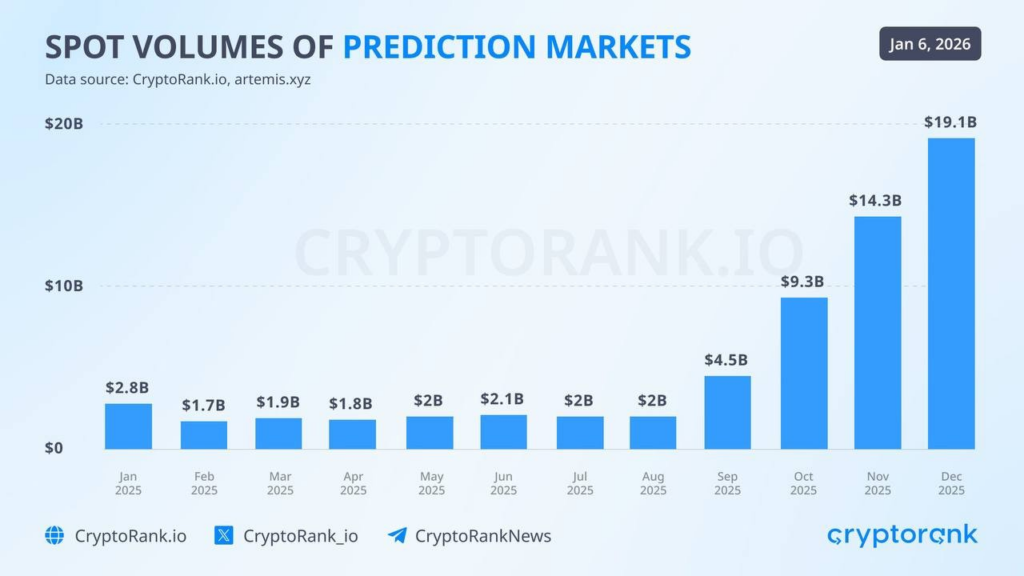

In December, the total volume of the prediction markets reached $19.1 billion, setting an all-time high and exceeding the previous record by approximately 35%. This sharp jump confirms that prediction markets have moved beyond being a niche pastime for enthusiasts and are gradually becoming an independent segment of financial infrastructure.

The growth was driven by several major platforms at once. The leader in monthly trading volume was Kalshi, with around $7 billion. It was followed by Opinion, where turnover reached $6.7 billion, and Polymarket, with approximately $5.3 billion. Together, these three venues accounted for the bulk of market liquidity and set the pace for the entire sector.

It is important to note that the exact date when the $19.1 billion record was fixed and the primary source of this figure are not specified in the available fragments. Nevertheless, the context points to a December peak in activity. In particular, on December 17, 2025, Coinbase announced the launch of prediction markets on its platform, which became a strong signal of sector legitimization and may have further boosted interest from both retail and institutional participants.

The overall rise in interest in prediction markets also fits into the broader market backdrop of the year’s end. After a series of high-profile crypto hacks in November 2025, market participants began to more actively seek alternative ways to hedge risks and express expectations about future events. In this sense, prediction markets appear to be a logical instrument: they allow participants not just to speculate on an asset’s price, but to place bets on specific outcomes — from macroeconomic indicators and regulatory decisions to political events and technological launches.

Another growth factor is the expansion of topics. Whereas prediction markets were previously associated mainly with politics and elections, a significant share of current turnover now comes from contracts linked to inflation, Federal Reserve rates, economic releases, the crypto market, ETFs, court rulings, and even corporate events. This makes such platforms more universal and increases their appeal to professional traders.

From a market structure perspective, the December record highlights several trends at once. First, liquidity is concentrating around a few major players, which improves pricing efficiency. Second, user trust in the mechanism of prediction markets as a source of collective probability assessment is growing. Third, the sector is gradually emerging from the gray zone and increasingly interacting with regulated venues and large ecosystems.

Thus, the December volume of $19.1 billion can be viewed not as a one-off spike, but as a marker of the maturity of prediction markets. Even in the absence of a precise date and a detailed source, this figure fits well into the broader picture: prediction markets are becoming an important element of the modern financial ecosystem, where information, expectations, and probabilities begin to be traded alongside traditional assets.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.