⚡️ In the crypto community, there are two eternal camps — traders and hodlers. Although both make money on the same asset, their approaches are completely opposite, like black coffee versus a sweet cappuccino.

Trader — the hunter of the moment

Traders are people who bet on short-term market fluctuations. They buy and sell tokens within minutes, hours, or days, trying to catch price differences.

Examples from practice:

Examples from practice:

- In January 2021, Bitcoin jumped from $30,000 to $42,000 in a couple of weeks. Traders who “caught the wave” in time could double their capital on the swings.

- Many actively trade altcoins like Solana or Dogecoin, which can rise 15–20% in a single day (and just as sharply drop).

Pros of trading:

- Fast capital turnover.

- Ability to profit both on price increases and decreases (shorting).

- Constant adrenaline: boredom is not an option.

Cons:

- Cons: Requires experience and discipline, otherwise the market can “blow your mind” and your deposit.

- High fees from frequent trades.

- Stress, sleepless nights, and the habit of checking charts even at a friend’s wedding.

Hodler — the philosopher with iron nerves

Hodlers believe in the long-term value of cryptocurrencies. Their strategy is simple: buy — and hold, regardless of storms. Even if the price drops 50%, they repeat the mantra: “It will be higher in 5 years.”

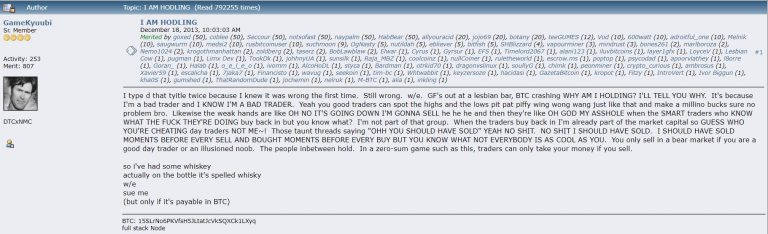

The word HODL, often interpreted as “hold on for dear life,” appeared in the crypto community in 2013 after a heated (and, according to some, slightly “tipsy”) discussion on the Bitcoin Reddit forum. The trigger was bearish news: the Chinese government had banned buying and selling BTC for the first time.

At the time, a user named GameKyuubi wanted to write hold, but apparently made a typo. And that’s how the legendary HODL was born. It unexpectedly caught on and soon became one of the most famous and widely used terms in crypto investing.

Examples from practice:

- Those who bought Bitcoin at $200–300 in 2015 and simply held became millionaires when the price exceeded $60,000 in 2021.

- Ethereum hodlers who bought coins in 2016 at $10–20 now have over 100x profit, even if they never traded once.

Pros of HODLing:

- Minimum stress: no need to catch every price impulse.

- Saving on fees: buy and forget.

- Historically, “buy and hold” strategy yielded the highest profits.

Cons:

- You might endure a prolonged drop: in 2018, Bitcoin fell from $20,000 to $3,000, and not everyone had the nerves to hold.

- Short-term opportunities are missed: while the hodler holds, traders profit from volatility.

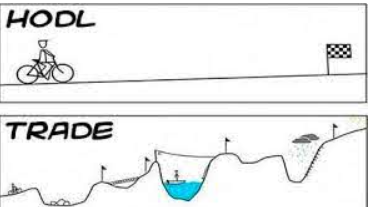

Who wins in the end?

In the short term, traders often win. They can skillfully “squeeze” profit from daily swings. But statistics show most traders eventually end up in the red because the market is unpredictable.

In the long term, hodlers are ahead. Even Warren Buffett famously said: “Time in the market is more important than timing the market.” In crypto, this rule works doubly: those who survive crises and don’t sell in panic usually come out on top.

The golden middle

In practice, many investors combine strategies: 70% of the portfolio is held long-term (Bitcoin, Ethereum), and 30% is used for trading or experimenting with altcoins. This way, they preserve the calm of a long-term investor and the adrenaline of a trader.

? Conclusion: traders and hodlers are not enemies, but two types of players on the same field. The first enjoys adrenaline and instant results; the second — patience and strategy. The winner is not the one who chose the “right camp,” but the one who best understands their nerves, goals, and investment horizons.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.