? YouTube was once associated solely with short clips, entertainment content, and viral animal videos. Today, the platform is confidently transforming into a key player in the television advertising and online video markets. Its evolving perception and expanding audience make YouTube not just a content hub but a significant financial asset for Alphabet.

Market Share and Financial Performance

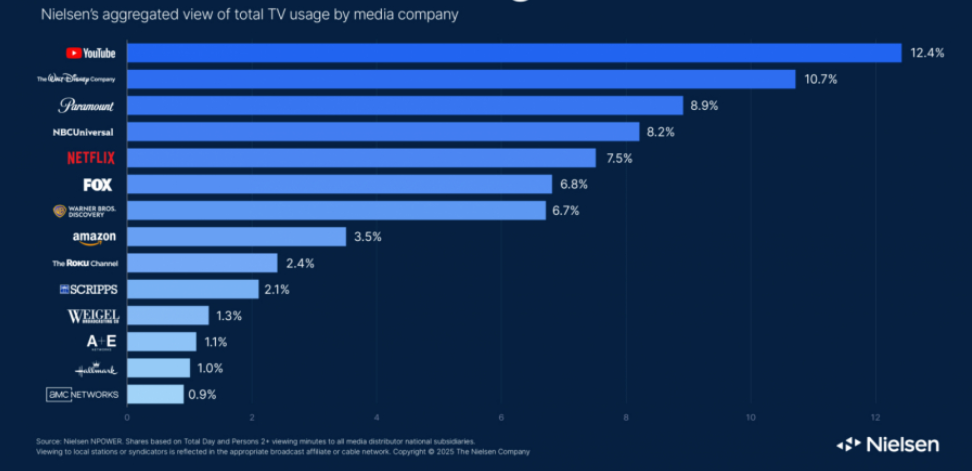

According to recent studies, YouTube’s share of U.S. TV viewing reaches 12.8%, compared to Netflix at 7.5%. This indicates that YouTube has become a full-fledged participant in TV consumption, capable of competing with major streaming services.

Financial results are impressive: in 2024, YouTube generated approximately $54.5 billion in revenue, of which around $36 billion came from advertising. Goldman Sachs forecasts continued rapid growth, projecting platform revenues could reach $107.5 billion by 2030.

Audience Shift

A key factor in YouTube’s growth is audience expansion. Whereas its core viewers were once teenagers and young adults, the platform now attracts users aged 40–60. This opens new opportunities for advertisers targeting a more mature and financially capable audience.

Content creators also benefit: over the past three years, YouTube has distributed about $70 billion to creators. This level of support encourages high-quality, diverse content, increasing the platform’s appeal to viewers and advertisers alike.

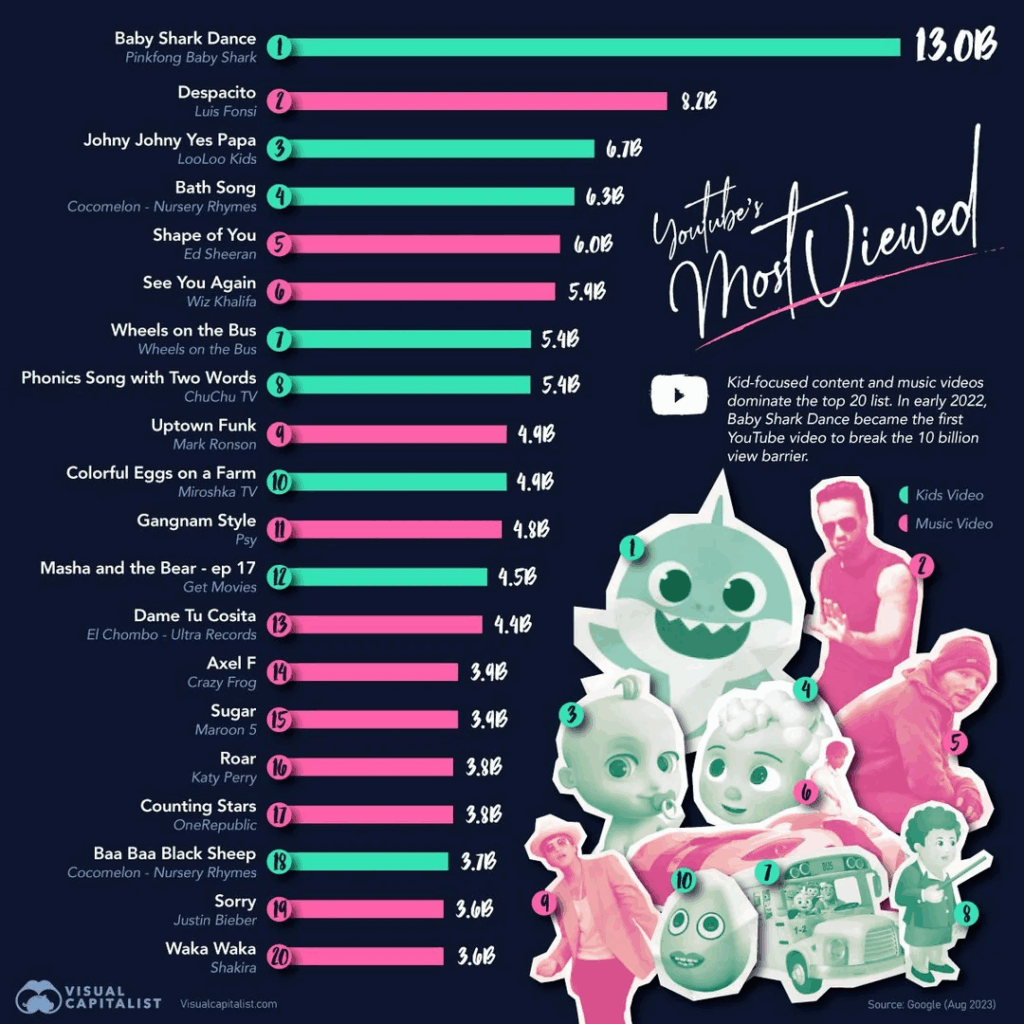

Most Viewed YouTube Videos of All Time

Influence of Artificial Intelligence

Generative AI technologies are accelerating the platform’s growth. Automation of video production reduces content creation costs while improving quality. Machine learning algorithms in advertising systems allow brands to more accurately reach their target audience, making campaigns more effective and profitable.

GOOGL Stock Technical Analysis

From a technical perspective, Alphabet shares show strong positions. The stock broke the “cup-with-handle” pattern base at $197.95 and is currently trading around $202.94. Analysts see a buying zone up to $207.85, with potential growth in the $225–230 range.

Long Position Plan:

- Entry: $198–203

- Stop-loss: $191

- Target: $225–230

? Conclusion

YouTube is evolving into a full-fledged online TV platform capable of competing with traditional TV and streaming services. Audience growth, creator support, AI integration, and expanded advertising opportunities make the platform a key driver of Alphabet’s growth.

From both fundamental and technical perspectives, GOOGL appears to be a strong asset. The question remains: can YouTube surpass Netflix and become a global leader in online TV, fully replacing traditional television for a broad audience?

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.