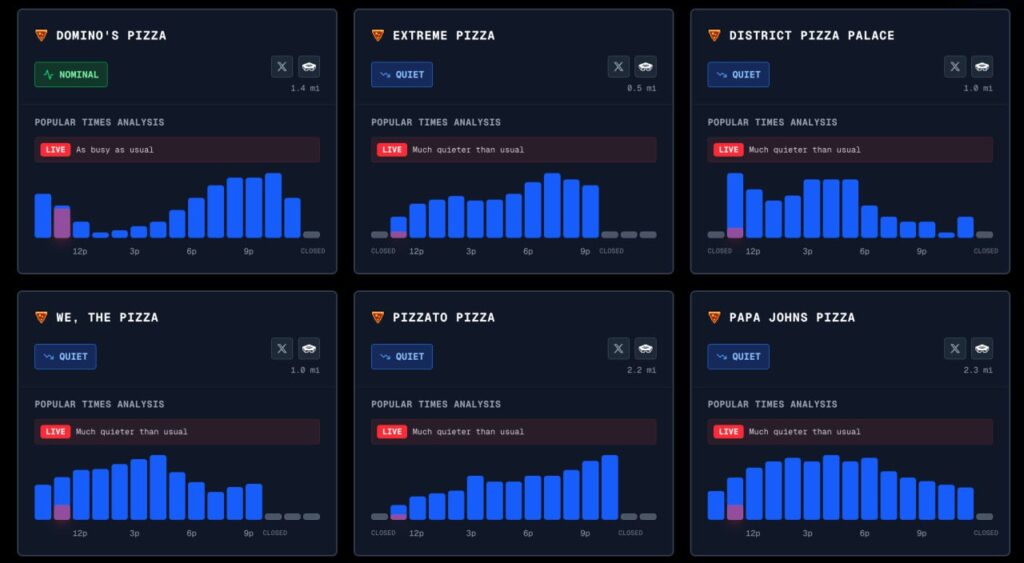

An intriguing dashboard called PizzINT has appeared online, tracking in real time the workload of pizza restaurants in the area around the Pentagon. At first glance, it looks like a joke or an internet meme, but in reality, there is a perfectly rational logic and a long history of observations behind it.

The essence of the indicator is simple, and that is exactly why it is especially devious. When the number of late-night food orders sharply increases near major military facilities, especially the Pentagon, it often coincides with unscheduled meetings, emergency work, and staff working beyond normal hours. Military personnel, analysts, and staff officers do not go home, which means they need to eat quickly and in large numbers. The simplest option is pizza, which can be ordered for dozens of people at once and delivered late at night.

Why pizza specifically? Because it is the perfect “emergency food.” It requires no cutlery, is delivered quickly, is easy to scale for large groups, and is traditionally used in office and command environments in the United States. When on a normal weekday evening it is quiet around the Pentagon, and then suddenly at night orders from Domino’s, Papa John’s, and other chains multiply several times, it almost always means that something unusual is happening inside the building.

It is important to understand that the pizza index does not indicate exactly what will happen. It does not say whether it will be a military operation, an emergency meeting on an international crisis, or an urgent response to intelligence information. But it does signal the key point — the normal work rhythm has been disrupted, and the system has shifted into a heightened readiness mode.

Historically, such spikes have repeatedly coincided with major events. Analysts and OSINT enthusiasts have retrospectively found anomalies in pizza orders before the start of operations in Iraq, Syria, during crises around Iran, and other hotspots. This is not an official indicator or intelligence tool, but a side effect of human behavior under stress and urgency.

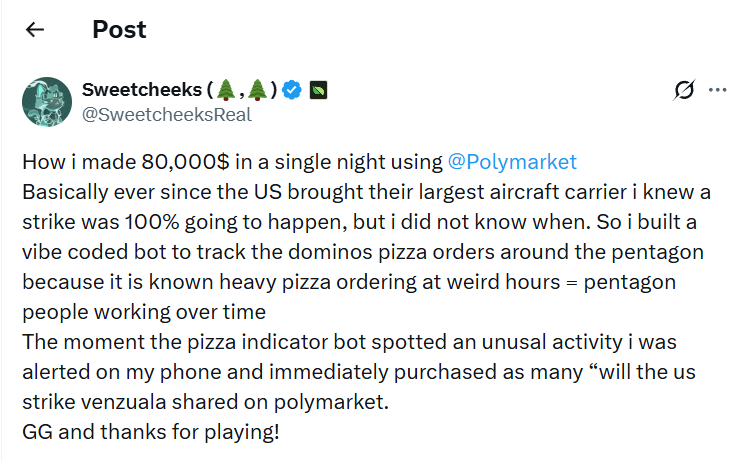

Recently, this principle was used not just for observation, but for real trading. One trader managed to earn around $80,000 by placing a bet on the Polymarket platform on developments around Venezuela. He assumed that the probability of a US strike was high, but the exact timing was unknown. Instead of guessing based on news and political statements, he wrote a simple bot that tracked late-night anomalies in pizza orders near the Pentagon.

When the indicator showed a sharp surge in deliveries deep into the night, the trader placed a bet on the scenario “The US will strike Venezuela.” A few hours later, the information was officially confirmed, the market closed, and the trade generated a profit.

Why does this work at all? Because such signals are almost impossible to fake in advance. Politicians can say one thing, diplomats can stall for time, and markets can hesitate. But when dozens or hundreds of people suddenly stay to work overnight in one of the most secure buildings in the world, it almost always shows up in mundane details. In this sense, pizza becomes an indirect but honest indicator.

Of course, the pizza index is not a universal forecasting tool and does not guarantee accuracy. Sometimes spikes may be related to drills, internal inspections, or crises that never reach the public sphere. But as an early signal of heightened activity, it works surprisingly consistently.

In the end, the “Pentagon Pizza Index” is an example of how, in the era of open data, on-chain betting, and alternative analytics, even something as mundane as late-night food delivery can become part of geopolitical analysis. Big events rarely start with loud headlines. More often, they start with someone ordering one more pizza at two in the morning.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.