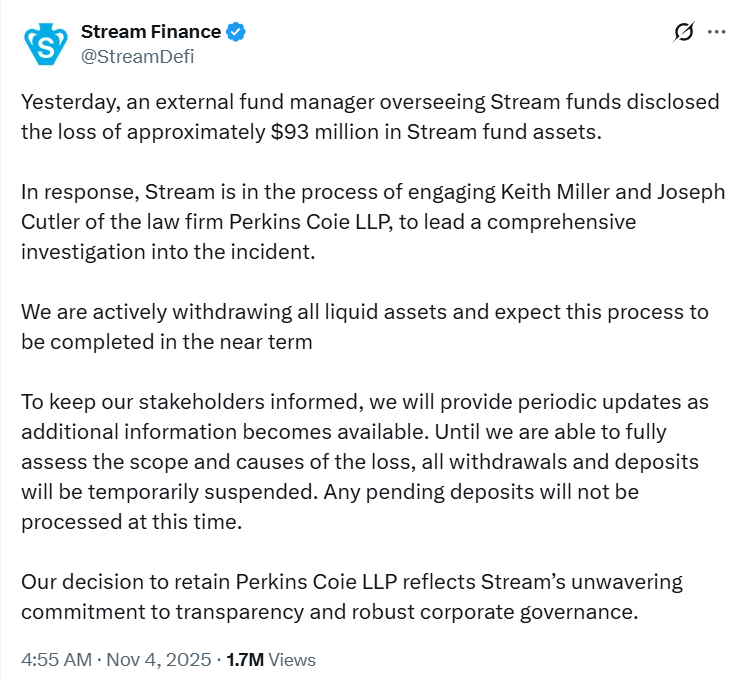

? The decentralized platform Stream Finance announced the suspension of all operations after it became known about the loss of $93 million in user assets. The company reported the incident on its official accounts, emphasizing that the funds were under the management of an external fund manager — who was the first to notify the team about the sudden disappearance of funds.

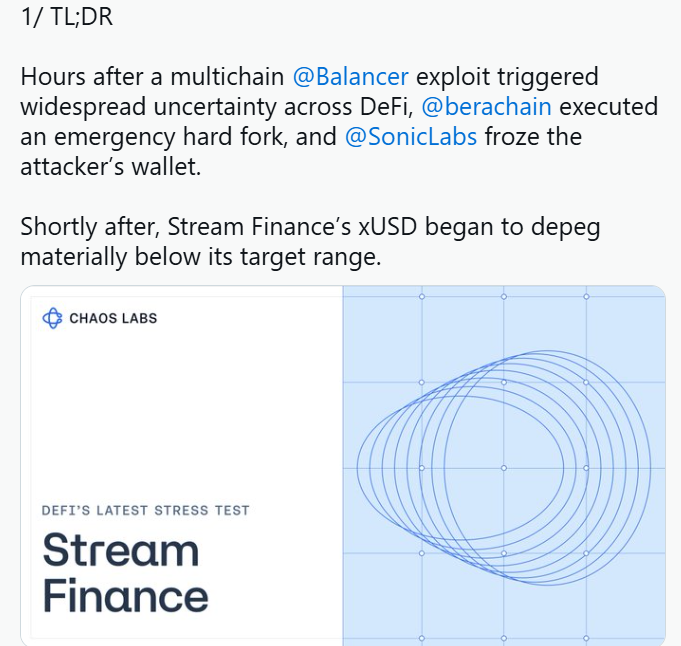

Possible link to the Balancer hack

According to preliminary data, the incident may be related to the hack of Balancer — a major DeFi liquidity protocol (as we reported earlier), from which more than $128 million was recently withdrawn. Although the direct connection has not yet been confirmed, experts note that the timing coincides and that the asset placement schemes of Stream and Balancer overlapped.

Chaos Labs co-founder Omer Goldberg suggested that the Balancer exploit may have triggered a chain reaction in Stream Finance’s liquidity and the collapse of the project’s internal stablecoin.

XUSD collapse and transaction freeze

After the announcement, the stablecoin Staked Stream USD (XUSD) lost its peg to the dollar and fell to $0.26, according to CoinGecko data. Deposits and withdrawals were immediately halted, and all pending transactions were frozen.

The Stream Finance team stated that “all liquid assets are being withdrawn from external accounts” and that the process is nearly complete. The company hired law firm Perkins Coie, specializing in crypto project protection, to investigate the incident.

Problems started earlier than admitted

Users note that withdrawal delays and lack of support responses were seen several days before the official statement. Complaints about “stuck transactions” and “non-transparent contract behavior” appeared on forums and social media.

Interestingly, as early as October 31, 2025, Stream Finance had to explain inconsistencies between its TVL (Total Value Locked) figures and data from the analytics portal DefiLlama. The team then explained the discrepancy by saying that “DefiLlama does not account for recursive yield strategies.” However, users were already questioning the project’s transparency.

What Stream Finance is

Stream Finance positioned itself as a next-generation DeFi platform with “recursive yield strategies” — meaning that profits from investments are automatically reinvested into other strategies to amplify returns. Such models are considered highly risky, especially when there’s limited control over external liquidity pools.

The company’s main product was the XUSD stablecoin, supposedly backed by crypto assets and liquidity tokens. However, after the $93 million loss, the sustainability of this model is now in doubt.

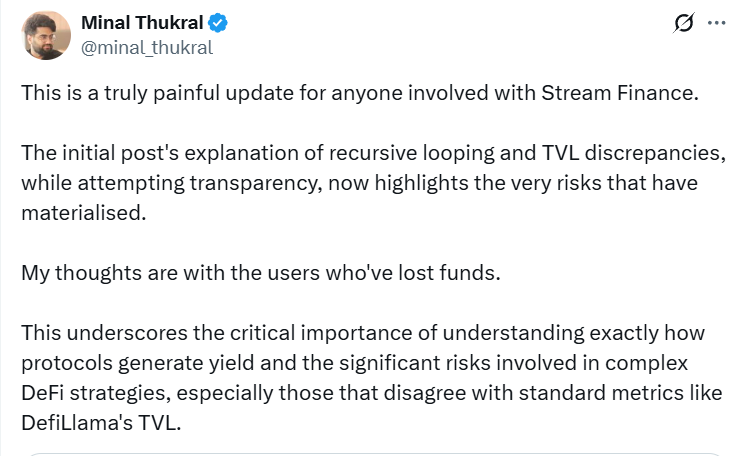

Experts’ opinion: “DeFi has become too complex for its own good”

According to Minal Turkal, Head of DeFi Ecosystem Development at CoinDCX, this case clearly shows how “excessive engineering” can backfire on users:

“The more complex the yield mechanism, the harder it is to understand what’s happening with your assets. Stream Finance became a victim of its own complexity. Investors must clearly understand how revenue is generated and where their funds are actually stored.”

Analysts note that such situations undermine trust in the DeFi sector, especially after a series of major hacks and stablecoin collapses in 2024–2025.

⏳ What’s next

The Stream team promised to publish updates as new information becomes available and to cooperate with law enforcement. As of now, it remains unclear whether any of the lost funds can be recovered.

Investors watch the situation anxiously, recalling that DeFi once promised “new financial freedom,” but increasingly delivers old problems — just wrapped in blockchain packaging.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.