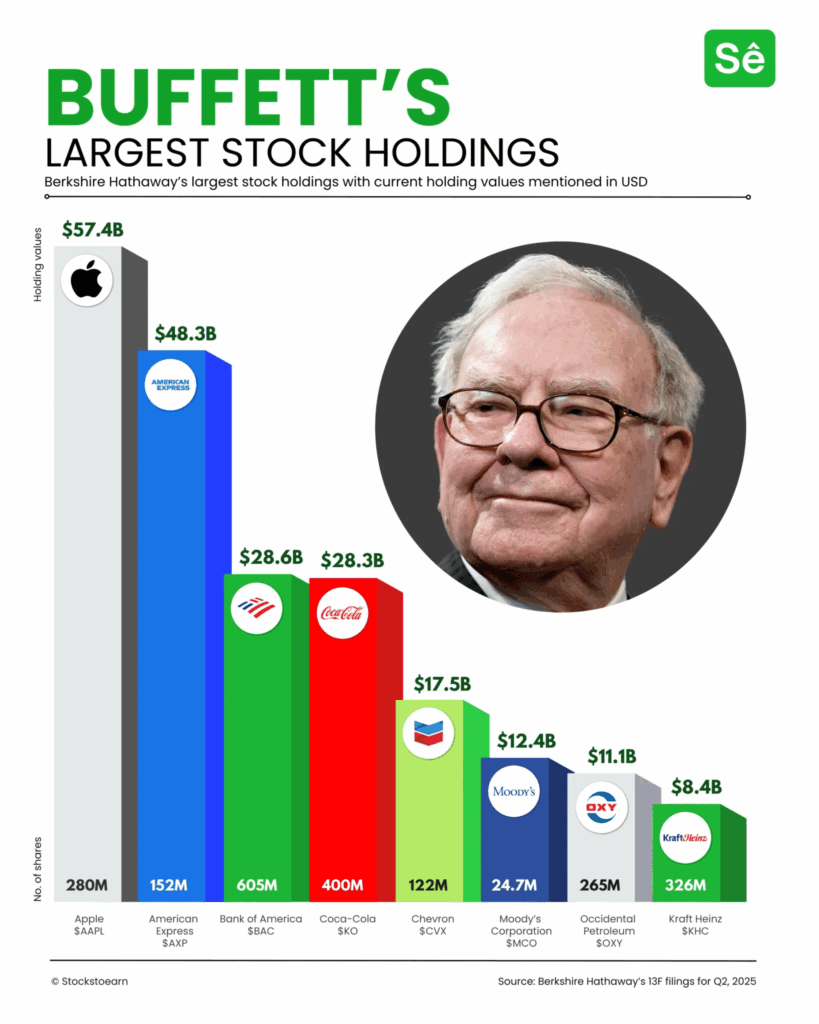

Despite the fact that the portfolio includes more than 40 public companies, the lion’s share of assets – 71% – falls on just five names: Apple, American Express, Bank of America, Coca-Cola, and Chevron. This is that very signature Buffett approach: instead of throwing money anywhere, it’s better to own a small number of excellent businesses than a large number of mediocre ones.

And now the man who for decades has been a symbol of discipline, foresight, and healthy conservatism in investing, “steps into the shadows”. He passes management to the children of a new era, who grew up in a digital world. But he does it the way he lived: calmly, reasonably, without unnecessary fanfare.

As he steps away from business, Buffett is also accelerating another important process – transferring his fortune to charitable foundations managed by his children. They are now between 67 and 72 years old, and they will become the heirs of his philosophy of reasonable and meaningful use of capital. Buffett will allocate the majority of his assets there – about 150 billion dollars. This is one of the largest charitable redistributions of wealth in modern history, and in Buffett’s style – quiet, calm, without the parade of vanity typical for billionaires.

At the same time, the investor emphasizes that his departure is gradual and well thought out. He plans to retain a significant portion of his Berkshire Hathaway class A shares until the shareholders “find comfort” with the new CEO. For Buffett, this is more than a formality: he clearly wants the transition of power in Berkshire to be as stable as everything he has done over the past six decades.

And here it is probably the right moment to remember what he taught the whole world. Buffett became living proof that distance wins. That principles are not an accessory you can change depending on your mood. That a person who communicates with you only because of money is a problem solved with one movement toward the toilet. His approach here is the same as in investing: no haste, only logic, trust, and respect for those who follow behind him.

He created a system that will outlive him. And he did it without hype, without shouting, without a vanity fair – simply by following common sense, discipline, and respect for investors.

❤️ A legend. We press F, as one should – with respect, a touch of sadness, and enormous gratitude for what he left to the world. Have a good rest, Oracle of Omaha. You earned it!

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.