? The U.S. stock market has reached the most overvalued levels in history.

According to recent research by Elliott Wave International, in 2024–2025 the U.S. market is at record overvaluation levels. Combined metrics, including P/E, Forward P/E, CAPE, P/B, EV/EBITDA, Q Ratio, and the market capitalization-to-GDP ratio, show that the U.S. market leads in overvaluation across all historical periods.

Key historical peaks are highlighted on the chart:

- 1929 — period before the Great Stock Market Crash.

- 1966 — high stock prices amid economic boom and investment hype in tech and industrial companies.

- 1999 — dot-com peak, when internet and tech companies soared amid speculative frenzy.

Today’s overvaluation levels even exceed those of 1929 and 1999, raising concern among some analysts.

Why is the market overvalued?

- Historically low interest rates

Prolonged low-rate policy by the U.S. Federal Reserve encouraged borrowing and stock investments. Investors sought yield and shifted to riskier assets, inflating prices. - Growth of major tech companies

Megacaps and Big Tech — Apple, Microsoft, Amazon, Tesla — account for a significant portion of Nasdaq and S&P 500 indices. Their high market cap creates an illusion of stability while raising overall market overvaluation. - Speculative investor sentiment

Interest in “meme stocks,” AI companies, and crypto investments drives stock demand, not always backed by fundamentals.

Consequences of high overvaluation:

- Higher risk of correction — historically, overvaluation peaks often ended in sharp market declines (1929, dot-com crash 2000).

- Increased volatility — any macroeconomic or geopolitical event can trigger significant swings.

- Opportunity for strategic entry — experienced investors see such moments as a chance for short selling or profit-taking.

What should investors do now?

- Risk control and diversification

Avoid relying solely on major indices and popular stocks. Allocating capital across sectors and asset classes reduces risk. - Focus on fundamentals

Selecting companies with stable profits, strong balance sheets, and real revenue growth minimizes the impact of potential corrections. - Monitor macroeconomics

Inflation, interest rates, and global economic conditions directly affect asset valuations.

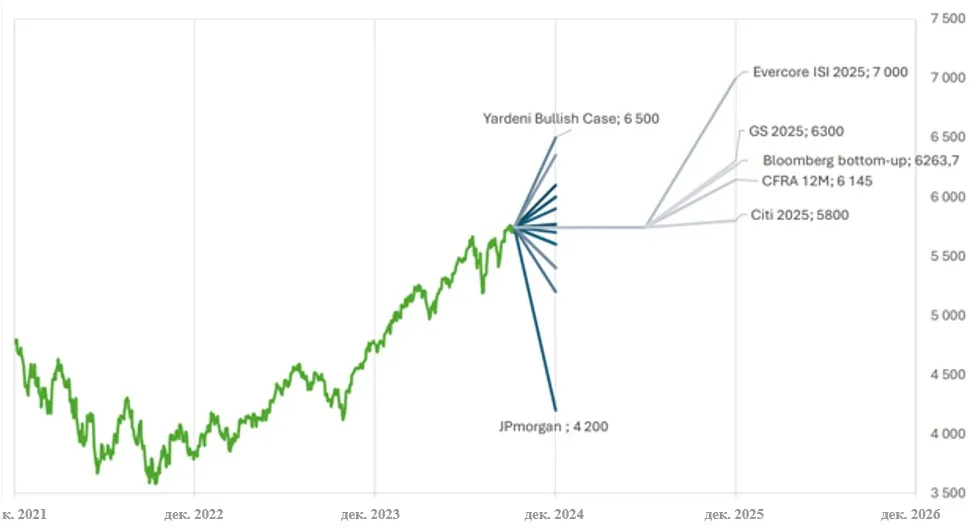

⚡ Conclusion: The U.S. stock market has reached an unprecedented level of overvaluation. This does not imply an imminent crash, but history shows periodic corrections are inevitable. Investors should stay vigilant, manage risks carefully, and use the current market for strategic decisions. The market’s future will depend on economic growth, inflation, Fed policy, and geopolitics.

We believe that the future of the U.S. stock market will depend on numerous factors — economic growth, inflation, Fed policy, and geopolitical conditions. It is important to be prepared for different scenarios and consider both positive and negative influences when shaping an investment strategy.

⚡️ Record overvaluation levels are a signal for caution, not panic. Time for analysis, planning, and disciplined investing.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.