? The crypto market is not just numbers on charts. It’s chaos, fear, excitement, and evolution in its purest form. Here, survival doesn’t depend on who has more coins, but on who has stronger nerves and clearer thinking.

While the crowd swings between “it’s all over” and “we’re going to the Moon,” whales do one thing — they think. Calmly, without emotions, without panic.

Being a whale means thinking strategically — seeing the market not as a source of instant profit but as a game of survival.

And if you want to play on this field, you need to rewire your mindset.

? Here are 5 principles real players live by — those who don’t sink when the storm hits.

Inversion Thinking — think in reverse.

Almost all beginners enter the market asking, “How can I make a million?”

Whales start with another question: “How can I avoid losing everything?”

That’s the fundamental difference in thinking. While the crowd searches for shortcuts to profit, the whale identifies every possible path to loss — and closes them one by one.

Mistakes in crypto are expensive: scam projects, unchecked tokens, overleveraged trades, panic selling during corrections. If you’ve avoided the obvious traps — you’re already ahead of half the market.

Sometimes the secret to success isn’t running faster — it’s simply not tripping.

Survivorship Bias — don’t believe in the illusion of success.

You read about those who made millions on Bitcoin. You look at traders showing perfect charts of their trades. But you don’t see those who lost everything.

They don’t give interviews, don’t run channels, and don’t write books. They’re simply gone from view.

This perception bias is one of the most dangerous. We see only survivors and begin to believe success is the norm.

But in reality, the market is a graveyard of failed trades and shattered illusions.

A whale knows: behind every “successful” investor are dozens of others who weren’t so lucky. That’s why he doesn’t copy others — he builds his own results.

Parkinson’s Law — time is against you.

The more you think, the higher the risk of missing an opportunity.

The market won’t wait for you to finish your calculations. Crypto isn’t a university — there are no right answers, only timely decisions.

Analysis is important. But analysis paralysis is deadly. You can be right — but if you act too late, you still lose.

Whales act fast because they have a plan. They don’t improvise in panic — their scenarios are ready in advance. When the market crashes, the crowd screams. The whale simply executes the plan.

Authority Bias — nobody knows for sure.

The crypto world is full of “gurus,” influencers, and analysts who always have an opinion. But even the smartest make mistakes. Even those who predicted the last cycle may miss the next one.

Listen — but don’t follow blindly.

If you’re just copying others’ decisions, you don’t have your own strategy. You’ve become part of someone else’s game — and you’re not the one setting the rules.

A whale analyzes others’ arguments, but makes the final call himself. He doesn’t seek advice — he seeks understanding.

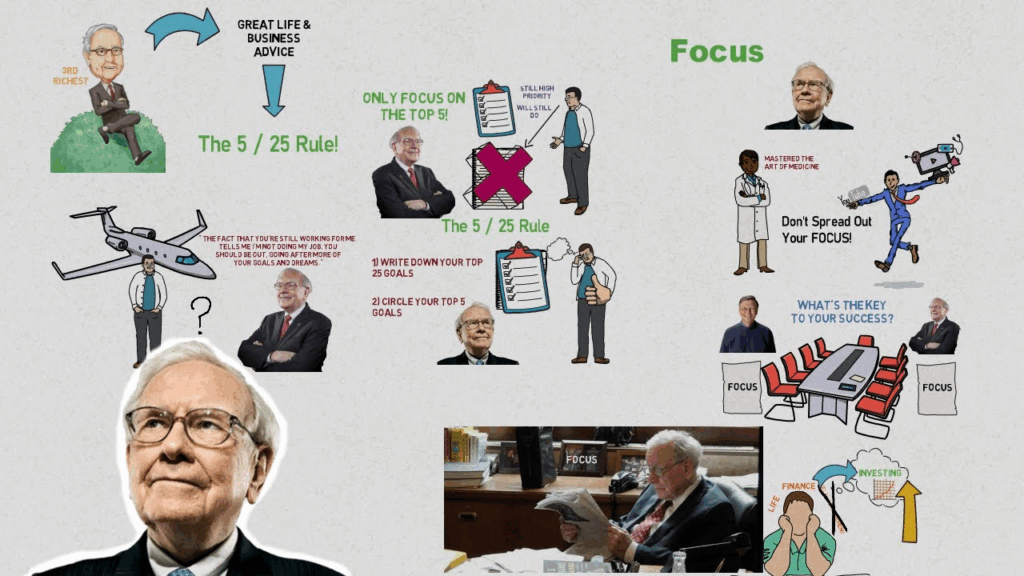

Buffett’s 5/25 Rule — kill distraction.

Focus is a luxury only the strong can afford.

Most traders and investors lose money not because they chose a bad strategy, but because they can’t stick to one.

Choose 25 goals — and cross out 20. Keep only what truly matters: 5 directions, 5 coins, 5 ideas. Dedicate your full attention to them.

Whales don’t scatter their energy. They concentrate effort, capital, and focus. When the crowd chases another “hyped token,” the whale simply stays on course.

The whale’s main rule: Not emotions, but logic. Not haste, but strategy. Not the crowd, but independence.

In crypto, survival doesn’t belong to those who entered first or shout the loudest on Twitter.

Survivors are those who can think clearly when everyone else is blinded by panic or greed.

? A true whale doesn’t swim with the current — he creates his own.

And if you want to become one of them, start simple: stop reacting, start analyzing. Let your decisions be driven by reason, not fear.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.