? Virtual Bar: Gold Tokenization and New Opportunities for Investors

The World Gold Council (WGC) introduced the concept of a “Virtual Bar” — a new wholesale digital precious metal ecosystem designed to complement existing gold trading mechanisms, including Loco London standards. The project combines the benefits of physical gold ownership with the flexibility and technological efficiency of digital tools.

Traditional Gold Ownership Models

Currently, the market uses two main approaches:

- Physical Delivery — the investor gains ownership of specific gold bars stored in a vault with unique serial numbers, assay information, and weight. Advantages include full transparency and control over the bars. Physical gold ownership protects against custodian credit risk. The main drawbacks are high entry cost (typically from one 400-ounce bar), limited liquidity, and significant fees.

- Unallocated Metal Accounts (UMA) — the investor holds a claim on a certain amount of gold stored by a custodian. This model provides greater flexibility, allows trading in fractions down to one-thousandth of an ounce, and easy participation in transactions. The main risk is potential loss of assets: in case of custodian bankruptcy, investors’ claims may be nullified.

New Instrument: PGI

PGI (Physical Gold Instrument) is a digital unit that enables investors and financial institutions to make fractional investments in physical gold while minimizing the drawbacks of traditional models. The instrument provides:

- fractional ownership starting from 0.001 ounces;

- protection against custodian insolvency;

- more flexible use of gold as collateral;

- simplified transfer of ownership rights between participants.

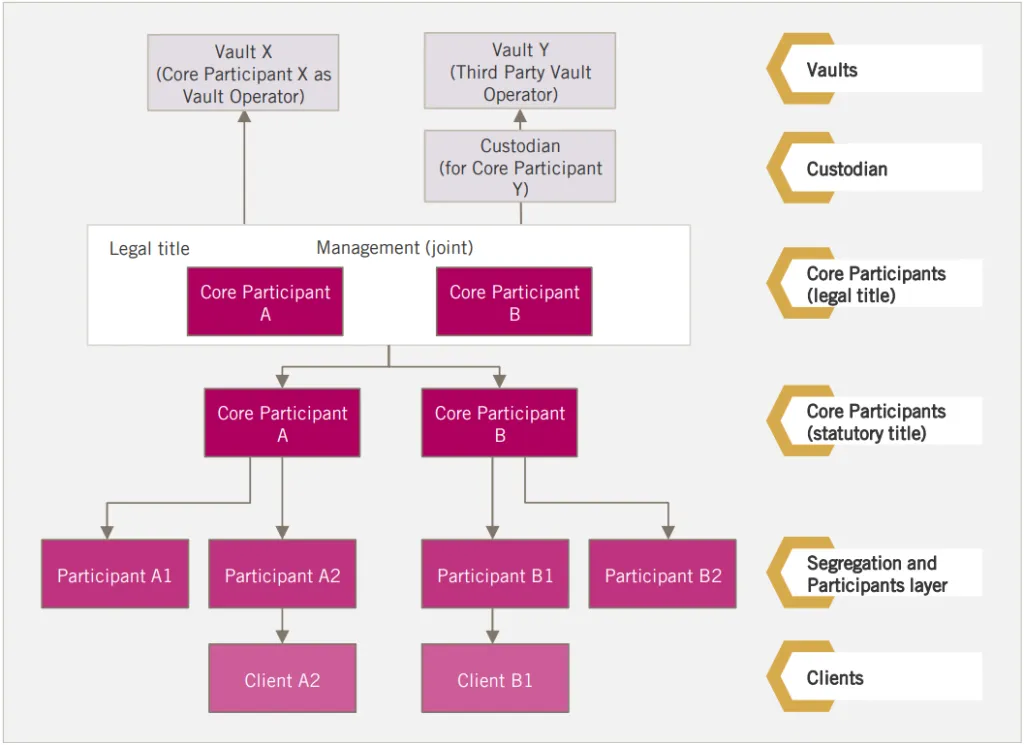

The tokenized gold system is structured into three levels:

- Vault — Key Participant: transfer of the physical bar to the custodian and registration of ownership.

- Key Participant — Asset Fractionalization: creation of a legal joint ownership agreement and issuance of PGI.

- Fractionalization — Client: distribution of PGI through intermediaries to a wide investor audience.

Diagram of the transfer of gold bar ownership rights through the issuance of PGI. Source: WGC

Initially, a small consortium of key participants jointly owns the bars and issues PGI, confirming their beneficial rights. Tokens can then be transferred digitally to other participants who hold them for clients. System algorithms automatically track changes and rebalance assets, ensuring transparency and security.

