? The artificial intelligence market has been booming in recent years — investments in AI companies are pouring in at record rates, and project valuations are rising as if backed by real products. In reality, behind this growth often stands… nothing. Bloomberg isn’t afraid to draw direct parallels with the 2007 mortgage crisis: back then, banks repackaged loans and sold them as valuable assets — today, AI startups are doing the same with investments.

Money running in circles

Companies eagerly receive funding, spend it on flashy presentations and marketing videos, and then sell their tokens or equity to investors hoping for a miracle. Money literally circulates between market players, creating an illusion of growth. Meanwhile, real products and technologies often remain at the prototype or MVP stage.

Why does it look like a bubble?

A classic bubble forms when asset prices grow faster than their real value. The AI market already shows such signs: startups are being valued at astronomical levels despite limited user bases or actual revenue. Investors are buying into expectations, not achievements — and the louder the hype, the stronger the urge to invest “before it’s too late.”

Bloomberg’s diagnosis

Bloomberg analysts directly compare the current situation to the 2007 mortgage crisis: banks then repackaged and resold loans, creating an illusion of profitability. Today, AI startups do the same — selling stakes and creating a sense of market boom. The only difference is that instead of houses and loans, the assets now are algorithms and machine learning models.

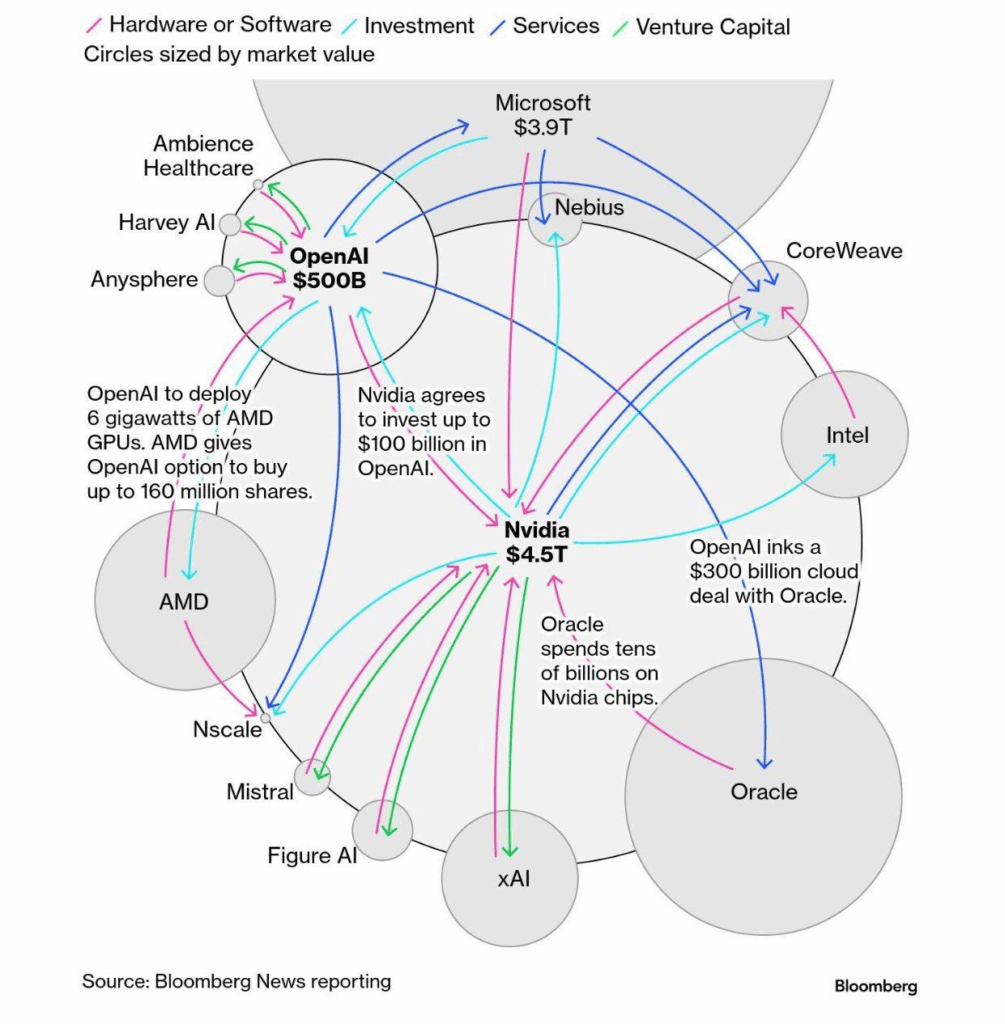

How money circulates: the AI ecosystem map

Bloomberg’s chart illustrates a complex web of investments, technologies, and deals among leading AI players. Circle size represents company valuation, while arrows show directions of funding, partnerships, and supply chains.

- OpenAI ($500B) — the central player, receiving investments from Nvidia and Microsoft, buying hardware from AMD, and signing billion-dollar cloud contracts with Oracle. It also collaborates with startups like Harvey AI and Anysphere.

- Nvidia ($4.5T) — key chip manufacturer for AI, investing in OpenAI and other startups, selling hardware to Oracle, and supplying CoreWeave, Mistral, Figure AI, and xAI.

- Microsoft ($3.9T) — invests in OpenAI and gains access to its technologies to power cloud services.

- AMD and Intel — provide computing power rented or purchased by startups and major players. For instance, OpenAI operates 6 gigawatts of AMD GPUs.

- Oracle — major buyer of Nvidia hardware and cloud partner of OpenAI.

- Venture startups (Harvey AI, Anysphere, Mistral, Figure AI, xAI, CoreWeave, Nscale) — receive funding, technology, and infrastructure from big players, closing the loop of capital and resources.

Illustrating the bubble

The chart clearly shows how money and resources “bounce” between companies, creating the illusion of a vast market. However, many of these flows are internal investments and deals that inflate valuations on paper rather than reflect real revenue or working products. This is exactly what Bloomberg compares to the financial schemes of the 2007 mortgage crisis.

What’s next?

Eventually, expectations collide with reality. When investors realize that project valuations aren’t backed by real products or profits, the bubble may burst. Some companies will disappear, others will lose value, and the market will undergo a cleansing. The next decade will likely be a time of reassessment and cautious investing.

? Conclusion

Today’s AI market resembles a carnival with fireworks and loud music — dazzling, noisy, and thrilling. Yet behind the spectacle lies a risk: money keeps spinning in circles while real progress remains in the shadows. Investors should remember that even in tech, bubbles have consequences — and sometimes the most expensive toys turn out to be empty inside.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.