⛏️ Global oil markets are showing an unusual phenomenon: the amount of oil on tankers in the oceans has reached the highest level in the last two years. According to Bloomberg, citing data from analytics firm Vortexa, around 1.25 billion barrels are currently at sea, the highest level since April 2023. Other analytics agencies, such as Kpler and OilX, confirm the trend, recording tanker volumes not seen since mid-last year.

Reasons for the sharp increase in tanker inventories

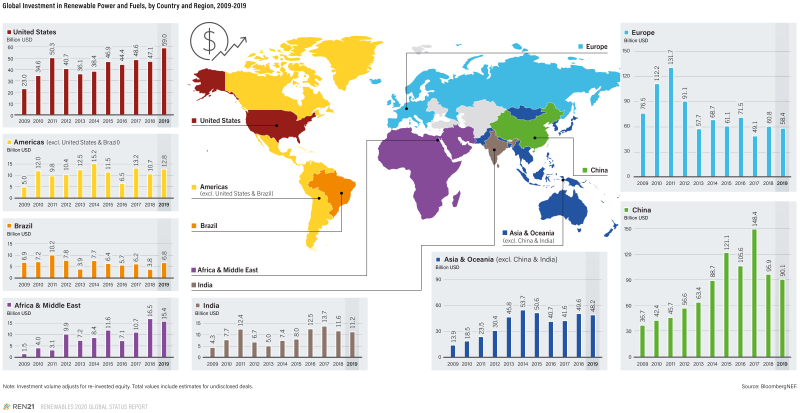

The main driver of this phenomenon is a sharp rise in global oil supplies. According to the International Energy Agency (IEA), current trends could lead to a record market surplus as early as next year.

In September, exports from OPEC+ countries, as well as from other regions including the U.S. and West Africa, significantly influenced the market. The three largest exporters — Saudi Arabia, the U.S., and Russia — increased deliveries by over 2 million barrels per day compared to August, adding extra pressure on the global market.

Where is the oil?

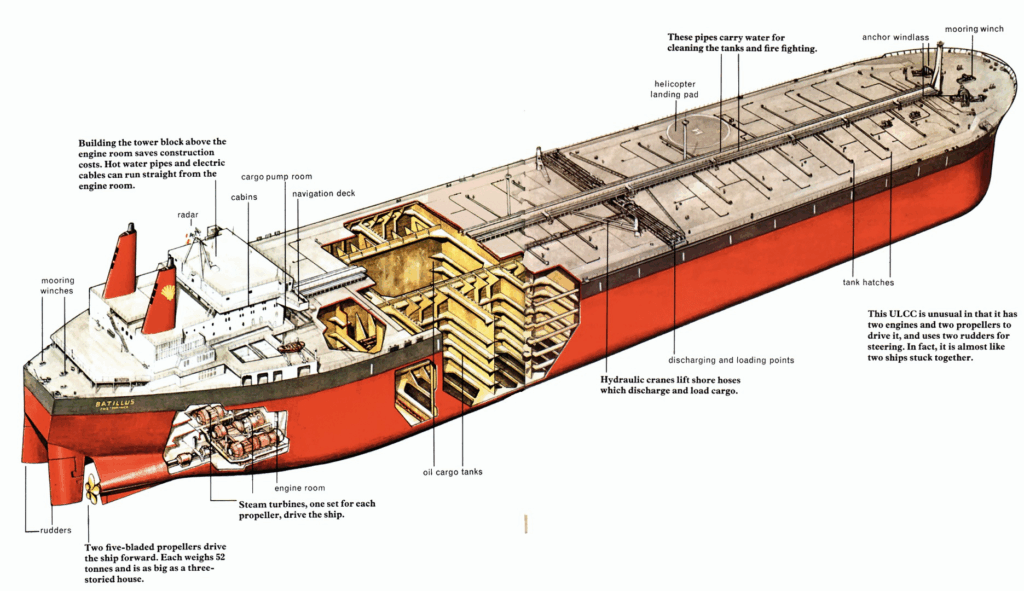

According to the latest data, the largest oil accumulations on maritime tankers are distributed as follows:

| Region | Volume on tankers, mln barrels | Main exporters |

|---|---|---|

| Persian Gulf & Middle East | 420 | Saudi Arabia, UAE, Kuwait |

| USA (Gulf of Mexico, East Coast) | 350 | United States |

| West Africa | 180 | Nigeria, Angola, Congo |

| Europe (North Sea, Baltic Sea) | 140 | Norway, UK |

| Russia & Black Sea region | 160 | Russia |

| Other regions | 0,0–10 | — |

Summary: over half of global oil tanker inventories are concentrated in the Persian Gulf and the U.S.

