? Investing in the right industries today can determine an investor’s financial future for decades ahead. Global trends, technological breakthroughs, and demographic shifts are creating new waves of opportunity while simultaneously increasing risks for those who choose outdated or overly conservative sectors.

The technology sector remains the primary growth driver. Artificial intelligence, cloud platforms, quantum computing, and robotics are creating companies with exponential returns. For example, giants such as NVIDIA and Microsoft, actively developing AI platforms, are showing double-digit year-over-year growth, while startups in generative AI and robotics are already attracting billions in investments. Analysts believe that by 2030, AI’s share in the global economy could exceed 15%, making investments in this sector strategically vital for long-term wealth.

Equally promising is the renewable energy sector.

Tesla’s electric vehicles, CATL’s battery solutions, and smart grid infrastructure are just the tip of the iceberg. Government incentives worldwide, including subsidies for solar panels and wind farms, are driving sustainable demand growth. Forecasts by Bloomberg New Energy Finance suggest that by 2035, more than half of global energy generation will come from renewables, making companies in this industry strategic assets for investors.

The third sector, biotechnology and healthcare, combines innovation with demographic trends. An aging population and rising healthcare spending are creating a massive market for companies working on gene therapy, immunotherapy, and medical devices. Moderna and CRISPR Therapeutics are already demonstrating how breakthrough developments can transform the industry, while analysts project exponential growth in the biotech market by 2035.

However, there are also “danger zones” where investors risk losing money.

Traditional oil and gas extraction is gradually losing ground under the pressure of the green energy transition and global CO₂ emission restrictions. ExxonMobil and Chevron remain major players for now, but long-term forecasts point to slowing growth and high price volatility.

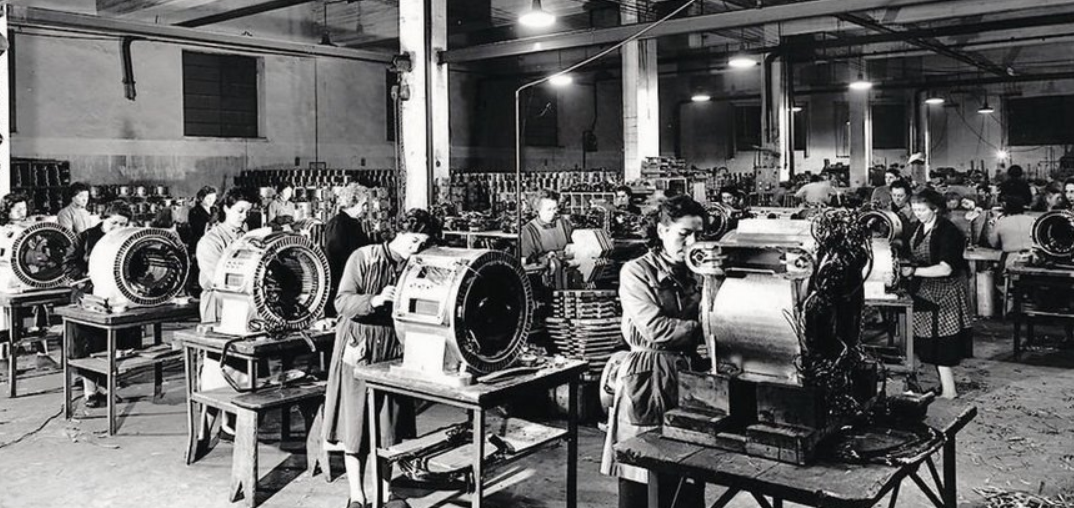

Another risky industry is outdated manufacturing, particularly companies that fail to invest in automation and new technologies. Such firms may face declining demand, rising costs, and a loss of competitiveness. Investors putting money into these companies today risk becoming “hostages of the past” as the market moves forward.

? The bottom line is clear: building wealth by 2035 requires careful sector selection and the ability to track global trends. Technology, green energy, and biotechnology offer the highest growth potential, while oil & gas and outdated manufacturing carry significant risks. Investors who can assess companies by their ability to adapt to the future and implement innovations will be among tomorrow’s millionaires.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.