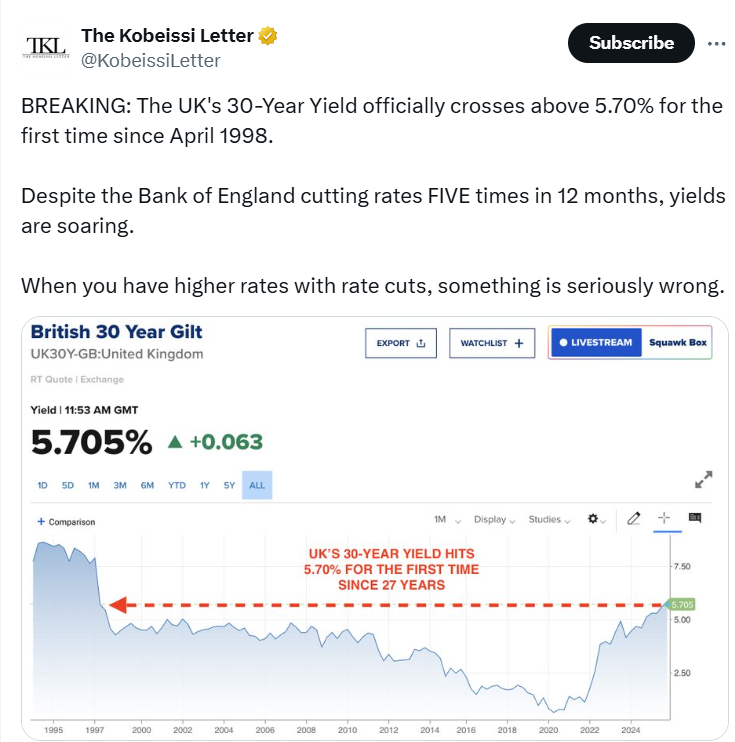

? UK 30-Year Bond Yields Surpass 5.7% for the First Time Since 1998!

UK 30-year government bonds have crossed the 5.7% yield mark — a level not seen in nearly 27 years. This comes despite the Bank of England cutting interest rates five times in the past year. Normally, rate cuts lower bond yields. But reality shows the opposite: yields are rising, and investors are getting nervous.

Breaking: UK 30-year bond yields officially exceeded 5.70% for the first time since April 1998. Despite FIVE rate cuts in the last 12 months, yields are surging. When yields rise while rates are falling — something is seriously wrong.

Why This Is Worrisome

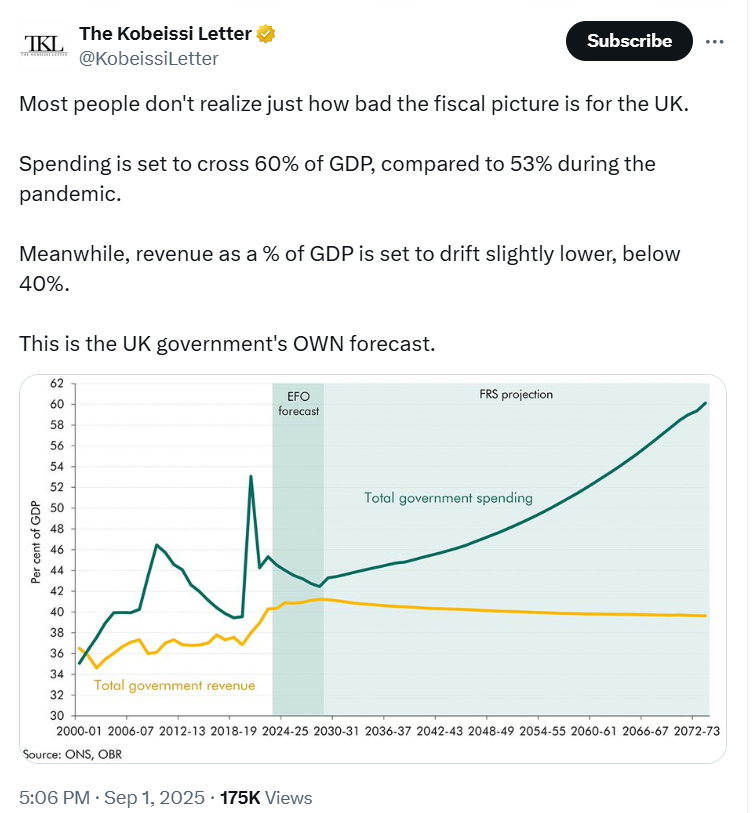

1. Fiscal imbalance

UK government spending is projected to exceed 60% of GDP, while revenues fall below 40%. That means a structural deficit: the country spends far more than it earns, relying on borrowing.

Most people don’t realize how bad the UK’s fiscal outlook is. Spending is forecast to surpass 60% of GDP (53% during the pandemic). Revenues are expected to dip below 40%. And this is the government’s own forecast.

2. Long-term debt burden

If current policies remain, debt could reach 274% of GDP by 2073, with interest payments alone consuming ~13% of GDP — nearly a third of the budget.

