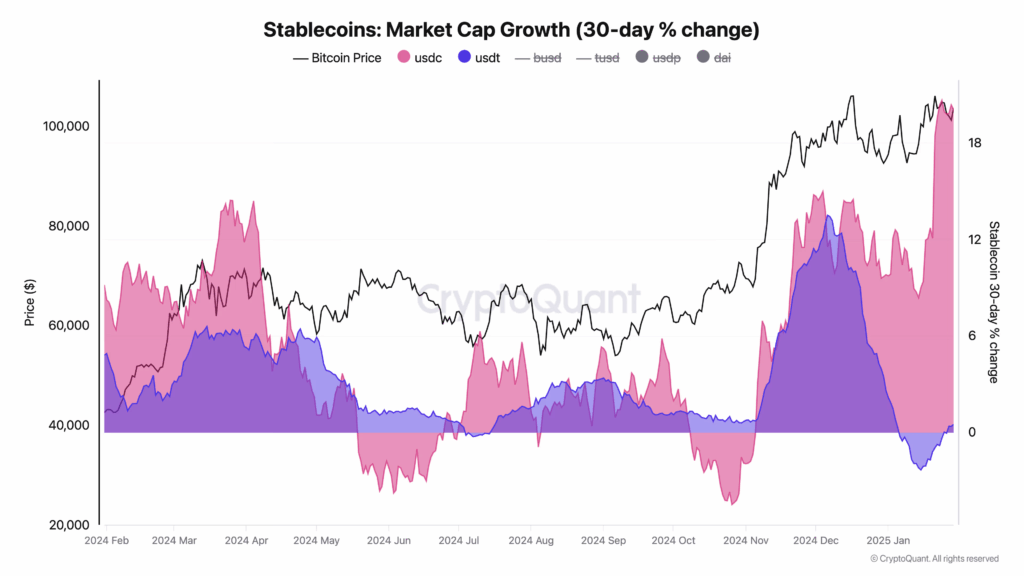

? Since November of last year, the stablecoin segment in the cryptocurrency industry has been experiencing a real boom. Market leaders — Tether (USDT) and USD Coin (USDC) — have shown impressive market capitalization growth.

Overall, this represents an inflow of over $76B of fresh fiat into the crypto economy through just these two assets.

Why are stablecoins rising?

Experts highlight several key factors:

- Improved regulatory environment

- The US, EU, and several Asian countries have started actively implementing clear rules for stablecoins. This has attracted institutional investors who previously feared legal uncertainty.

- Growing trust from institutions

- Banks, funds, and large companies see stablecoins as a safe tool for fast transactions and hedging volatility.

- Different niches for USDT and USDC

What does this mean for the crypto market?

- Capital inflow: +$76B in a year directly increases liquidity. With stablecoin prices stable, this money can quickly flow into Bitcoin, altcoins, and DeFi products.

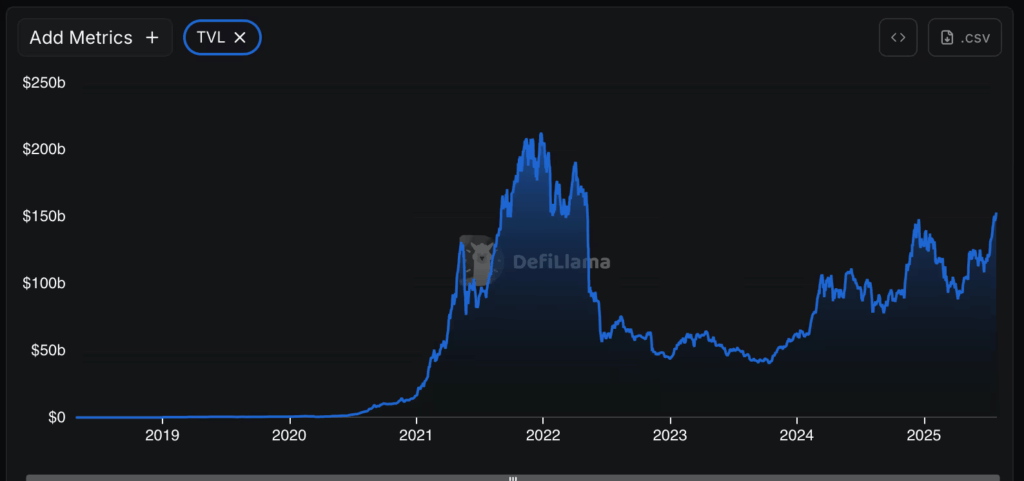

- DeFi growth: large stablecoin volumes make lending, staking, and trading easier without excessive volatility.

- Tokenization development: stablecoins are becoming a convenient base tool for tokenizing real assets — from bonds to real estate.

- Bull market signal: historically, an increase in stablecoin share in the crypto economy has preceded major bull phases, as it indicates that “dry powder” is ready for investment in risk assets.

? Conclusion:

The growth of USDT and USDC market capitalization is not just statistics. It signals that large money and serious players are returning to the crypto market. If the trend continues, 2025 could see a stronger bull momentum, especially alongside favorable macroeconomic conditions and monetary easing.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.