Pilot Stage and WGC Plans

The pilot project was launched with the participation of several banks and financial institutions. Testing of the technology is scheduled to be completed by the first quarter of 2026. The next step is scaling: onboarding a wider range of clients, integrating with financial infrastructure, and engaging with regulators and standard-setting bodies. The first wave of participants is expected to establish the basic management system and operational rules for the PGI ecosystem.

Legal and Market Challenges

WGC CEO David Tate noted that the new digital model allows “the transfer of gold in digital form within the ecosystem and its use as collateral.” However, experts warn of potential resistance from conservative participants in the gold market.

“We are trying to standardize this digital layer of gold so that the same financial products already used in other sectors can be applied in the market. My goal is for many asset managers worldwide to start seeing gold differently,” added David.

From a legal standpoint, a key limitation is that existing Financial Collateral Arrangements (FCAR) privileges do not extend to gold, complicating the automatic recognition of PGI as a lightweight collateral asset. The white paper provides a detailed discussion of possible adaptations and regulatory amendments to minimize compliance costs and ensure alignment with EMIR and the Dodd-Frank Act.

Trends and Outlook

PGI combines three current trends: rising gold prices, the expansion of the real-world assets (RWA) market, and the adoption of blockchain and crypto technologies. In September, SmartGold, a gold-backed IRA provider, partnered with blockchain startup Chintai Nexus to tokenize $1.6 billion worth of gold and generate returns on DeFi markets.

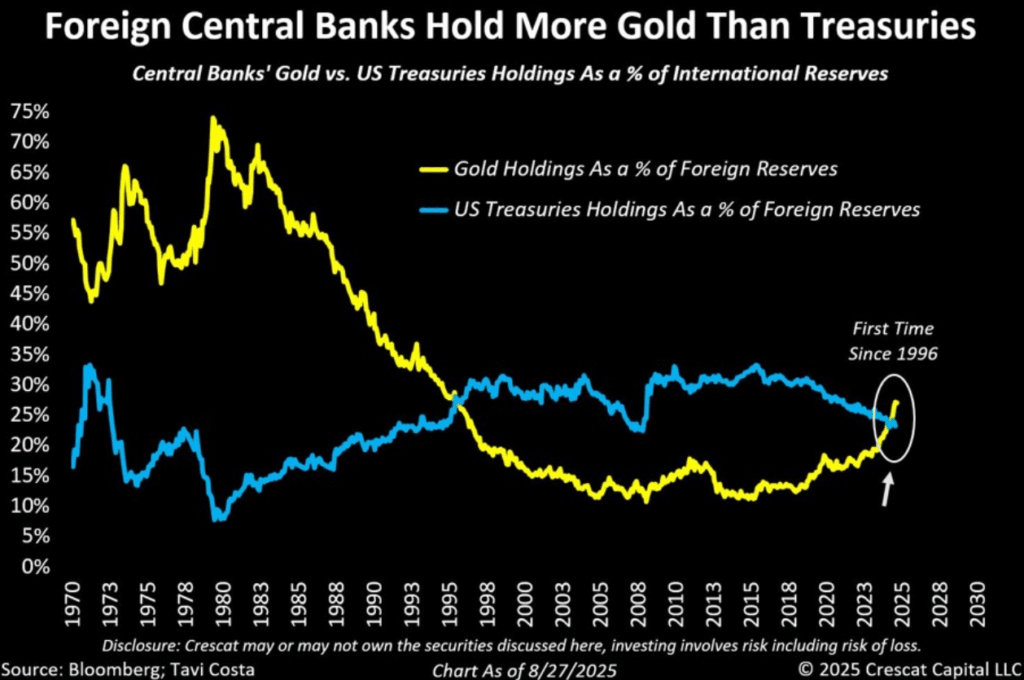

Chart of central banks’ gold holdings relative to U.S. government bonds. Source: Reuters

A declining U.S. dollar index, macroeconomic uncertainty, and active central bank purchases are driving the digitization of gold. Gold prices reached a new record of around $3,670 per ounce, while inflows into gold ETFs remained at peak levels, with total market capitalization exceeding $400 billion.

Annual gold price chart. Source: TradingView

Top 5 gold ETFs by AUM as of September 7, 2025. Source: VettaFi

Tokenization opens new opportunities for public companies and institutional investors. Matador Technologies, focused on Bitcoin, plans to implement tokenization of physical gold via blockchain, while NatGold Digital sells tokens representing rights to gold still in the ground. The NatGold presale showed high interest: 53,627 coins worth over $103.5 million were sold to 7,052 users from 145 countries.

? Conclusion

PGI is more than just a gold token. It is an infrastructure that integrates physical metal with digital technology to enable more flexible, secure, and transparent use of precious metals within the financial ecosystem. The pilot launch and subsequent scaling could fundamentally transform the approach to gold ownership and trading, opening new opportunities for institutional investors and the RWA market as a whole.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.