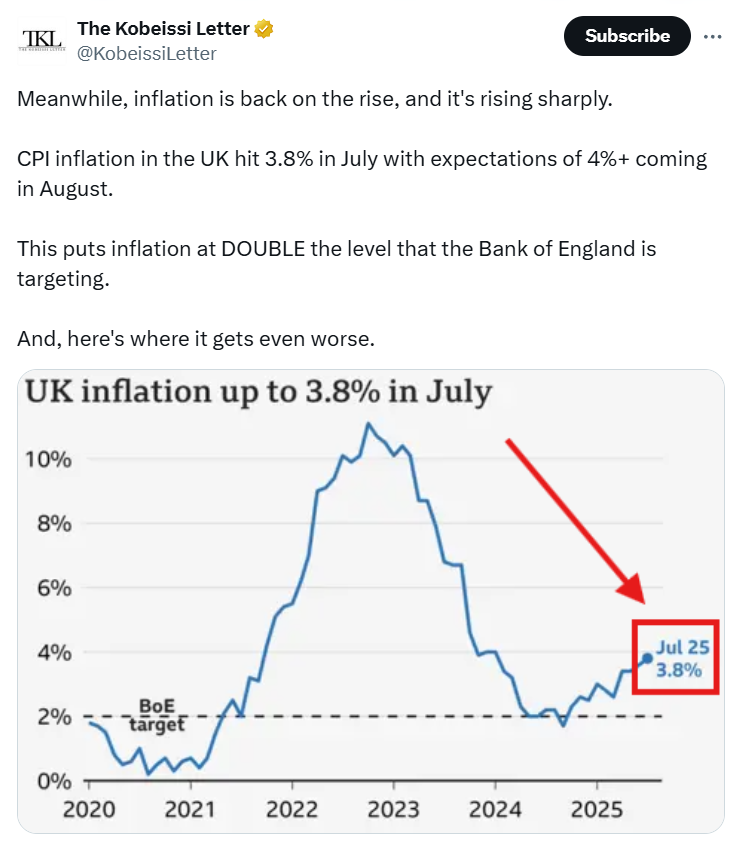

3. Rising inflation

UK inflation hit 3.8% in July and is forecast above 4% in August. High inflation with low interest rates creates a paradox: real yields stay negative or low, yet investors still demand higher returns to hold risky government debt.

Meanwhile, inflation is accelerating fast — double the Bank of England’s target.

4. Weak economy and looming recession

The Bank of England is cutting rates not because of overheating growth, but because the economy is stalling. Recession risk is real.

The Bond Market Paradox

Normally, lower rates = lower yields. But now yields are climbing despite rate cuts. This signals investors’ distrust in government debt.

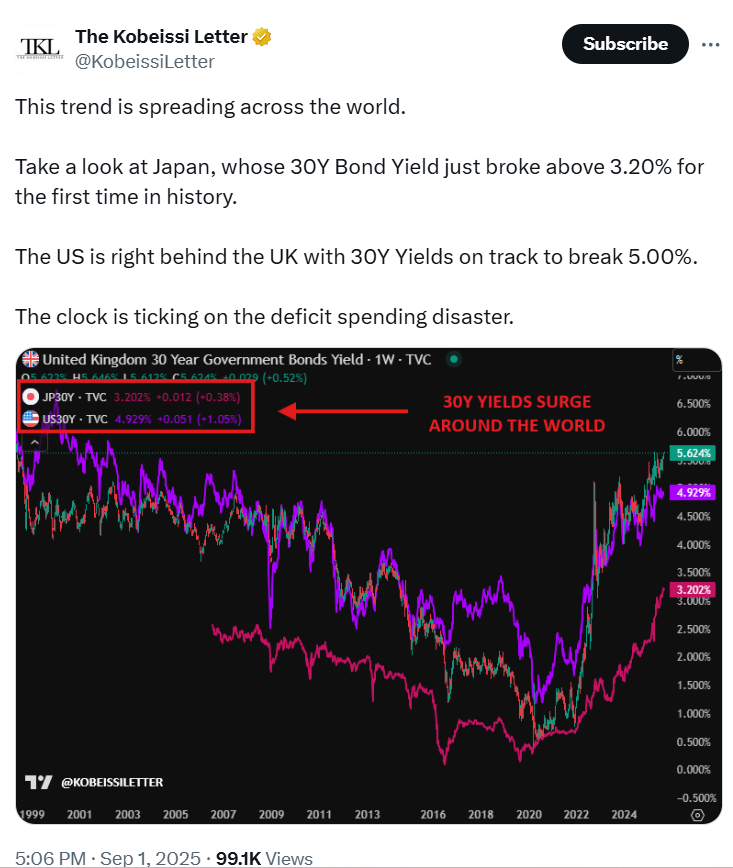

The same trend is visible globally: US and Japanese bond yields are also rising despite low rates.

In Japan, 30-year yields topped 3.20% for the first time ever. In the US, they’re nearing 5.00%. The clock is ticking — deficit-driven crises loom closer.

In Japan, 30-year yields topped 3.20% for the first time ever. In the US, they’re nearing 5.00%. The clock is ticking — deficit-driven crises loom closer.

Gold as a “Safe Haven”

With yields rising and macro risks mounting, gold has surged to record highs. Investors are flocking to safe assets.

What does it mean for investors?

- Bondholders: higher yields = falling prices on existing bonds.

- Gold & safe-haven investors: stand to gain from rising asset prices.

- Long term: if deficits and debt remain unchecked, upward yield pressure will persist.

⚠️ Bottom Line

UK 30-year bonds are flashing red. Rising yields amid falling rates reflect deep structural issues: high debt, inflation, and weak growth.

Investors should carefully monitor these signals and choose their strategy taking into account the risks of a debt crisis.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.