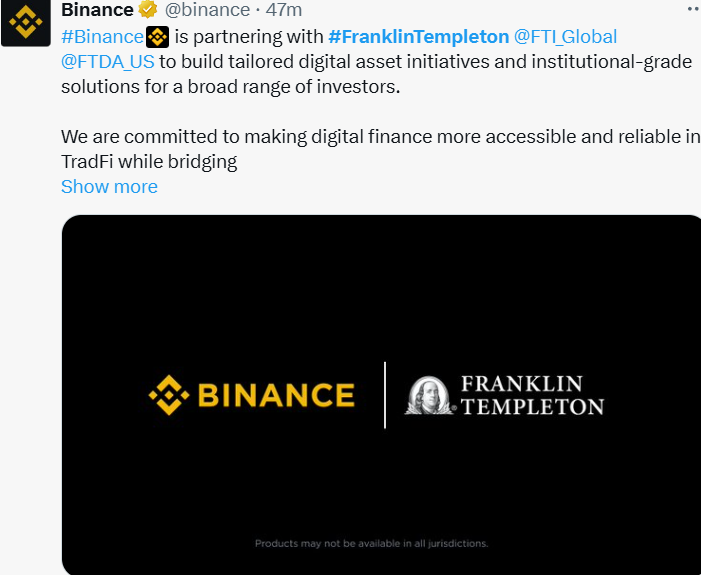

? Binance, the largest cryptocurrency exchange, has announced a strategic partnership with the international investment company Franklin Templeton. The goal of the collaboration is to jointly develop initiatives in digital assets, including investment products, asset management technologies, and solutions for institutional clients.

This partnership combines Franklin Templeton’s expertise in securities tokenization with Binance’s global trading infrastructure to create investment products that bridge traditional financial markets with decentralized assets.

In other words, this alliance involves exchanging expertise and implementing best practices in financial regulation and security, which could help increase trust in the cryptocurrency market and expand its institutional segment.

Key areas of the partnership:

- Securities Tokenization: Using blockchain technology to create digital versions of traditional financial instruments, enhancing transparency and efficiency.

- Development of Investment Products: Creating products that offer returns and efficient interactions for global investors.

- Integration of Traditional and Digital Markets: Merging Franklin Templeton’s experience in traditional financial markets with Binance’s technology platform, expanding institutional investors’ access to digital assets.

Binance representatives noted that the partnership with Franklin Templeton will allow offering investors a wider range of reliable products for working with digital assets. Franklin Templeton sees an opportunity to integrate cryptocurrencies and blockchain technologies into its investment strategies, providing clients access to innovative financial solutions.

Experts note that such partnerships demonstrate how traditional financial companies are gradually adapting to the crypto market, and joint initiatives by major players can accelerate the institutionalization of digital assets.

Details on specific products and initiatives are expected to be released by the end of 2025.

? This collaboration highlights the growing interest of traditional financial institutions in digital assets and their desire to integrate innovative technologies into their investment strategies.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.