⛏️ During the gold rush, those who earned the most were not the ones digging for gold, but those selling shovels. In the 21st century, however, the “gold rush” has changed form — instead of cowboys, we now have giant corporations; instead of rivers — multi-kilometer mines; and instead of the cry “Eureka!” — analysts’ reports and data from the U.S. Geological Survey.

As of 2025, global gold mining continues to grow despite macroeconomic instability and price fluctuations. Gold firmly holds above $4,000 per ounce, while leading countries strengthen their positions.

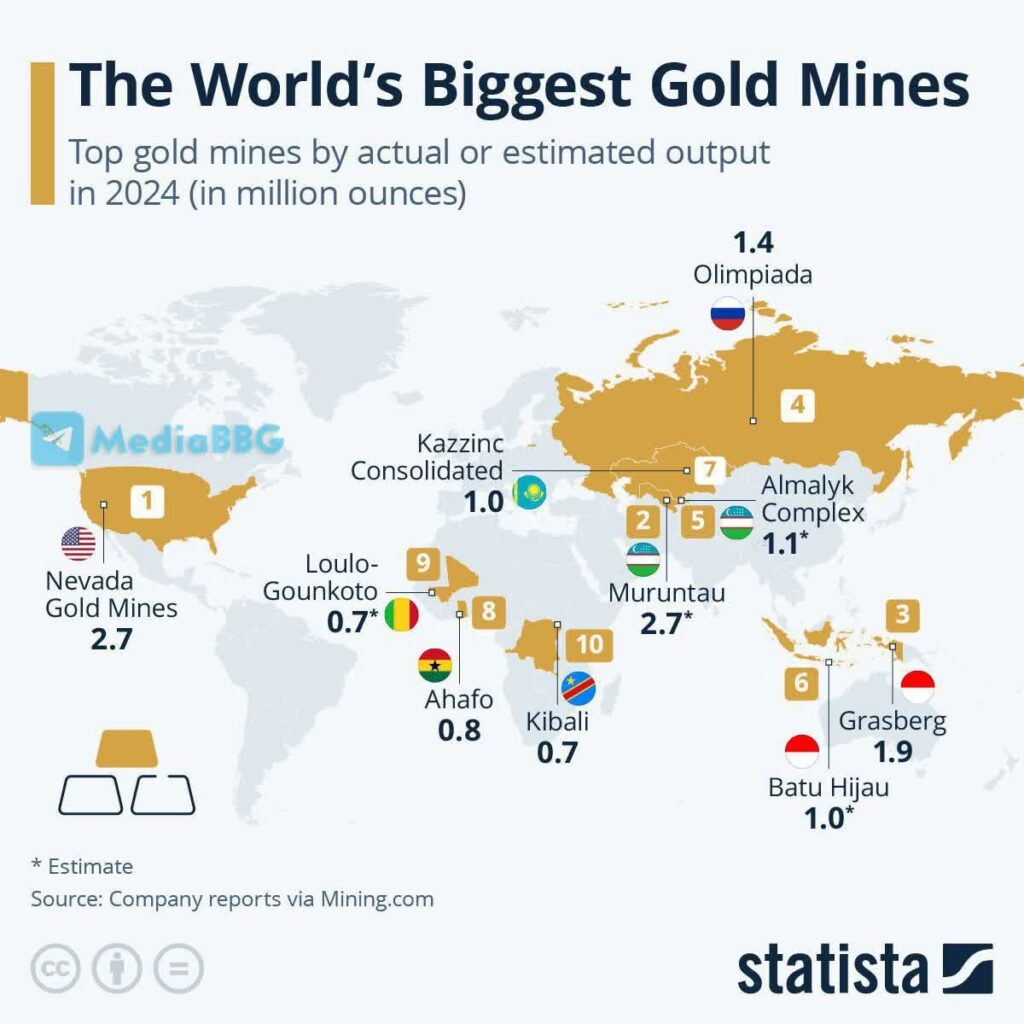

Photo: The 10 largest gold mines of 2024. For 2025 — we’re waiting… ?

World leaders in gold production (according to USGS and Visual Capitalist):

▪️ 1st – China (370 tons)

China retains its title as the world’s largest gold producer. Despite a decline from the record 2016 level (455 tons), production has consistently remained above 300 tons for over a decade. Chinese companies are actively developing new deposits and investing in ore processing.

