? By mid-2025, the number of people whose cryptocurrency assets exceed $1 million grew by 40%, reaching a record 241,700 individuals. This is reported in the latest report from the consulting firm Henley & Partners, which traditionally tracks the wealthiest investors and trends in the global economy.

Institutional Investments as the Main Driver

The sharp increase was driven by several factors. First and foremost — the Bitcoin rally and the growth of the crypto market capitalization, which reached $3.3 trillion in June 2025. In addition, institutional investments played a significant role. According to Henley, the interest of large financial firms, funds, and public companies was the key to growth.

The number of so-called crypto centimillionaires (capital over $100 million) increased by 38% to 450 people, while the number of crypto billionaires grew by almost a third — by 29%, reaching 36 by the end of June.

“This significant growth coincides with a turning point for institutional adoption of cryptocurrencies,” note Henley analysts. The U.S. played a key role, where support for the crypto industry from the Trump administration strengthened Wall Street’s position.

“For this new class of investors, diversification across multiple jurisdictions became a way to protect against regulatory risks and technological lag. The ability to interact with innovative solutions while maintaining legal stability is perceived as a necessary condition,” added Henley & Partners top manager Dominik Volek.

Record Inflows into Bitcoin-ETF and Ethereum-ETF

2025 was a historic year for exchange-traded funds:

- Inflows into U.S. spot Bitcoin-ETFs increased from $37.3 billion to $60.6 billion.

- Investments in Ethereum-ETFs quadrupled, reaching $13.4 billion.

The main buyers were hedge funds and investment advisors, with their investments in Q2 totaling $1.35 billion and $688 million, respectively. Brokers and private investment firms also actively increased their positions.

Bitcoin Solidifies as a “Store of Value”

The growth in crypto millionaires has been largely driven by Bitcoin. Over the year, the number of investors holding Bitcoin worth over $1 million increased by 70%, reaching 145,100 individuals.

- The number of large BTC holders with assets over $100 million jumped 63% — to 254 investors.

- The number of Bitcoin billionaires grew by 55%, reaching 17 individuals.

Philipp Baumann, founder of research and investment firm Z22 Technologies, explains the trend by noting that Bitcoin is gradually becoming a “base currency of accumulation,” and its role as “digital gold” is strengthening in investors’ eyes.

Interestingly, the total number of cryptocurrency users grew only by 5% — to 590 million people. This shows that wealth growth was concentrated among a limited group of the wealthiest investors.

Crypto Migration: Where Capital Owners Are Moving

Henley & Partners also analyzed which countries are becoming magnets for cryptocurrency capital. The top 5 destinations included:

- Singapore

- Hong Kong

- USA

- Switzerland

- UAE

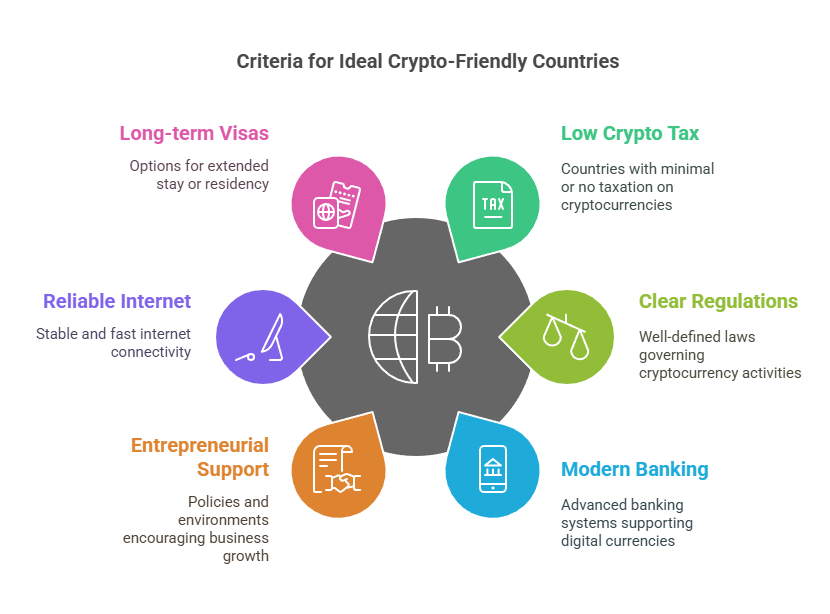

The ranking considered factors such as:

- level of mass adoption of cryptocurrencies;

- development of infrastructure and innovation;

- regulatory policy;

- tax regime;

- economic stability.

? In addition, smaller countries are developing their own strategies to attract crypto investors. Among them are Costa Rica, El Salvador, Greece, Latvia, Panama, New Zealand, and Uruguay. These countries focus on liberal regulation and simplified residency conditions.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.