EA Gibson Shipbrokers chief analyst Svetlana Lobacheva noted that the increase in crude oil exports from the Middle East was particularly significant. Several factors influenced the situation:

- increased production under the OPEC+ agreement;

- reduction of on-site crude flaring;

- planned maintenance shutdowns at regional refineries.

All these factors together have led to record oil inventories at sea, ready for shipment to various parts of the world.

Monthly tanker volume dynamics

- April 2023 — 1.20 billion barrels (previous maximum)

- September 2024 — 1.05 billion barrels

- August 2025 — 1.18 billion barrels

- October 2025 — 1.25 billion barrels (new maximum)

The trend shows steady growth in tanker inventories, especially from August to October. This may indicate the start of a new market cycle with increased liquidity.

At the end of September, British energy company BP revised its global oil demand forecast, shifting the expected consumption peak from 2025 to 2030. This reflects global changes in energy policy, the transition to renewable sources, and the gradual slowdown of oil consumption growth in developed countries.

Combined with rising tanker inventories, this trend creates an interesting situation for investors and traders: despite high oil prices, market supply is increasing, which may temporarily pressure prices and increase market volatility.

Experts warn that in the coming months, competition between exporters may intensify, and price adjustments are possible due to redistribution of large oil volumes on global markets. For analysts, companies, and investors, this is a signal to carefully monitor logistics chains and the global geopolitical environment.

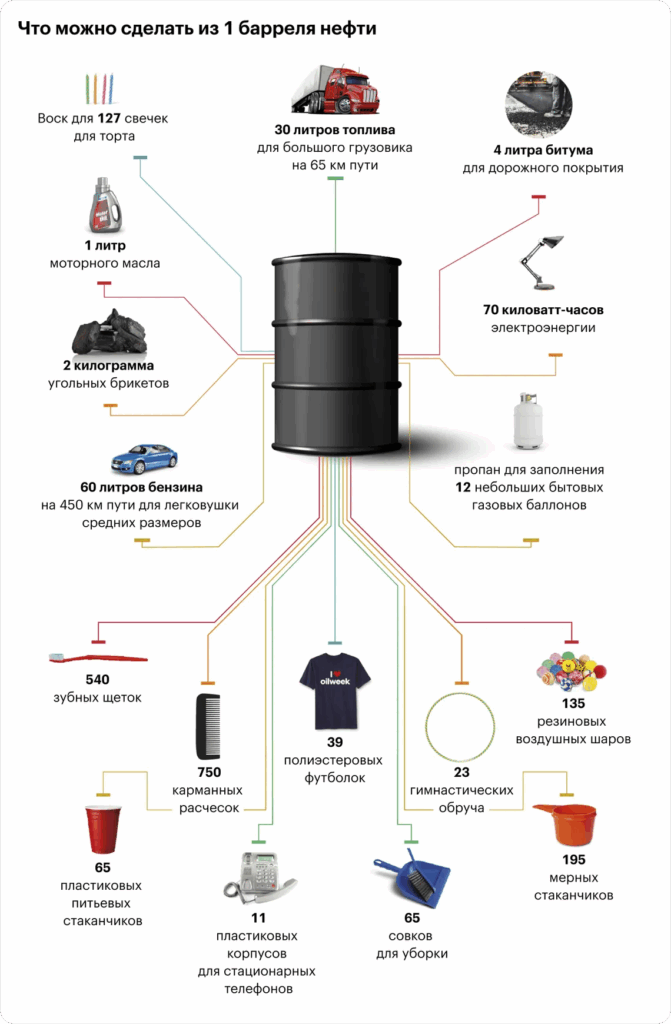

Why oil will not run out: 5 main reasons according to one scientific view

- We still do not know exactly how oil forms. There are two main theories:

- Organic — oil originated in ancient times from organic matter and plankton under high temperature and pressure.

- Inorganic — oil forms deep in the Earth’s mantle through complex chemical reactions.

Despite differences, both theories agree on one point: oil is a renewable resource.

- Oil is not always where it is extracted. Modern exploration and extraction methods allow repeated recovery in required quantities, even if a field initially seems unpromising.

- Humanity extracts only part of the reserves. Even in the richest fields, less than half of the hydrocarbons are recovered.

- Not all fields are developed. Many oil deposits remain poorly studied or inaccessible.

- There are still undiscovered fields. New oil reserves continue to be found, providing additional resources for future generations.

? Conclusion:

- Record tanker oil volumes indicate rising global supply;

- Main sources — OPEC+, USA, Saudi Arabia, and Russia;

- Short-term effect — possible price pressure;

- Long-term trend — demand reorientation, technological and geopolitical factors shaping the oil market through 2030 and beyond.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.