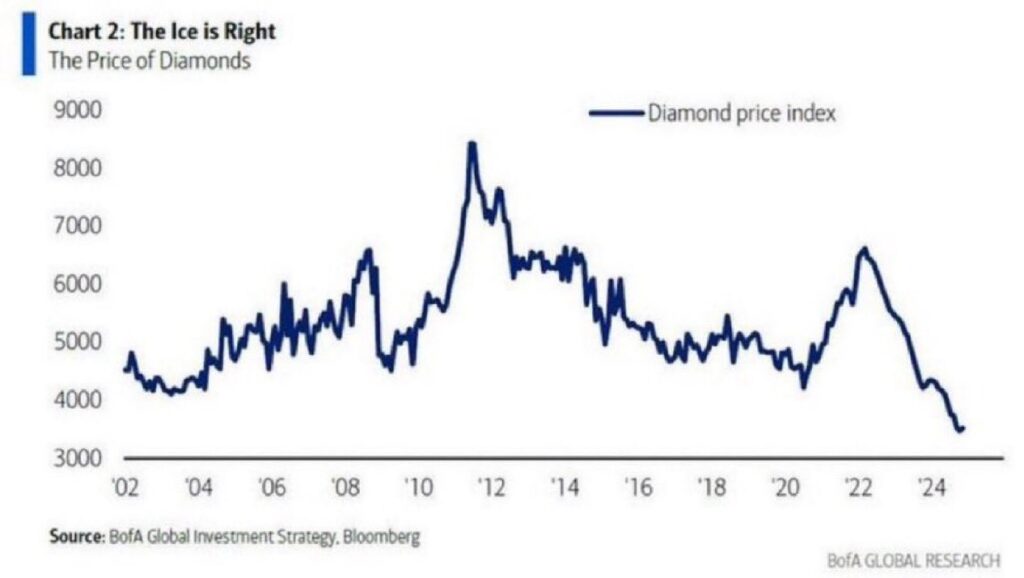

Diamonds may be a girl’s best friend, but for an investment portfolio today they are increasingly becoming a source of disappointment. Diamond prices have fallen to their lowest level this century, and the decline has been continuing for several consecutive months. A market that for decades was perceived as a symbol of stability, status, and “eternal value” has suddenly proven vulnerable to changes in the economy, culture, and consumer behavior.

The price decline began in June and coincided with several negative factors at once. First, the market reacted to concerns related to a possible increase in import tariffs in the United States, one of the key centers of jewelry consumption. Second, an oversupply of less sought-after items emerged – small and mid-sized stones that are harder to sell amid weak demand. Third, seasonal slowing of activity played a role, and this year it turned out to be deeper than usual. This stands in sharp contrast to the period from February to May, when diamond prices, on the contrary, showed growth and created the illusion of market recovery.

However, the fundamental problem is much broader than temporary fluctuations. The world is gradually turning away from conspicuous consumption toward more conscious spending. This is noted by finance and investment expert, founder of the financial club “Multiplicator”, Evan Golovanov. According to him, in China and the United States – the two key diamond-consuming countries – demand for jewelry has sharply declined amid economic difficulties, falling consumer confidence, and a reassessment of life priorities. At the same time, traditional institutions historically associated with diamonds have also weakened, including marriage as a social and economic ritual.

To put it plainly and without romance – people are getting married less often. And if they do marry, they increasingly do so without expensive symbols. Money that previously went toward purchasing a diamond ring is now more often directed to a down payment on housing, investments, education, or experiences. Instead of a stone in a box, couples choose joint travel, a round-the-world trip, or simply a financial safety cushion. For the modern generation, the value of experience and freedom often outweighs that of a status object.

The decline in interest in luxury goods is not limited to the diamond market. Arthur Meinhard, Head of Global Markets Analytics at Fontvielle Investment Company, notes that diamonds merely reflect a broader trend. According to the annual Bain & Company report published in November, in 2025, for the first time in the past 15 years excluding the pandemic period, global demand slowed simultaneously across several luxury segments: jewelry, branded clothing and bags, as well as premium cosmetics. This points to structural changes in consumer behavior rather than temporary weakness of a single product.

There is another important aspect highlighted by experts. Diamonds are largely a product of marketing, and the marketing machine that supported their “magical” status for decades is now operating much less effectively. In the 20th century, the idea of a diamond as a mandatory symbol of love and status was actively promoted by the industry. Tiffany played a huge role in this process. The legendary blue box became a cultural code, penetrating cinema, music, and mass consciousness. The Tiffany color was recognizable everywhere – from storefronts to automobiles. The diamond was sold not as a stone, but as a dream, a story, and a social marker.

Today, this magic is gradually fading. New generations are less receptive to traditional marketing narratives, more often ask the question “why?”, and are unwilling to pay for a symbol if it carries no practical or personal value. Against this backdrop, diamonds are losing their exclusivity and turning from an “eternal asset” into an ordinary commodity subject to the laws of supply and demand.

As a result, the diamond market has reached a point where economic pressure, cultural shifts, and weakening marketing influence intersect. And while this may mean more affordable prices for buyers, for investors it has become clear: the era when diamonds were considered a reliable and unconditional store of value is over. Paradoxically, the stone that was meant to be eternal has proven too dependent on a changing world.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.