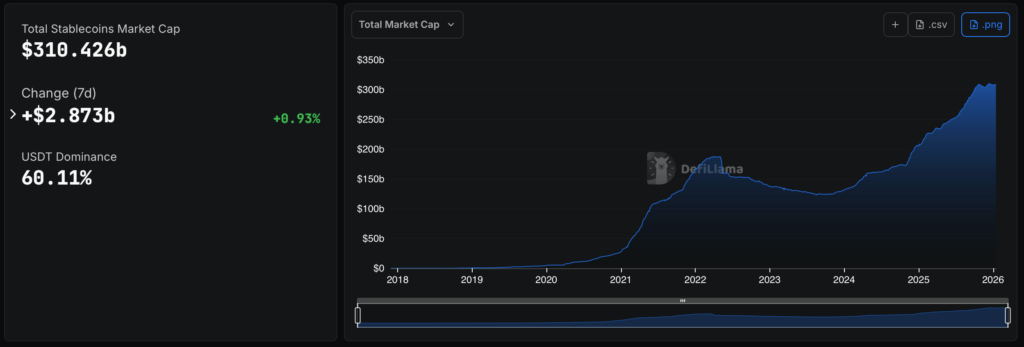

The total market capitalization of stablecoins has reached a new all-time high, surpassing the $310 billion mark and breaking the previous record set in December. For the market, this is an important psychological and structural milestone: stablecoins are firmly establishing themselves as the core liquidity layer of the entire crypto economy, rather than merely a supporting tool for trading.

Notably, this growth followed a brief pullback in December 2025, which many interpreted as the beginning of a deeper correction. The reality turned out to be the opposite. In the first weeks of 2026, the market not only recovered but entered a phase of accelerated expansion. Over the past week alone, the stablecoin sector saw $2.873 billion in net inflows, signaling that capital is actively positioning itself for further activity — from trading and hedging to participation in DeFi, RWA, and on-chain payments.

The main beneficiaries of this liquidity inflow remain the two largest players. Tether (USDT) has grown to a market capitalization of approximately $186.595 billion, reinforcing its role as the dominant global settlement instrument in the crypto economy. USDC by Circle has continued its steady recovery, reaching a valuation of $76.649 billion, reflecting growing trust from institutional investors, payment providers, and regulated platforms.

Beyond the leaders, positive momentum is also visible among alternative stablecoins. Ethena’s USDe rose by 2.57%, strengthening its position as a synthetic dollar liquidity instrument within the DeFi ecosystem. DAI by Sky increased by 3.92%, pointing to renewed interest in decentralized issuance models and managed collateral structures. At the same time, the market remains selective: for example, Sky’s USDS declined by 6.8%, reminding participants that competition within the sector is intensifying and capital is increasingly reallocating toward the most resilient and liquid models.

In a broader context, the rise in stablecoin market capitalization is more than just a numerical milestone. It is a signal of accumulating dry powder. Historically, such periods have often preceded phases of heightened activity in the crypto market: rising trading volumes, the launch of new DeFi products, increased inflows into tokenized assets, and growth in on-chain payments. Stablecoins are increasingly used not only for speculation, but also as a settlement layer for AI agents, cross-border transfers, corporate treasuries, and government pilot programs.

In essence, the market is sending a simple message: liquidity is not leaving, it is concentrating. And as long as the total stablecoin market capitalization continues to set new highs, the crypto economy is building the foundation for the next growth cycle — one that is more mature, infrastructure-driven, and closely connected to the real economy.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.