? The week on the stock market was busy and dynamic: Nasdaq reached a historic high, and the S&P 500 is near record levels. Meanwhile, the Dow Jones and Russell 2000 stopped at their 21-day moving averages — a classic resistance zone. This natural pause allows the market to catch its breath before the next move.

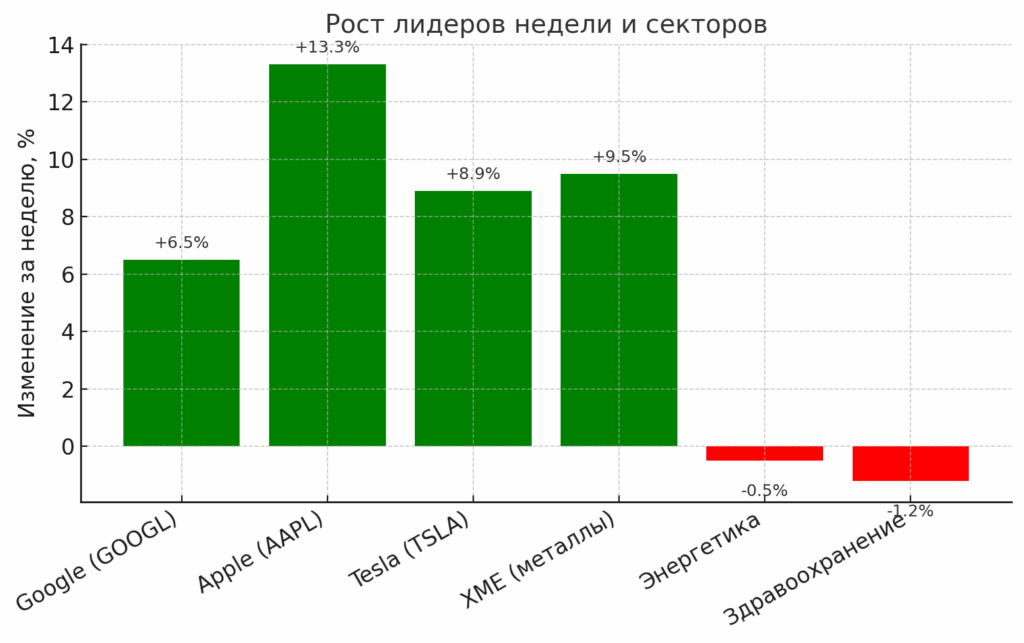

The main leaders of the week were Google, Apple, and Tesla. These “Big Seven” companies showed strong buy signals:

Google (GOOGL) rose 6.5%, surpassing a key level.

Apple (AAPL) gained 13.3% — the best weekly increase in the last 5 years, breaking important technical barriers.

Tesla (TSLA) climbed 8.9%, holding above significant averages amid news about autopilot development

Sector ETFs showed mixed dynamics: metallurgy and mining rose (XME +9.5%), while energy and healthcare slightly lagged.

Diagram showing how a position liquidation occurs and what it means to “catch” it.

Conclusions and Recommendations:

The market largely depends on the performance of the largest companies, so controlling diversification and risk levels is crucial.

Consolidation near moving averages can be a good opportunity to prepare for new trades.

During earnings season, it’s important to strictly follow entry rules — volatility rises.

In the coming days, attention should be paid to reports from Cisco, CoreWeave, and Sea, as well as Tuesday’s inflation data, which could trigger a new market impulse.

⚡️ Keep your watchlists up to date, and remember: patience and discipline remain key allies of a successful investor.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.