?️ August 17, 2025: Markets at Highs, Awaiting Powell

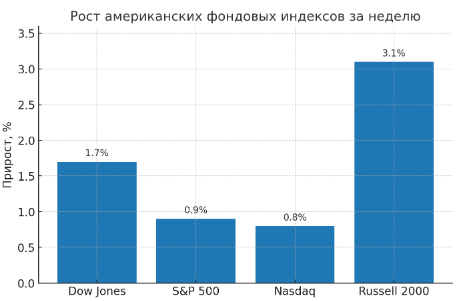

Last week, U.S. indices showed solid gains. Dow Jones rose 1.7%, S&P 500 increased by 0.9%, and Nasdaq added 0.8%. The small-cap index Russell 2000 stood out, jumping 3.1%.

Leading sectors include airlines, construction companies, biotechnology, and banking.

Investor attention is focused on the upcoming speech by Fed Chair Jerome Powell at the Jackson Hole symposium on Friday (as previously reported). Expectations are fairly specific: the market is pricing in nearly an 85% probability of a rate cut on September 17 and anticipates 1–2 additional easing moves by the end of the year. Any shift in Fed rhetoric could be a turning point for markets — from a sharp correction to an acceleration of the current uptrend.

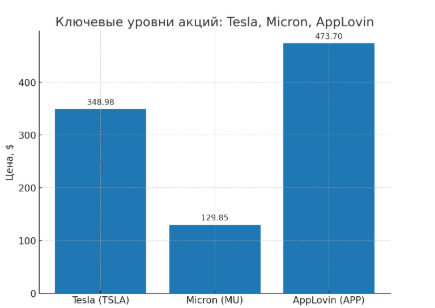

Important technical signals are also forming on individual stocks:

- Tesla (TSLA) is approaching a key entry level around $348.98, although fundamentally the company continues to show declining profits for the third consecutive year.

- Micron (MU) remains a beneficiary of the AI-memory trend — the entry zone is $128.6–129.85 with volume confirmation.

- AppLovin (APP), operating at the intersection of AI and advertising, is testing support near $428.99, with the next growth target around $473.70.

Sector-wise, airlines (ETF JETS +8.4% for the week), construction companies (XHB +4.8%), and biotechnology (ARKG +8%) remain attractive.

What should investors do?

For investors, the current situation calls for maintaining a high share of market exposure while partially locking in profits in overheated AI sectors.

At the same time, attention should be given to new growth leaders — airlines, biotech, and construction companies.

Corporate earnings reports of major retailers — Walmart, Home Depot, Lowe’s, TJX — as well as Palo Alto Networks will also be important.

The key event of the week — Powell’s speech on Friday. It could determine whether the market continues to climb or if the long-awaited correction begins.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.