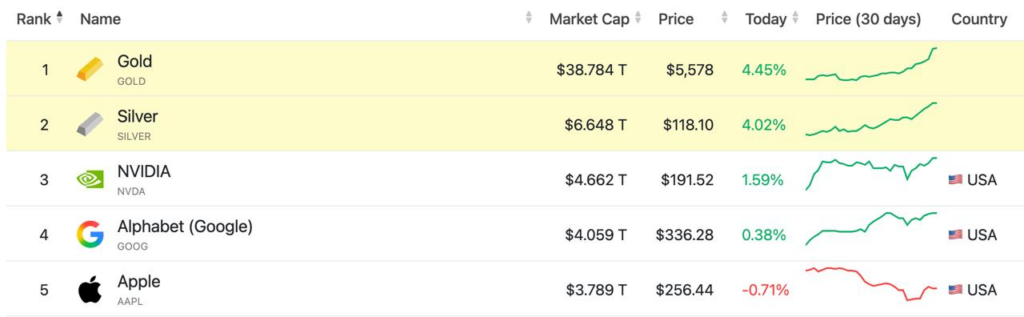

A truly unique and, without exaggeration, historic situation has formed in the market. Traditionally, precious metals are considered defensive assets that rise during periods of crises, recessions, geopolitical instability, or stock market declines. But now we are witnessing a rare scenario: precious metals are continuing a powerful rally simultaneously with the U.S. stock market reaching new all-time highs, including the S&P 500 index.

Gold and silver are updating records in sync, ignoring the classic “risk-on / risk-off” logic. This suggests that the market is pricing in not local events, but systemic changes in the global financial architecture — rising debt levels, weakening trust in currencies, structural imbalances in monetary policy, and a redistribution of capital in favor of real assets.

Silver looks particularly impressive in this race. The metal has reached a new all-time high of around $120 per ounce. In just 29 days, silver delivered a return four times higher than the S&P 500’s return for all of 2025. And this is happening while the S&P 500 itself is at record levels. Such a gap is rare even by commodity market standards and usually points to demand panic or a structural supply deficit.

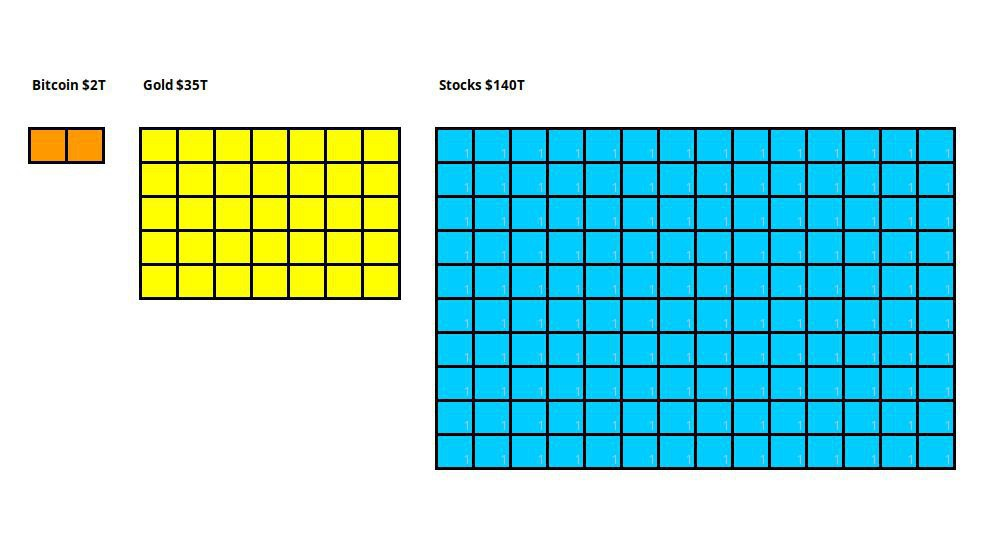

Gold has also sharply accelerated. In a single day, its market capitalization increased by approximately $2.2 trillion and is now estimated at around $35 trillion. To grasp the scale: Bitcoin’s market capitalization is about $1.8 trillion. In other words, gold’s one-day increase in value exceeded the entire market size of the world’s largest cryptocurrency. This is not a price move — it is a tectonic shift of capital.

It is important to correctly perceive the scale of what is happening. A hypothetical rise in gold from $5,400 to $5,500 per ounce is not just “plus $100.” It represents trillions of dollars in new valuation, redistributed liquidity, and a reassessment of global reserves. Unlike stocks or cryptocurrencies, the gold market is so massive that even a small percentage move implies enormous capital flows.

This is why comparisons between the markets of Bitcoin, gold, and equities look so striking on charts. Bitcoin appears gigantic within the crypto market, but against the backdrop of gold and global equity markets, it still remains a relatively compact asset. Gold, meanwhile, is currently confirming its status not just as a “safe haven,” but as a core element of the global financial system in an era of debt overload.

In effect, we are witnessing a moment when investors are no longer choosing between growth and protection. They are buying both. And this is perhaps the most alarming — and at the same time the most telling — signal of the current cycle.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.