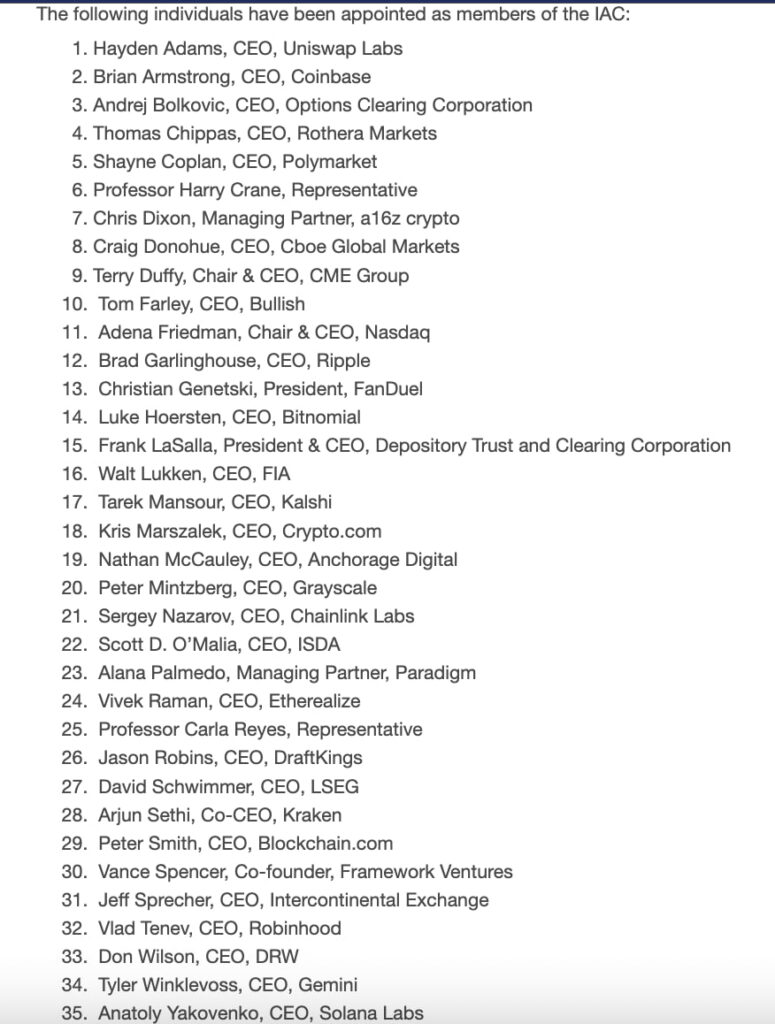

The U.S. Commodity Futures Trading Commission (CFTC) announced an expansion of the Innovation Advisory Committee (IAC), adding leading executives from the cryptocurrency industry. The committee now consists of 35 members, 20 of whom represent companies working with digital assets, blockchain technologies, and crypto-financial products.

The committee includes well-known figures such as Coinbase CEO Brian Armstrong, Ripple CEO Brad Garlinghouse, Solana co-founder Anatoly Yakovenko, as well as executives from Uniswap, Kraken, Kalshi, Polymarket, Robinhood, and a16z crypto.

Among the new members are Hayden Adams of Uniswap Labs, Chris Dixon of a16z crypto, Sergey Nazarov of Chainlink Labs, Vlad Tenev of Robinhood, Tyler Winklevoss of Gemini, Arjun Sethi of Kraken, Kris Marszalek of Crypto.com, Peter Mintzberg of Grayscale, Nathan McCauley of Anchorage Digital, Shayne Coplan of Polymarket, Tarek Mansour of Kalshi, and Peter Smith of Blockchain.com.

The expansion of the IAC reflects the growing importance of the crypto industry and blockchain technologies for the U.S. financial market. The committee is intended to provide recommendations to the CFTC on the regulation of innovative financial instruments, digital assets, and technologies, ensuring a balance between encouraging innovation and protecting market participants.

The committee also includes representatives of traditional financial institutions and exchange operators such as Nasdaq, CME Group, Cboe, and LSEG, allowing it to combine the experience of the classical financial sector with the expertise of the crypto industry.

According to CFTC representatives, involving cryptocurrency company executives in advisory work creates an opportunity for a deeper understanding of how digital markets function, their risks and prospects, and will help shape policies that support the safe integration of innovative products into the existing financial system.

Experts note that this step demonstrates the regulator’s serious attention to the development of the crypto industry and recognizes its potential as an important part of the future financial infrastructure of the United States.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.