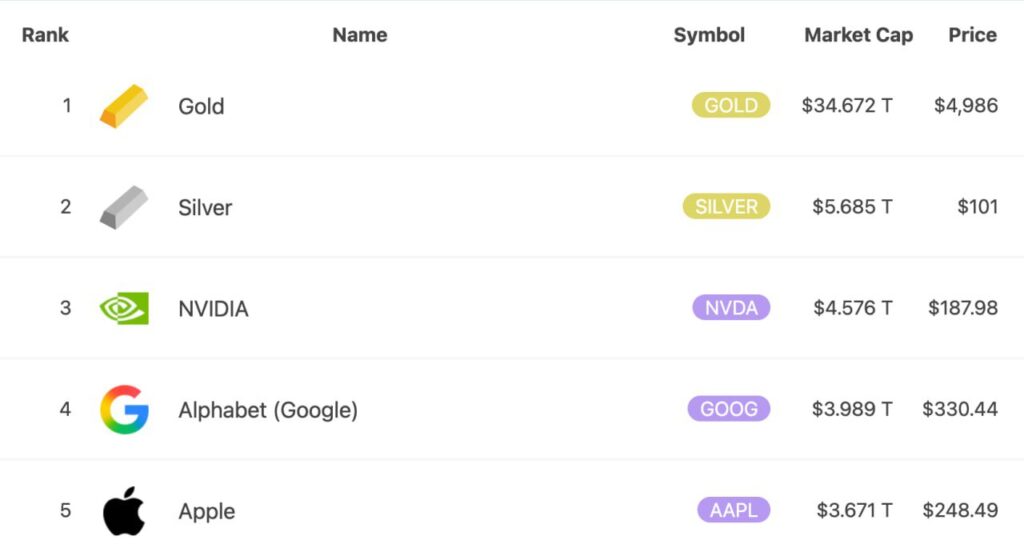

Silver is confidently returning to the big investment league, doing so without unnecessary noise but with very telling figures. The metal’s price has broken above the $100 per ounce mark, and in terms of total market capitalization, silver has risen to second place among all assets globally, trailing only gold and surpassing the largest technology corporations. In a single ranking, a metal with a thousand-year history now stands alongside giants such as NVIDIA, Apple, and Alphabet – a comparison that speaks volumes about the current state of the global market.

Silver’s rise appears especially symbolic against the backdrop of broader uncertainty in the global economy. High interest rates, record levels of government debt, geopolitical tensions, and the gradual erosion of trust in fiat currencies are pushing investors back toward time-tested assets. But while gold is traditionally viewed as a conservative store of value, silver occupies a unique position – at the intersection of a defensive asset and an industrial resource.

The key difference between silver and gold lies in its dual nature. It is not merely a precious metal for savings, but a strategically important industrial component. Silver is widely used in electronics, solar energy, electric vehicles, medical technologies, and the defense industry. Every solar panel, every modern chip, and a significant share of “green” infrastructure are literally dependent on silver. Against the backdrop of the global energy transition, demand from the real economy is growing faster than supply.

At the same time, supply remains constrained. Silver mining is stagnating: many deposits are depleted, investment in exploration has been declining for years, and new projects require time and capital. Unlike fiat money or even digital assets, silver cannot be “printed” at the press of a button. This creates a structural deficit that is becoming increasingly evident as industrial demand continues to rise.

Another important factor is the reassessment of silver’s role in institutional investment portfolios. Historically, the metal was considered the “younger brother” of gold and was often used merely as a speculative add-on. Today, that perception is changing. Against the backdrop of high gold prices, silver appears undervalued in relative terms, especially when viewed through the historical gold-to-silver price ratio. Many funds see silver as a more volatile, but potentially more profitable, analogue to gold in a scenario of sustained inflationary pressure and currency instability.

The psychological factor should not be underestimated either. Breaking the $100 level is not just a number, but a powerful market signal. Such levels attract broad attention, amplify capital inflows, and trigger a self-reinforcing demand effect. For some investors, silver becomes “gold for those who missed gold,” while still preserving the protective function of capital.

It is also noteworthy that silver benefits from the technological boom. While markets debate NVIDIA’s capitalization and the future of artificial intelligence, the physical infrastructure behind these technologies relies on very tangible resources. In this sense, silver emerges as a quiet beneficiary of the digital revolution: without it, scaling data centers, energy systems, and high-tech manufacturing would be impossible.

Ultimately, silver’s rise is not a short-term anomaly or a speculative spike. It reflects deeper processes: capital reallocation, risk reassessment, and a renewed interest in real assets with limited supply. Silver is once again becoming what it historically was – a universal asset of trust that functions both as protection and as a bet on future industrial development. And judging by current dynamics, the market is only beginning to recognize this.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.