Santiment: the collapse of Strategy could become the most bullish signal for Bitcoin.

The crypto market has a strange paradox: sometimes the strongest signal for growth appears not when everything is going well, but when things become so bad that they simply cannot get any worse. This idea was expressed by Maksim Balashevich, founder of the аналитical platform Santiment.

According to him, if liquidation or a major collapse of Strategy ever happens (the company that became the main corporate symbol of Bitcoin faith thanks to Michael Saylor), it could mark the final market bottom and a turning point.

Why is Strategy so important? Strategy currently holds 713,502 BTC – around 3.4% of Bitcoin’s total supply. The company has effectively turned into the largest публично traded “Bitcoin wallet,” while Saylor has become the face of one idea: buy BTC always, under any conditions, without doubt. For the market, Strategy is not just a company. It is a symbol.

Capitulation as a Turning Point This is where Balashevich’s logic begins: when the strongest symbol of belief breaks, capitulation occurs. And capitulation often signals the end of a downtrend. “The most bullish signal is when things are so bad that they cannot possibly get worse. Saylor’s liquidation would be the final удар, after which the market turns,” he says.

Balashevich speaking at the Crypto Startup School at the Frankfurt School of Finance & Management. Source: Crypto Startup School

A Historical Example Balashevich points to the collapse of FTX in November 2022. Bitcoin fell to $15,500, and many believed the industry would not recover. Yet that moment marked the start of a new rally: by June, BTC had doubled to $30,000. Such events often “cleanse” the market: weak players exit, panic peaks, and space opens for a new cycle.

Could Strategy Actually Sell BTC? At the moment, there are no public signs that Strategy is preparing to sell its Bitcoin holdings. The company continues servicing its debt, with major maturities scheduled for 2027-2032, leaving plenty of time.

However, Balashevich considers a hypothetical scenario: if conditions become extreme, shareholders could pressure management. “I’m not sure it could even happen… but shareholders might force him to sell something or remove him from the board,” he notes.

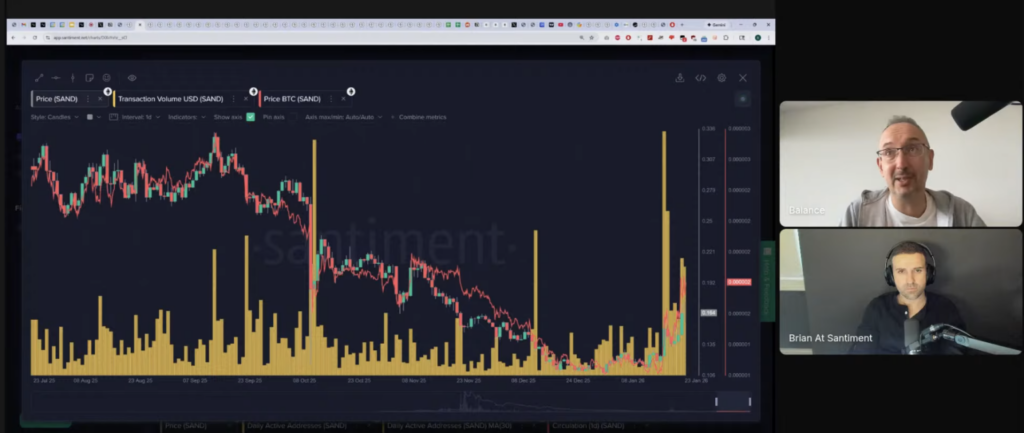

Balashevich regularly appears on the Santiment YouTube channel, providing his thoughts on the crypto market. Source: Santiment

Forecasts and caution. In the short term, Balashevich allows for a BTC rebound in the $92,000–95,000 range, but warns that the rally could be interrupted by a new wave of selling.

Regarding bold forecasts, such as $250,000 per Bitcoin in 2026, he is skeptical. According to him, it is more a matter of time, but no one knows exactly when the market might reach those levels.

Conclusion

Santiment’s ключова теза is unusual but psychologically sound: if even Strategy – Bitcoin’s main corporate bull – were to break, it could become the moment when the market finally reaches maximum fear and reverses upward.

For now, this remains a purely speculative scenario, but it clearly reflects the psychology of crypto markets: sometimes growth begins exactly when hope seems completely lost.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.