▪️ 2nd – Australia (310 tons)

Australia holds second place thanks to large deposits in Western Australia. Local mines are considered among the most automated in the world.

▪️ 3rd – Russia (320 tons)

Russia also ranks in the top three, accounting for about 9% of global gold output. The main mines are located in Krasnoyarsk Krai and the Far East.

▪️ 4th – Canada (220 tons)

The northern country is actively developing mining in Ontario and Quebec, where gold literally lies beneath the glaciers.

▪️ 5th – USA (170 tons)

Nevada remains the heart of American gold mining — home to the legendary Nevada Gold Mines complex.

Top 10 largest gold mines in the world, 2024–2025:

▪️ 1st – USA, Nevada Gold Mines (2.7M oz)

A massive joint venture between Barrick and Newmont that spans nearly all of Nevada. Gold is mined here by the ton — no wonder the state is called “America’s Golden Heart.”

▪️ 2nd – Uzbekistan, Muruntau (2.7M oz)

One of the world’s most impressive open pits — nearly half a kilometer deep! Muruntau is not just a mine but an entire industrial city operating around the clock.

▪️ 3rd – Indonesia, Grasberg (1.9M oz)

Once the world’s largest gold mine. Today it produces not only gold but also copper, stretching over 4,000 meters above sea level.

▪️ 4th – Russia, Olimpiada (1.4M oz)

One of the country’s oldest and most profitable mines, generating billions annually. Olimpiada is the golden classic of Siberia.

▪️ 5th – Uzbekistan, Almalyk Complex (1.1M oz)

Another pride of Uzbekistan: a modern complex expanding rapidly and already among the world’s top 5 producers.

▪️ 6th – Kazakhstan, Kazzinc (1M oz)

Central Asia’s largest producer of precious metals, mining gold, silver, lead, and zinc.

▪️ 7th – Indonesia, Batu Hijau (1M oz)

On the island of Sulawesi, gold is extracted from a literal tropical paradise — but with precise engineering and billion-dollar turnovers.

▪️ 8th – Ghana, Ahafo (0.8M oz)

Africa strengthens its position: Ghana is becoming the continent’s new gold hub. The Ahafo mine symbolizes the region’s “golden renaissance.”

▪️ 9th – Mali, Loulo-Gounkoto (0.7M oz)

A Canadian Barrick Gold project. Despite regional political instability, the mine consistently ranks among the global top ten.

▪️ 10th – DR Congo, Kibali (0.7M oz)

Another African giant — mining gold amid jungles, with advanced technology and international investment.

Fun fact

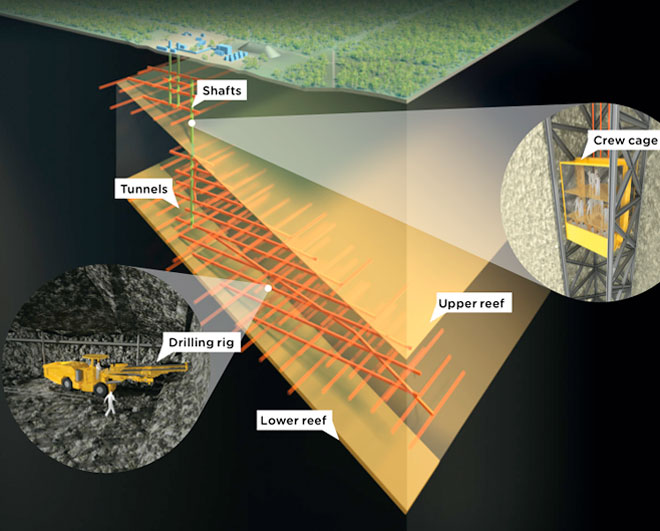

The Mponeng mine in South Africa is the deepest mine in the world, reaching 3,777 meters (and up to 4 km by some accounts). At such depths, rock temperatures exceed +60°C, requiring cooled air for workers. The main ore is gold. Located near Johannesburg, it remains a symbol of engineering heroism — and of humankind’s timeless greed for precious metals.

? Summary:

Global gold production remains steady but is shifting: Asia strengthens its dominance, Africa is catching up, and the traditional giants — the U.S., Canada, and Australia — bet on technology and sustainability.

Gold, as a century ago, still stands as the universal measure of wealth and stability.

It seems the old saying still holds true: while some dig, others get rich.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.