US President Donald Trump publicly commented on the state of the dollar for the first time after the US currency posted its worst year since 2017. His remark was extremely brief and, at first glance, reassuring: “The dollar is doing great.”

The market reacted instantly – the dollar fell another 1%, hitting its lowest level since February 2022. This is not a paradox. It is logic.

What Is Really Happening to the Dollar

For more than 12 months, the US dollar has been in a steady downtrend. By the end of 2025, it had lost around 10%, marking its weakest performance in eight years. This is not short-term volatility and not an accident – it is a managed process.

That is why the market interpreted Trump’s statement not as support, but as a political signal: a weaker dollar suits the White House.

Why Trump Is Comfortable with a Weaker Dollar

- A weaker dollar = downward pressure on interest rates

Currency depreciation allows the Federal Reserve to cut rates faster and more aggressively without fearing an immediate shock to the economy. Cheap money is a classic stimulus tool. - Growth in US exports

American goods become more competitive on global markets. This is a direct benefit for industry and multinational corporations. - Debt servicing

The US lives with an enormous public debt. Lower rates and a controlled currency devaluation are among the few ways to make that debt less painful.

That is why Trump’s phrase “the dollar is doing great” means exactly this:

it is doing precisely what it is supposed to do.

Who Wins and Who Loses

Winners:

- owners of real assets;

- investors in gold, silver, equities, real estate, and crypto;

- export-oriented corporations.

Losers:

- people holding savings in cash dollars;

- wage earners without assets;

- retirees and the middle class living on fixed incomes.

This is the key message most people missed in Trump’s words.

Immediate Market Reaction

After his statement, investors acted without sentiment:

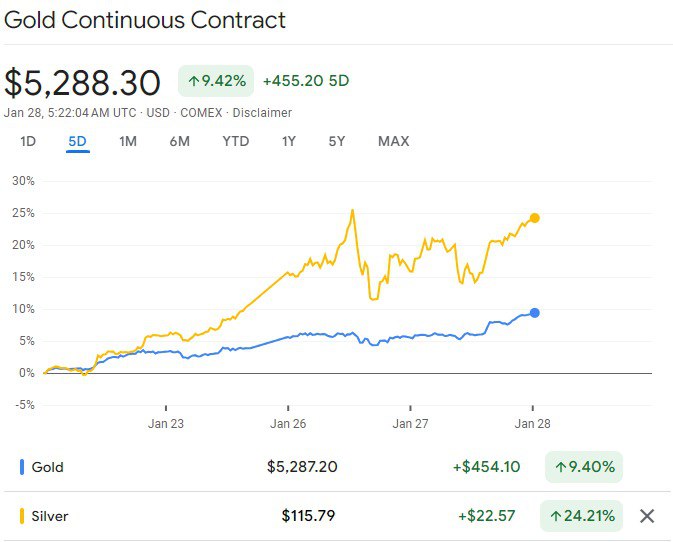

- gold and silver surged;

- capital outflows from currency into defensive assets intensified;

- the dollar hit new lows, confirming the long-term trend.

The market understood the main point: a weaker dollar is not a problem – it is policy.

Conclusion

Trump did not “misspeak” or make a mistake. He made it clear that the US is willing to tolerate a weaker currency in exchange for lower rates, stronger exports, and economic stimulus.

This leads to one simple rule for the coming years: either you own assets, or you pay for this policy with your purchasing power.

The dollar is doing exactly what policymakers want. Whether it is doing what ordinary people need is a very different question.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.