? The Consumer Price Index (CPI) is one of the key indicators used to assess inflation rates in the economy. It reflects how prices for goods and services purchased by the average consumer change, helping to understand how quickly the cost of living is rising.

In the US, the CPI is published monthly by the Bureau of Labor Statistics (BLS) and serves as a benchmark for both investors and the Federal Reserve (Fed). This indicator not only reflects the state of the consumer market but also influences decisions on interest rates, which directly affects the dollar’s exchange rate and global market dynamics.

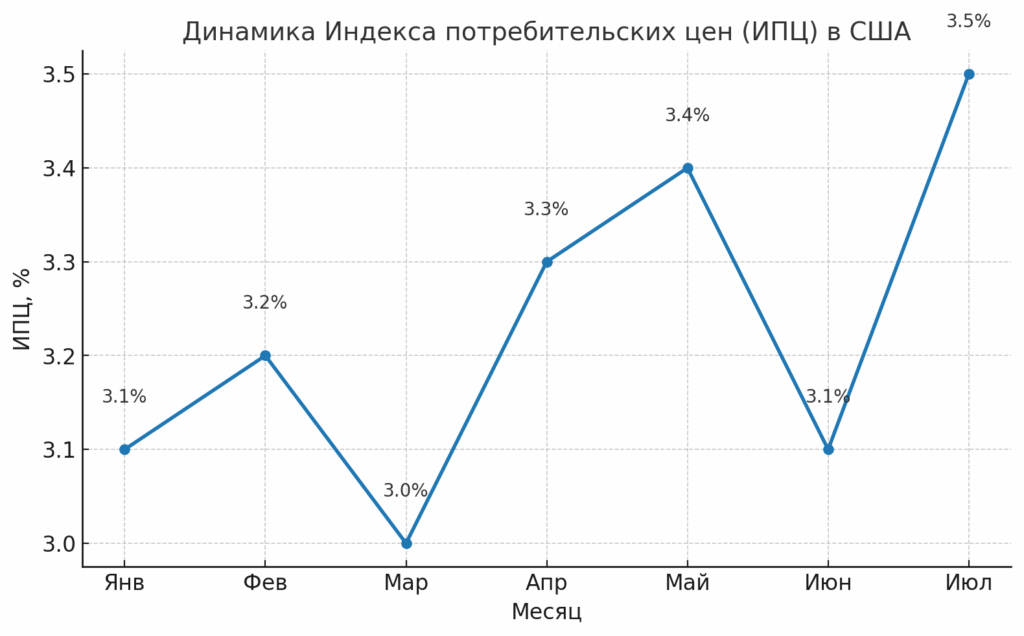

Chart showing the recent trend of the US Consumer Price Index.

How to interpret the data:

Readings above expectations are seen as a signal for tightening monetary policy, which is usually positive for the dollar (USD).

- Readings below expectations may indicate slowing inflation and weakening dollar positions.

Why it matters now:

Investors and traders await fresh statistics to adjust their forecasts on Fed rate decisions. Amid heightened volatility, CPI data can trigger sharp swings in currency pairs, gold prices, and stock indices.

⚠️ Bottom line: CPI figures are not just economic statistics but a crucial guide for decision-making in global markets. Today, all eyes will be on them.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.