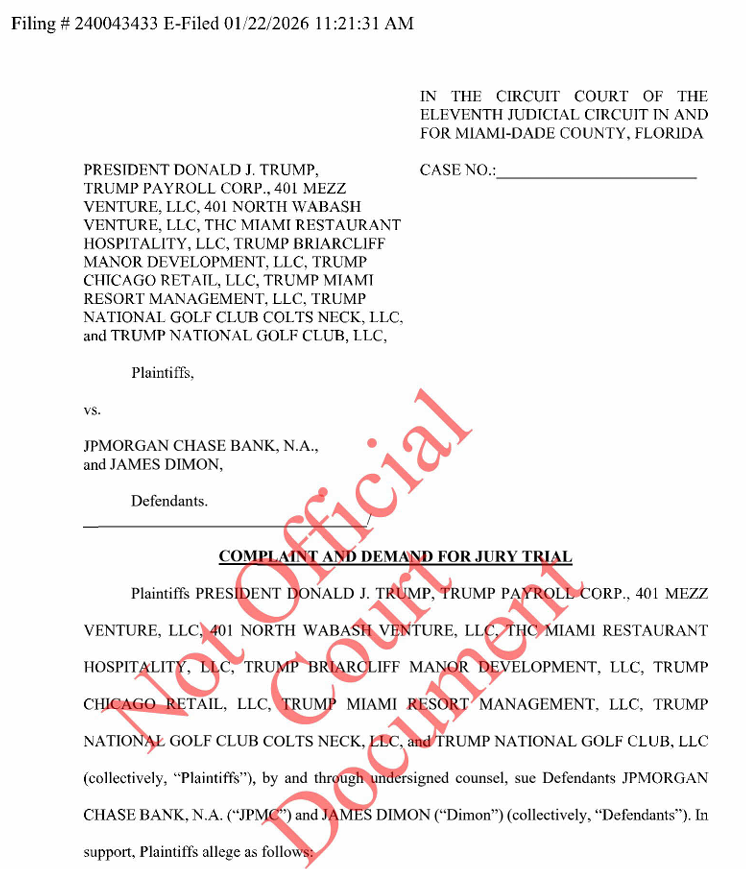

U.S. President Donald Trump has launched a high-profile lawsuit against the country’s largest bank, JPMorgan Chase, and its CEO Jamie Dimon. The lawsuit centers on alleged intentional debanking — the denial of access to banking services for Trump and affiliated organizations without any objective legal justification. The politician is seeking to have the bank’s actions declared illegal and to recover $5 billion in damages for financial and reputational harm.

According to the lawsuit, the issue began in February 2021, following the events of January 6 — the attempted storming of the Capitol by Trump supporters. During this period, the plaintiffs claim, JPMorgan Chase closed several accounts belonging to the president and his affiliated companies without explanation. Trump attributes the closures to political motives and pressure on his family and business entities, emphasizing that such actions are inconsistent with standard banking practices.

Additionally, the lawsuit highlights public statements by Jamie Dimon, which, according to the plaintiffs, caused significant reputational damage to Trump, compounding the effects of the account closures and creating a negative information environment around his financial operations.

During a recent speech in Davos, Trump again addressed the issue. CNBC reports that he said: “He took away my bank accounts. He shouldn’t have done that. It’s wrong. Jamie Dimon shouldn’t have done what he did.”

From the bank’s perspective, the situation appears differently. In an official statement, JPMorgan Chase said that the account closures were not politically motivated but were conducted in accordance with federal rules and regulatory requirements. Bank representatives noted: “JPMC does not close accounts for political or religious reasons. We close accounts only when they create legal or regulatory risks for the company. We regret having to take such actions, but regulatory requirements often make them necessary.”

The bank also stated that it supports the current administration’s initiative to end the practice of using the banking sector as a tool of pressure on certain organizations or groups, highlighting the ongoing discussion about transparency and neutrality in financial institutions.

The plaintiffs are asking the court to officially declare JPMorgan Chase’s actions illegal and to award $5 billion in damages. The lawsuit could set a precedent in the field of debanking, where large financial institutions deny clients access to banking services for political or other subjective reasons.

Historically, it is worth noting that in August 2025, Trump signed an executive order banning debanking for certain organizations, including crypto companies, which previously faced restrictions and isolation under the Biden administration’s policy known as Operation Choke Point 2.0. At the time, a number of fintech and crypto businesses were pressured by the risk of bank service denials, effectively limiting access to liquidity and payment instruments.

Legal experts emphasize that Trump’s lawsuit raises several complex issues: the interaction between the state and private banking sector, political motivation in financial decisions, reputational protection, and precedents of financial discrimination. The case is expected to be lengthy and could generate widespread attention not only in the financial sector but also in the political arena.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.