But no one wants to test it…

On the crypto market, this is again one of those moments when corporate confidence sounds almost like a challenge to fate. Strategy (formerly MicroStrategy) has once again publicly stated that it does not intend to sell its bitcoins even in the harshest scenario.

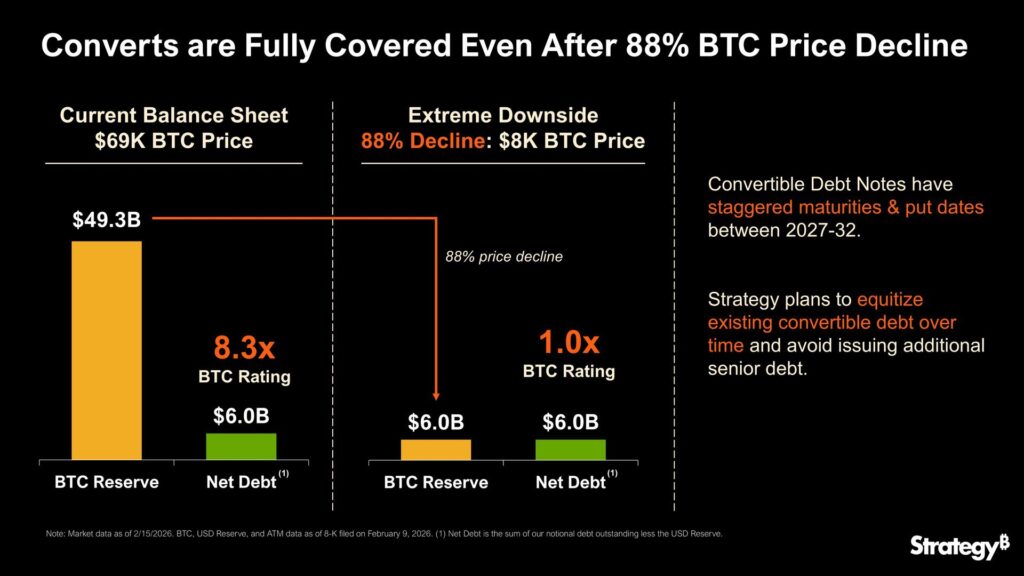

In an official post on X, Strategy wrote literally: “We can withstand a BTC price drop to $8,000 and still have sufficient assets to fully cover our debt.”

The statement sounds like a concrete manifesto from Michael Saylor: the company does not just hold Bitcoin, it builds its entire financial structure around it. In this structure, Bitcoin is not just an asset, it is a religion.

Strategy has long ceased to be just an IT company. Today it is the largest corporate holder of BTC in the world, effectively transforming into a Bitcoin treasury with publicly traded shares.

The model is simple yet risky:

- the company issues debt and equity,

- buys Bitcoin with the proceeds,

- Bitcoin rises — shares rise even more,

- the market falls — the decline is amplified because of the leveraged structure.

Saylor has repeatedly stated: selling BTC is capitulation. For him, Bitcoin is digital gold, and Strategy is a ship that must weather any storm. The problem is that the crypto market loves to test even the loudest promises. We can appreciate the resilience of the business model, but testing a drop to $8,000 is something few want to do.

Meanwhile, the market does not look nearly as confident. BTC has failed to hold above the psychological $70k mark, and the technical picture on the 4-hour timeframe indicates a possible test of the lower boundary of the local sideways range around $65k.

So while Strategy talks about Bitcoin at $8,000 as a theoretical stress test, the market is already nervous about movements of just a few thousand dollars. Here, the dynamic matters more than the absolute drop.

An even more alarming signal is the behavior of Ethereum and the entire altcoin sector. ETH and other altcoins are falling noticeably faster than Bitcoin. This is a classic “risk-off” scenario, where investors first exit the riskiest assets, leaving BTC as the last stronghold.

On the crypto market, it looks like the familiar process: “push, shove, kill the alts.” When Bitcoin simply corrects, alts usually experience a mini-apocalypse, reminding that crypto has first-tier assets and all others that fall faster than fundamentals can explain.

Today in the U.S., it is Presidents’ Day — a federal holiday. The American stock market is closed. Joke of the day: Trump is busy with a banquet and cannot dump the stock market. In reality, the market simply does not trade, and crypto is slightly calmer because there is no correlation with Nasdaq and S&P movements during the day. Although “calmer” in crypto is a relative term.

Interestingly, amid the price decline, retail investors seem to have become active. Coinbase CEO Brian Armstrong reported that the retail user balance in BTC and ETH rose in February compared to December.

This means small investors are accumulating again, possibly seeing the dip as a discount or simply unable to pass up another “buy the dip.”

But then the logical question arises: if retail is buying, why is Armstrong selling Coinbase shares? The market loves such ironic details.

While Bitcoin is jittery, a new genre of entertainment has appeared on social media: reminding celebrities of their past NFT losses. WatcherGuru launched a wave of posts where public figures are reminded how much they lost on “digital monkeys” and hype collections. Logan Paul is one of the main characters in this series. His NFT, once worth $635k, fell to $155. It is said he has already hurt his finger issuing bans for such jokes. The crypto market does not forget, especially when it comes to other people’s losses.

Conclusion: Strategy’s confidence is a signal, not a guarantee.

The statement that the company can withstand Bitcoin at $8,000 sounds powerful, but it also highlights the main market reality: corporate BTC holders are now part of systemic risk.

If such players truly can “never sell,” the market gains a new level of resilience. But if even one large holder fails under pressure, the domino effect could be far stronger than in previous cycles.

For now, the situation looks like this: Bitcoin holds, alts crumble, retail buys, CEOs sell, and Saylor again says he will survive everything. In crypto, this is almost classic.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.